The Shiba Inu ecosystem has started out the new week on a particularly positive note. The burn rate, which is a community initiative to reduce the massive supply of the token, has seen a significant jump as the price of the meme coin has recovered.

SHIB Burn Rises 233%

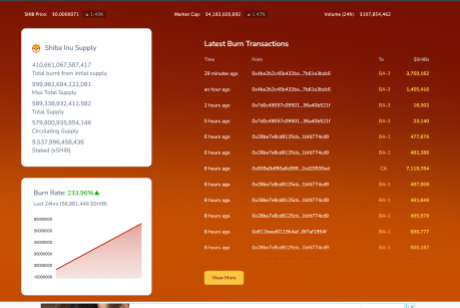

A Monday report by Shiba Inu burn tracking website Shibburn showed that the SHIB burn rate has seen an impressive 233% climb. This puts a turn on the particularly slow weekend which saw burn rates decline rapidly.

As the new trading week opens up, the total SHIB tokens burned during this time has crossed 56.98 million. This was the result of tokens being sent to the burn address across 29 addresses, with more than 3.7 million tokens sent to the burn address in the last hour as of the time of this writing.

The token burn also led to an increase in the burn rate for the last week as well. Monday’s burn figures saw the weekly burn total rise above 316.7 million. This is a 26% increase in the burn rate compared to the previous seven days.

Some of the largest burns came from the ‘0x909a9’ and ‘0x4be2’ addresses. Both addresses burned a total of 7,119,784 million and 8,095,490 million tokens respectively. The total comes out to over 15 million tokens, accounting for around 27% of the total burns for the day.

Shiba Inu Sees Price Recovery

On Sunday, the price of Bitcoin surged toward the $28,000 level, and in response, the rest of the crypto market followed the flagship cryptocurrency. Shiba Inu was no different and finally saw a reversal in its bull stretch since the month began.

Shiba Inu rose around 1.24% in the 24-hour period and although this is not as impressive as some of the recoveries mounted by other assets, it has helped the cryptocurrency to secure its support at $0.000007. This gives bulls some wiggle room as they regain their bearings in the market.

However, Shiba Inu is still seeing small losses of 0.59% on the weekly chart. This suggests that the bulls’ hold on the asset is weak and bears could regain control if momentum slips. This battle for control is mirrored by the daily trading volume of the crypto which is up 25.85% and sitting at $101.7 million, according to data from CoinMarketCap.

So far, there doesn’t seem to be any special event pushing the price of SHIB besides the Bitcoin recovery. Given this, if the Bitcoin rally ends, then SHIB will most likely follow and fall into losses again.