The post Solana Aims for $190 Mark, Here’s What Traders Should Watch appeared first on Coinpedia Fintech News

Solana (SOL), the world’s fifth-biggest cryptocurrency by market cap, is poised for a massive upside rally as it approaches a mega-bullish breakout. Most on-chain metrics suggest a strong bullish signal ahead of the breakout.

Solana’s Inverted Head-and-Shoulder Pattern

According to CoinPedia’s technical analysis, SOL appears bullish as it is on the verge of breakout from a bullish inverted head-and-shoulder price action pattern. It has been more than two months, SOL has been testing the resistance level, which now serves as the neckline of this bullish pattern.

Based on the historical price momentum, if SOL breaches the neckline of an inverted head-and-shoulder price action pattern and closes a daily candle above the $160 level, there is a strong possibility it could soar by 20% to reach the $190 level in the coming days.

Currently, SOL has the potential to breach this resistance level, as overall sentiment is bullish. Bitcoin (BTC), the world’s largest cryptocurrency, has broken through one of its strongest hurdles and is moving toward an all-time high. This breakout has shifted market sentiment firmly toward an uptrend.

SOL’s Bullish On-Chain Metrics

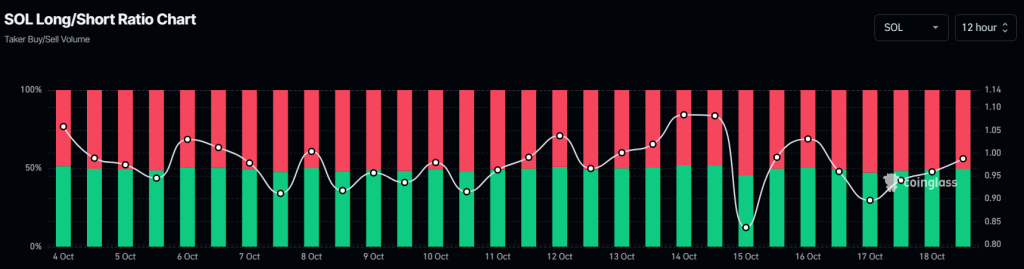

SOL’s positive outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, SOL’s Long/Short ratio currently stands at 1.034, indicating a strong bullish sentiment among traders. Additionally, its future open interest has jumped by 4.9% over the past 24 hours and continues to rise steadily.

This rising open interest suggests increasing trader interest as the price nears the breakout, with a high possibility of a surge in the next few hours.

At press time, SOL is trading near $155 and has experienced a price surge of over 4% in the past 24 hours. During the same period, its trading volume declined by 20% indicating lower participation from traders.