Solana (SOL) is facing significant selling pressure and struggling to hold key support levels as the entire crypto market remains under stress. Bulls have lost control, with SOL plunging over 37% since the start of March, reflecting the broader market’s risk-off sentiment.

The downturn isn’t limited to crypto—trade war fears and macroeconomic uncertainty have pushed the crypto and U.S. stock markets to their lowest levels since late 2024. With investor confidence deteriorating, SOL remains in a vulnerable position, failing to reclaim critical price levels.

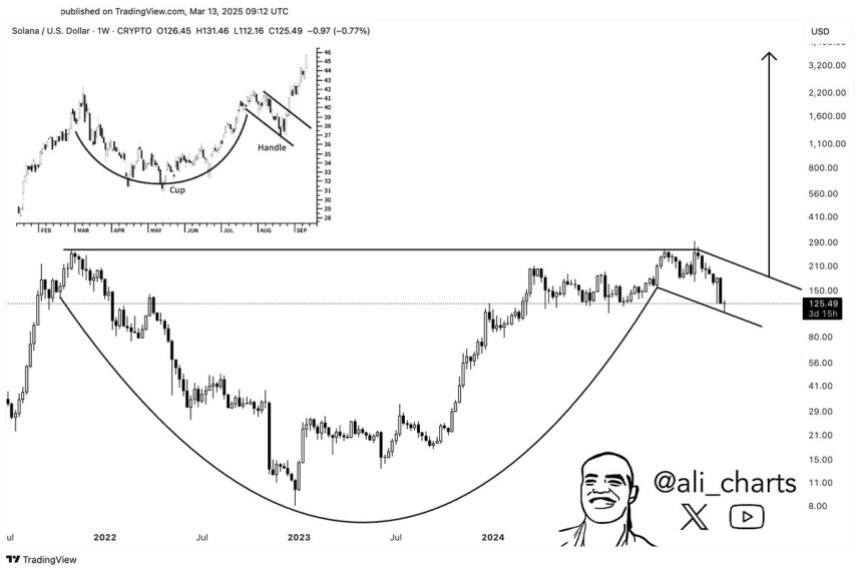

Despite the recent weakness, some analysts see potential for a turnaround. Top analyst Ali Martinez shared insights on X, highlighting that Solana is forming a textbook cup-and-handle pattern, a bullish technical formation that could lead to a breakout. If this pattern plays out, SOL could reclaim higher price levels, reversing some of its recent losses.

For now, Solana must overcome key resistance levels before confirming a bullish trend. If market conditions improve, SOL could see renewed momentum, but failure to hold current support could result in further downside. The next few weeks will be critical in determining Solana’s short-term direction.

Solana Bullish Setup Hints at a Potential Breakout

Solana is currently trading below the $130 mark, struggling to establish a foundation for a recovery phase. The broader market downturn continues to weigh heavily on SOL, with volatility and speculation driving short-term price action. With bears still in control, Solana’s direction remains uncertain, and short-term sentiment remains bearish.

Despite the recent decline, many investors remain hopeful that SOL is poised for a significant recovery once the broader market starts trending upward. Optimism comes from historical patterns, where Solana has shown strong comebacks following extended periods of selling pressure.

Martinez’s long-term technical analysis on X highlights that Solana is forming a textbook cup-and-handle pattern, a bullish formation that often precedes major breakouts. SOL could potentially surge to $3,800 if price action confirms this pattern, marking an astonishing 2,900% gain from current levels.

The next few days will be crucial as Solana and the broader crypto market attempt to establish local lows and build momentum for a potential rebound. If market sentiment shifts and key resistance levels are reclaimed, SOL could be one of the top performers in the next primary bullish phase.

Price Struggles Around $125

Solana is currently trading around $125, facing resistance at the $130 level after multiple failed attempts to reclaim it. With bears still in control, SOL remains under selling pressure, and bulls must act quickly to avoid further declines.

For a recovery to take shape, SOL needs to break above the $130 mark and push toward $150. If bulls manage to reclaim this key level, it will signal renewed buying strength, potentially setting the stage for a larger recovery rally. A move past $150 could shift market sentiment and open the door for higher price targets.

However, if SOL fails to hold the current demand, a further downside is likely. A drop below $125 could send the price toward lower support levels between $100 and $105, a zone where buyers may step in to stabilize the price.

The next few trading sessions will be crucial in determining whether SOL can regain momentum or if further selling pressure will drive it lower. Investors are closely watching key resistance and support levels, as short-term direction remains uncertain amid broader market weakness.

Featured image from Dall-E, chart from TradingView