Quick Take

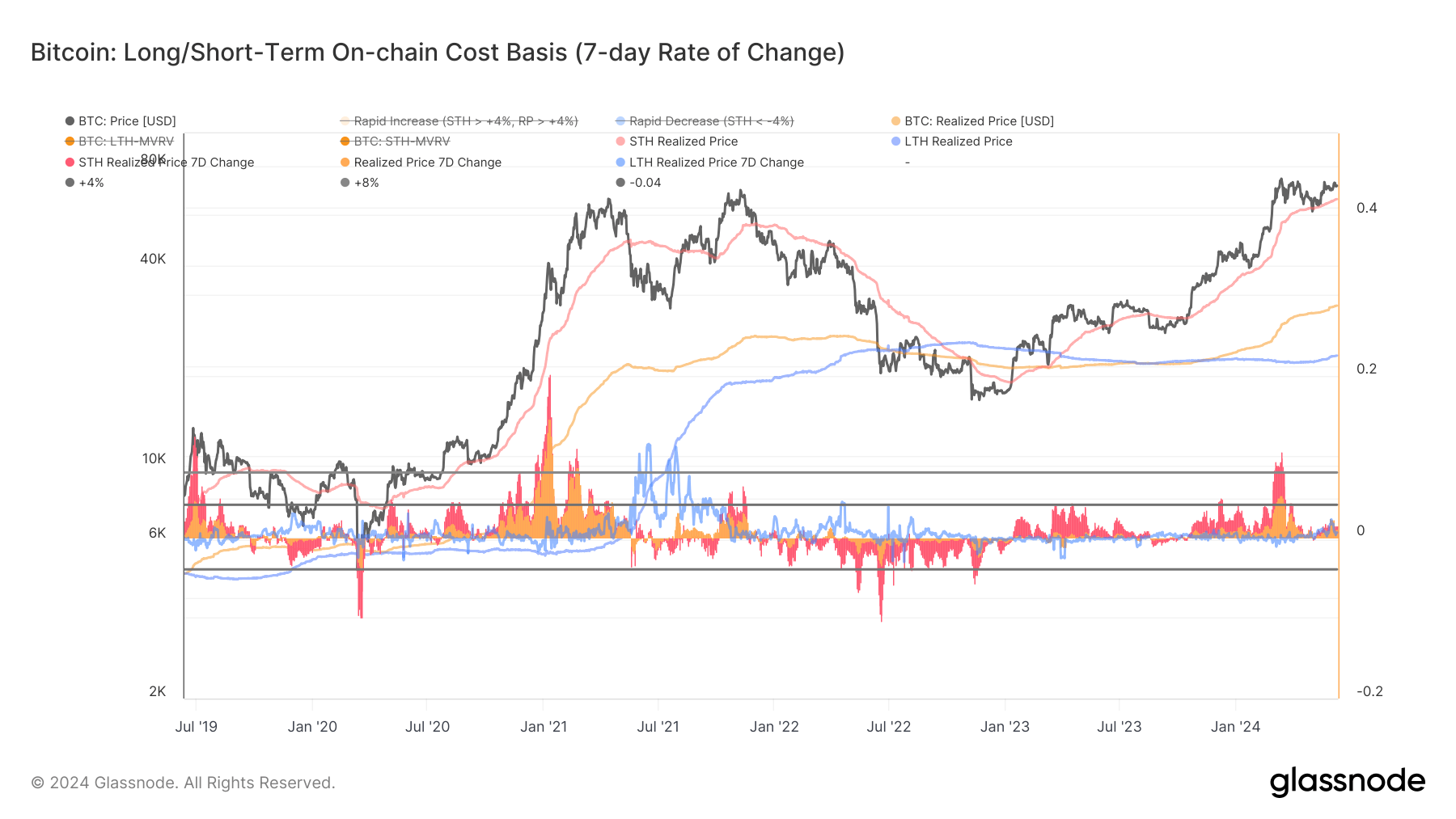

The Realized Price metric offers a comprehensive overview of the average on-chain acquisition price for the entire Bitcoin circulating supply. By analyzing Short-Term and Long-Term Holder heuristics, we can determine the realized price for different investor cohorts.

For the entire coin supply, the Realized Price denotes the aggregate on-chain acquisition price. For Short-Term Holders (STH), the Realized Price reflects the average acquisition price for coins moved within the last 155 days and held outside exchange reserves. These coins are the most likely to be spent soon. Conversely, Long-Term Holders (LTH) represent coins not moved within the last 155 days, indicating the least probable coins to be spent.

Data from Glassnode shows that the STH Realized Price has been steadily increasing, nearing $64,000, indicative of Bitcoin’s ongoing uptrend in the past 18 months. According to CryptoSlate, this metric provides crucial support, with Bitcoin testing this level at the start of May. The STH Realized Price rose 1.5% in the past week, signaling increased short-term speculation.

Notably, this metric spiked by 11% in March during Bitcoin all-time high over seven days, the highest since February 2021. The 1.5% increase indicates reduced market speculation compared to March, while Bitcoin consolidates below $70,000.

Additionally, CryptoSlate reported that the overall realized price recently surpassed $30,000, indicating investors exchanging Bitcoin at higher prices.

The post Short-term holder realized price nears $64,000, signaling Bitcoin uptrend appeared first on CryptoSlate.