Quick Take

Despite recent market turbulence and a brief negative funding rate last week, data shows sustained institutional interest in Bitcoin, a testament to the digital asset’s increasing recognition as a viable investment class. The Chicago Mercantile Exchange (CME) open interest for Bitcoin remains at all-time highs. It sits at a notional value of $5.4 billion, translating to approximately 121,210 Bitcoin. This trend has persisted for several months, demonstrating that significant sell-offs or deleveraging periods have not deterred institutional investors from maintaining their long positions on Bitcoin.

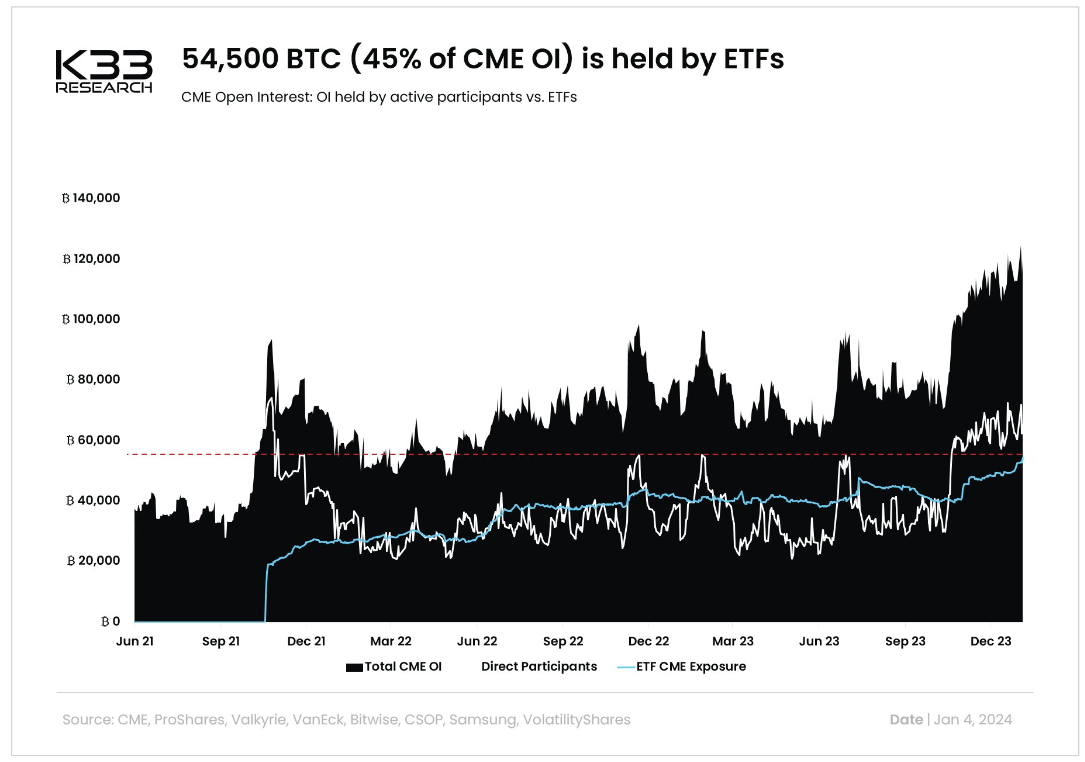

Research by K33, spearheaded by analyst Vetle Lunde, indicates that futures-based ETFs, such as BITO, hold almost 45% of CME’s open interest, tallying 54,500 BTC. Notably, as spot ETFs offer better price tracking and fees, a shift or rotation from these futures ETFs towards spot-based ETFs could be expected shortly.

Lunde also emphasizes the concept of redemptions or closing long positions. This practice entails CME selling to solidify profits, which are then potentially funneled into the spot ETF. This could serve as another key driver behind the anticipated shift from futures to spot-based ETFs, presenting an intriguing dynamic to keen market observers.

The post Shift in bitcoin investment: navigating from futures to spot ETFs appeared first on CryptoSlate.