Rising as one of the best-performing meme coins, Shiba Inu (SHIB) keeps making headlines in the crypto scene. The meme coin has jumped by over 30% during the past month, drawing both retail and analytical interest. Some analysts think SHIB may soon overcome a major resistance level with a community-driven rally bringing its market capitalization over $11 billion, therefore enabling even further gains.

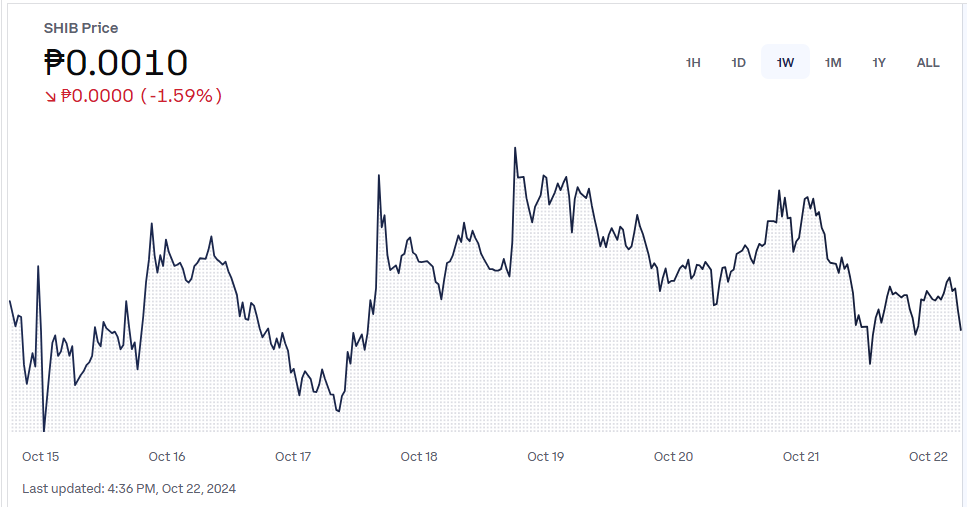

This thrill is driven mostly by a prediction from a pseudonymous analyst called FOUR. Fueled by what he describes as a “hyper meme coin cycle,” FOUR claims Shiba Inu is poised to hit new peaks. FOUR projects that a break above the $0.00002169 resistance level could send the price skyrocketing to $0.00003260, so indicating a possible 71% increase from SHIB, which is currently trading at $0.00001912.

$SHIB is Marching towards $0.00003260 price very soon than you expect

Memes super cycle is just started #Shib #MemeSeason #MemeSupercycle pic.twitter.com/8QXXiE7odd— FOUR | Crypto Spaces (@X_Four_iv) October 19, 2024

Shiba Inu: Major Resistance Level At $0.00002169

For traders and experts, the resistance level of $0.00002169 now takes front stage. Previously tested during a late September rush, this pricing point was rejected. But SHIB’s present increasing momentum has rekindled hope that this barrier will soon be broken. Analysts contend that if SHIB surpasses this level, it could set off a quick price rise motivated by ongoing support from its large population.

FOUR’s research fits this perspective. He points to the recent weekly candle close, implying that SHIB is getting closer to conquering its present obstacles. Shiba Inu might rapidly experience a notable increase in value if the resistance is overcome since the positive momentum has been growing.

Retail Investors Promoting The Rally

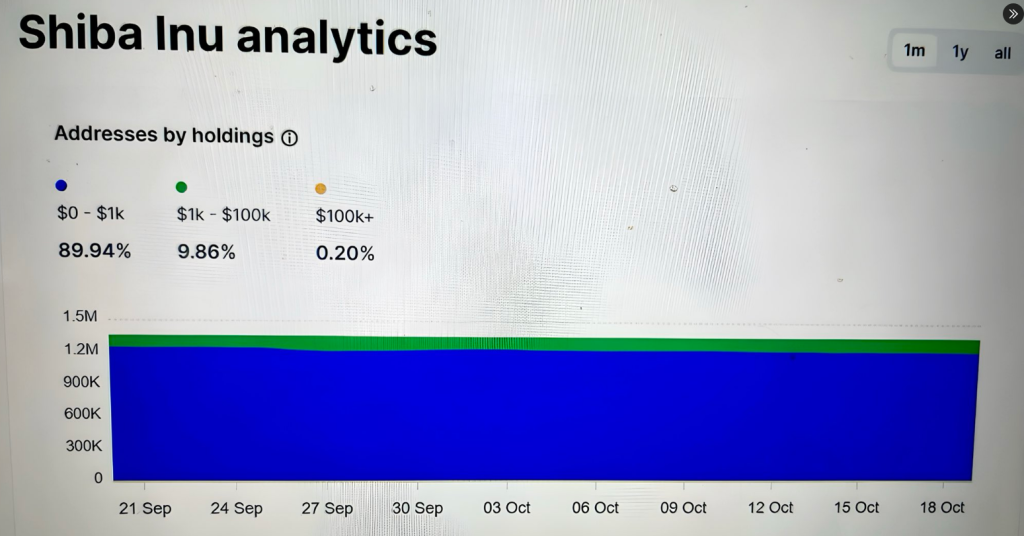

One may mostly credit Shiba Inu’s rise on the retail investor level. Data from CoinMarketCap shows that nearly 90% of SHIB holders are small investors holding anything from $0 to $1,000. The popularity of the coin has been driven by this grassroots support, hence increasing its resilience to changes in the market. The continuous rally can be attributed to retail investors believing in SHIB’s future for additional expansion.

This is #SHIB analytics from #Coinmarketcap . The blue colors are owned by retail with $0-$1K bag holders . Almost 10% of holders have $1k-$100K bag value and only .20% have 100K and above SHIB Bag . These belongs to exchange . This is a perfect narrative why SHIB should be an… pic.twitter.com/i7x8D49tUn

— Lola (@CryptoLollla) October 20, 2024

Still, it’s interesting to note that nearly a quarter of the meme coin’s holders had assets valued more than $100,000. Though rare, this group is important in the ecosystem and might perhaps include liquidity providers and exchanges.

Positive Viewpoint In Spite Of Volatility

Though Shiba Inu has a history of instability, some market analysts see a bright future for it. The community-driven support of the currency along with the larger meme coin cycle might drive SHIB higher in the next coming weeks. FOUR’s estimate of a 71% increase depends on breaking important barriers.

Investors will be closely observing to see if Shiba Inu can sustain its increasing pace and remove obstacles in its path.

Featured image from Katerina_Brusnika//Getty Images, chart from TradingView