Solana (SOL) has continued its recent bullish wave during the last 24 hours with a surge of 4%, but the trend in this social media-related metric could be to watch out for.

Traders May Have Become Too Hyped Around Solana On Social Media Recently

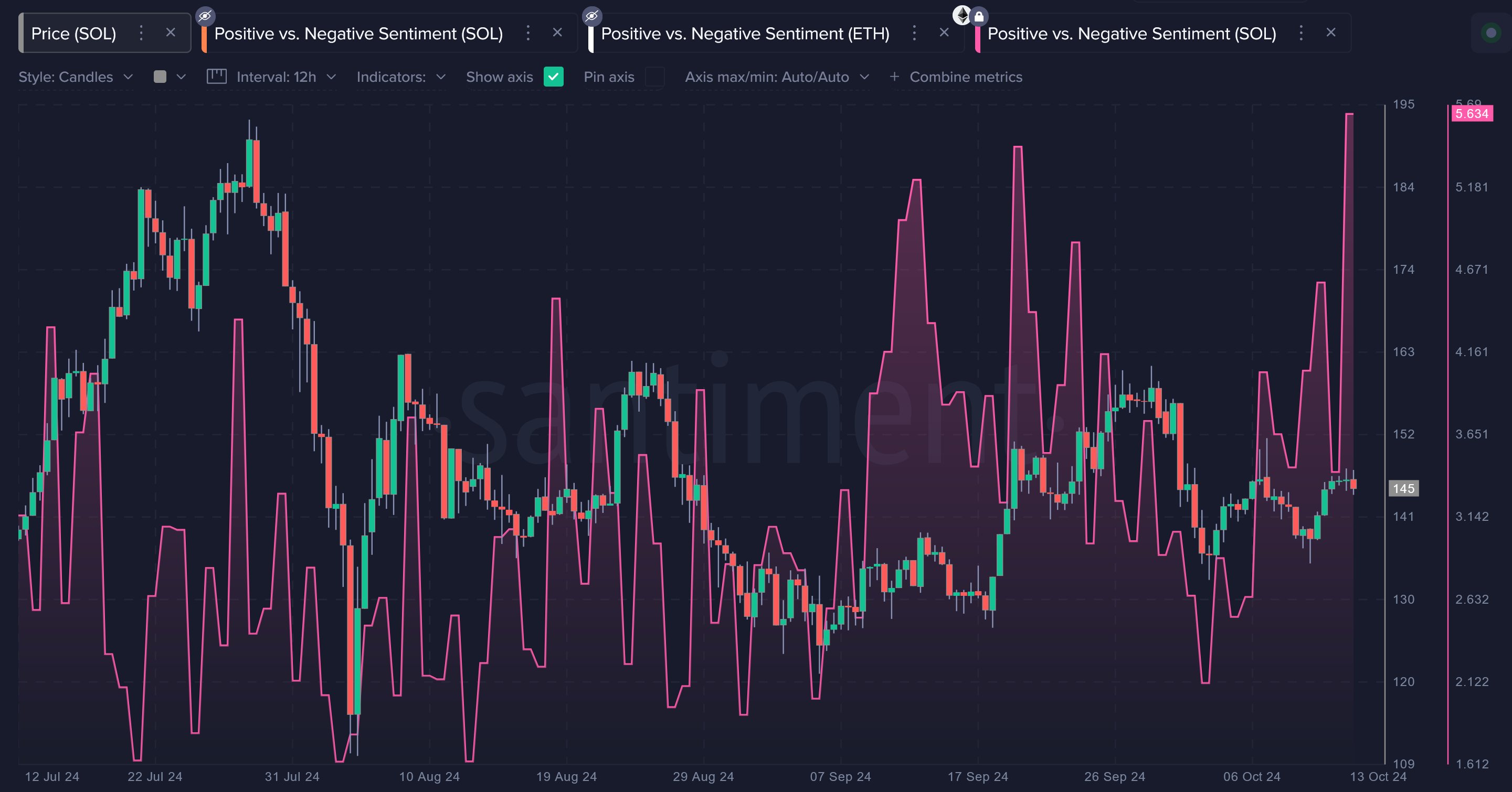

According to data from the analytics firm Santiment, the positive sentiment around SOL on social media has shot up to a nine-month high following the latest bullish momentum that the coin has seen.

The indicator of relevance here is the “Positive Vs. Negative Sentiment,” which, as its name suggests, keeps track of the ratio between the amount of positive and negative comments related to Solana that are appearing on social media. This metric works by analyzing the posts/threads/messages on various social media platforms (X, Reddit, Telegram, 4Chan, and BitcoinTalk) and running them through a machine-learning model to determine which ones relate to positive sentiment and which ones relate to negative sentiment.

When the indicator has a value greater than 1, it means the number of positive posts are outweighing the negative ones right now. On the other hand, it being under the mark implies the dominance of bearish comments.

Now, here is a chart that shows the trend in the Positive Vs. Negative Sentiment for Solana over the last few months:

As displayed in the above graph, the Solana Positive Vs. Negative Sentiment has registered a large spike as the latest recovery in the asset’s price has taken place. With this spike, the indicator has reached a value of more than 5.6, which means social media users are making over 5.6 times as many bullish posts as bearish ones.

This is the highest that the metric has been in around nine months, so the traders are clearly quite optimistic about the current SOL rally. While some bullish moods can be conducive to rallies, an excess of them can actually prove to be an obstacle.

Historically, cryptocurrencies like Solana have tended to show moves that are opposite to what the crowd is expecting. The probability of a contrary move rises the more sure the traders become of a direction, so a highly bullish market can lead to tops in the price.

This effect is also visible in the chart, as some past spikes in the Positive Vs. Negative Sentiment had occurred around local tops in Solana’s value. So far, SOL has only continued to rally further despite the investor FOMO, but considering the historical pattern, it’s possible a top may be hit before long, should hype on social media maintain at high levels.

SOL Price

Solana has continued its latest run with a 4% surge over the past day, which has taken its price above the $153 level.