Shiba Inu (SHIB), the popular meme-inspired cryptocurrency, is experiencing a notable change in market dynamics as the tide seems to be turning in favor of bullish sentiment.

Over the past week, there has been a remarkable surge in confidence among large-scale investors who have demonstrated their support for SHIB by acquiring billions more tokens than they have sold.

But what has sparked this newfound optimism, and what does it mean for the future of Shiba Inu?

Large Investors Embrace Shiba Inu Tokens

Recent data reveals that large investors have shown immense confidence in SHIB by acquiring an astonishing 338.1 billion more tokens than they sold over the course of the past week. This surge in accumulation by influential participants in the crypto market has led to a remarkable weekly total of 9.34 trillion Shiba Inu tokens being amassed.

Expanding on this extraordinary statistic, it becomes clear that the interest of large investors in SHIB is far from waning. Their notable accumulation of SHIB tokens signals a belief in the cryptocurrency’s potential for growth and indicates a positive outlook for its future prospects.

Such a substantial increase in token acquisition suggests that these investors see SHIB as an asset with significant value and are willing to invest substantial resources to secure their position.

A Tale Of Consolidation Amidst Investor Interest

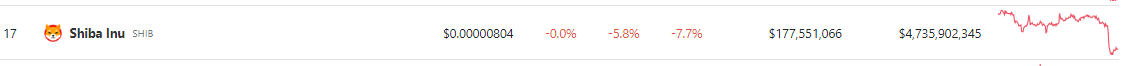

Despite the recent surge in confidence and substantial accumulation of Shiba Inu (SHIB) tokens by large investors, the price of SHIB has yet to exhibit a positive response. According to CoinGecko, the current price of SHIB stands at $0.00000804, representing a decline of 5.8% over the past 24 hours and a seven-day slump of 7.7%.

SHIB has since been trading within a narrow range, with minimal fluctuations exceeding 6%. Surprisingly, this phase of consolidation has piqued the interest of major investors who have predominantly taken up long positions during the past week.

Additionally, the crypto market as a whole has experienced fluctuations during this period of regulatory mess, and SHIB may be impacted by broader market trends.

While the price of SHIB has not yet responded positively to the influx of large investors, their sustained interest in the cryptocurrency indicates a belief in its long-term potential.

These investors seem to view the current consolidation period as an opportunity to accumulate SHIB tokens at favorable prices, positioning themselves for potential future gains.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk)

-Featured image from Getty