Galaxy Research has returned to the Solana governance arena with a fresh proposal that seeks to sidestep the deadlock that stymied last month’s SIMD‑228 vote on inflation. Published on GitHub on April 17 and titled “Multiple Election Stake‑Weight Aggregation (MESA) Vote for Reducing Inflation,” the document lays out a procedure that would let validators express a full spectrum of preferences instead of the blunt YES / NO / ABSTAIN triad that governs Solana referenda today.

New Solana Inflation Proposal Follows First Failure

Solana’s monetary schedule is presently hard‑coded: annual issuance starts at 8 %, declines by 15 % each year, and plateaus at a 1.5 % “terminal” inflation rate. According to dashboard provider Solana Compass, the network’s effective inflation stands at 4.591 %. While SIMD‑228 revealed broad agreement that those figures amount to “security overpayment,” the binary ballot failed to gather the two‑thirds super‑majority needed to tighten the curve.

Galaxy’s new plan keeps the familiar fixed, time‑dependent decline toward 1.5 % but replaces single‑outcome votes with what it calls a market‑driven aggregation. “Instead of throwing darts until the community is happy with an individual proposal,” the authors write, “it is more efficient to simply ask each person what they want and settle on the aggregate.”

Under MESA, validators would send stake to multiple YES accounts representing discrete disinflation rates—15 %, 17.5 %, 20 % and so on—while NO and ABSTAIN remain unchanged. The weighted average of those YES buckets would set the new curve. A worked example in the post shows how 5 % of YES stake for “unchanged,” 50 % for 30 % deflation and 45 % for 33 % would yield a composite 30.6 % rate.

Galaxy stresses that the scheme is “not to be confused with a market‑driven curve as detailed in SIMD‑228,” because the underlying schedule would still be deterministic once chosen. Yet, the firm argues, the method is “democratic and progressive” and could “eliminate the need to repeatedly take the idea to single‑outcome vote until a universally acceptable number is proposed.”

The pitch has already drawn scrutiny from core developers. Max Resnick of Anza responded on GitHub that the arithmetic of averaging creates a perverse incentive to vote tactically rather than truthfully: “Suppose I believe the best policy is 25 % a year. … With the average aggregation rule the best thing to do is try to forecast where the final outcome will be and set the most extreme policy in whichever direction you want to pull the policy from there.”

Resnick argues that selecting the median of submitted preferences would be “a truthful aggregation rule” and reiterates his preference for “a dynamic market‑based approach to issuance” over any static curve, adding, “I have faith that the Solana community is intelligent enough to understand a dynamic inflation policy.”

Galaxy’s authors acknowledge that critical implementation details remain open. They invite debate on how many YES buckets to include, whether SIMD‑228’s 33 % quorum and two‑thirds super‑majority thresholds should carry over, and whether a weighted average is in fact the fairest way to collapse the vote.

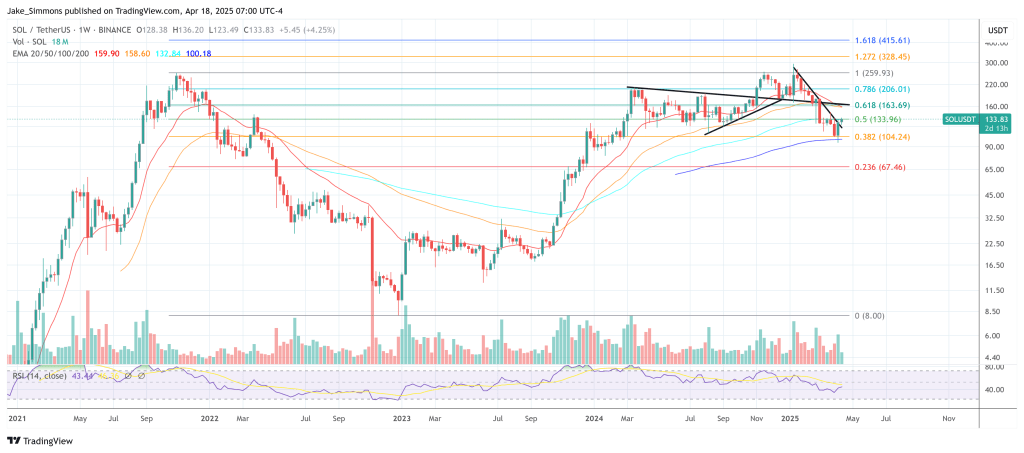

At press time, SOL traded at $133.83.