Quick Take

Amid Bitcoin’s recent 12% price decline, data suggests that short-term holders — those who have held the digital assets for less than 155 days — have exhibited relatively muted sell-off behavior compared to previous dips.

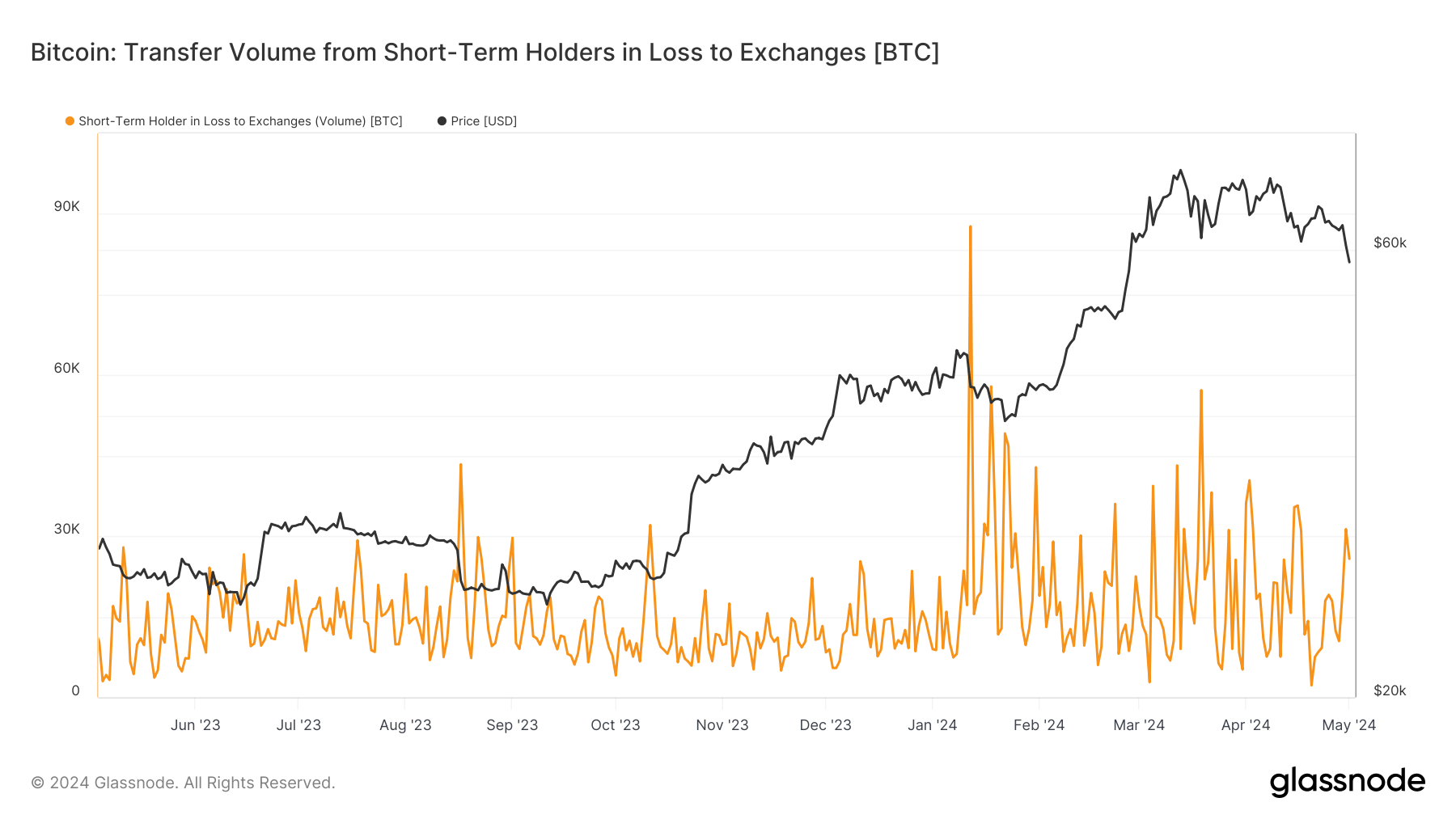

On May 1, approximately 26,000 BTC were sent to exchanges at a loss by short-term holders, while the previous day saw around 31,000 BTC offloaded in a similar fashion. Given the double-digit percentage drop in Bitcoin’s value, one might have expected a more aggressive sell-off from this typically skittish cohort.

Interestingly, when examining previous sell-offs since Bitcoin’s all-time high in March, a pattern emerges—each successive price dip has been met with diminishing sell pressure from short-term holders to exchanges. This trend implies that this group is gradually becoming less reactive to price fluctuations and more likely to transition into long-term holders who have held Bitcoin for over 155 days.

If this behavior persists, it could signal a maturing market dynamic, where short-term speculation gives way to more patient, long-term investment strategies.

The post Short-term Bitcoin holders show restraint in recent price drop appeared first on CryptoSlate.