Data shows the Solana (SOL) Open Interest has seen a 20% plunge in the past day. Here’s what this could mean for the cryptocurrency’s price.

Solana Open Interest Has Plunged After Market Volatility

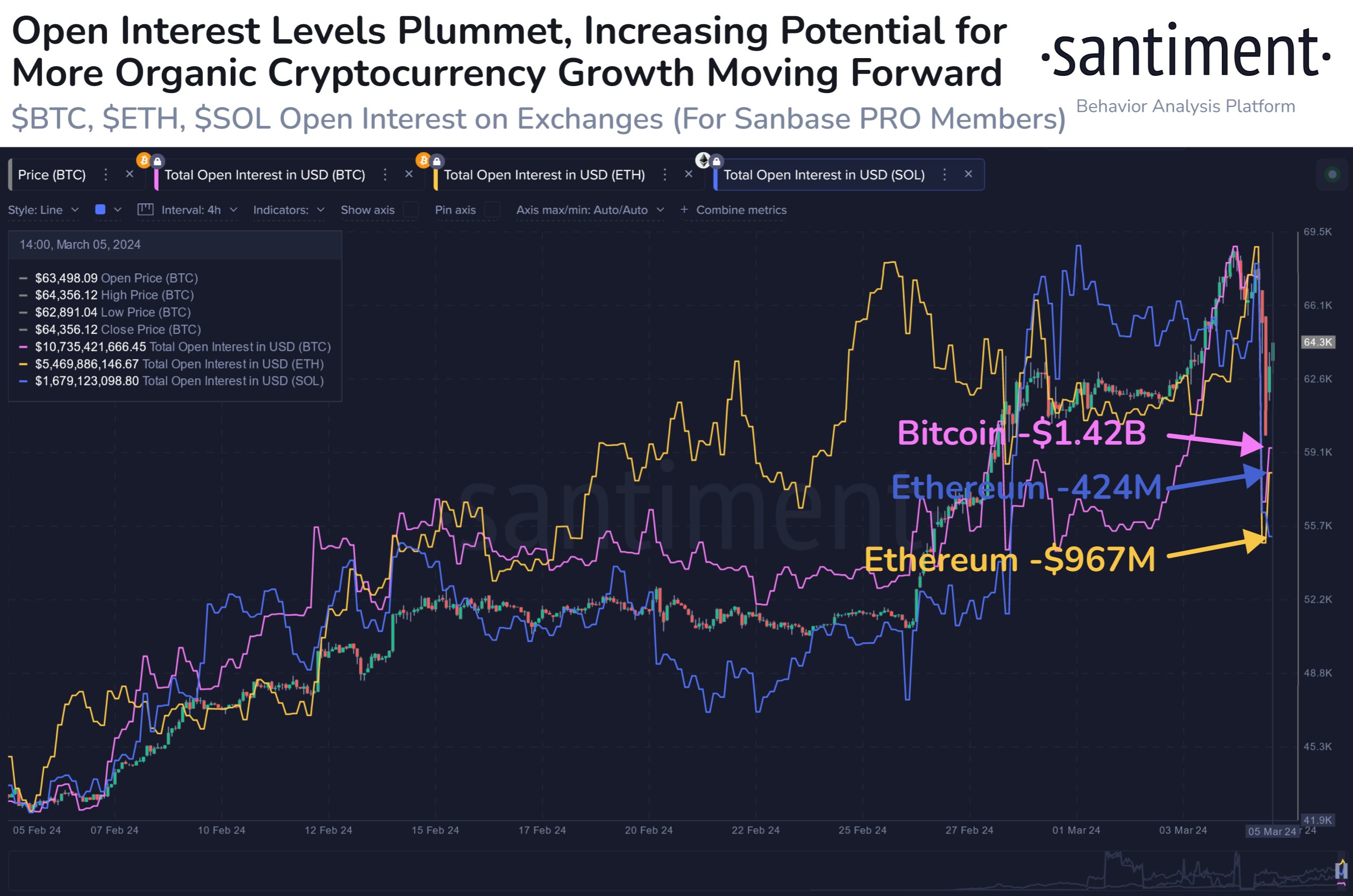

According to data from the analytics firm Santiment, the Open Interest of Solana and other cryptocurrencies has seen a steep decline since Bitcoin has set its new all-time high.

The “Open Interest” here refers to the total amount of derivative contracts (like futures and options) of a given cryptocurrency that are currently open on all exchanges. The metric makes this measurement in terms of the US Dollar (USD).

When the value of this metric goes up, it means that traders are opening up fresh derivative positions right now. Since such a trend usually results in the total leverage in the market rising, the asset may be more likely to witness volatility following it.

On the other hand, a decrease in the indicator implies either the holders are closing up their positions of their own volition or are getting liquidated by their platform. This kind of trend may lead towards more stable price action for the coin, assuming that leverage goes down alongside this decrease.

Now, here is a chart that shows the trend in the Open Interest for Solana, as well as for Bitcoin and Ethereum, over the past month:

As displayed in the above graph, all three of these cryptocurrencies have registered a notable drop in the metric as a consequence of the sharp price action the market has witnessed in the past day.

To be more particular, Bitcoin has seen its Open Interest drop by around $1.42 billion (corresponding to a change of -12%), Ethereum $967 million (-15%), and Solana $424 million (-20%).

Thus, it would appear that SOL saw the sharpest drawdown in the indicator as compared to the top two coins in the sector. In this Open Interest flush, investors of a variety would have been liquidated, like those who would have longed as SOL pushed up or those who opened shorts after its price crashed.

“In a way, we can view this open interest plummet as a sign that ‘speculative excess’ has been temporarily removed from the markets,” explains the analytics firm.

“Assuming funding rates can even out, prices can theoretically fluctuate under less influence of futures and options positions, and more on a true supply and demand market valuation from traders, investors, and hodlers,” notes Santiment.

SOL Price

After strong volatility in both directions during the past day, Solana has ended up arriving at the $130 mark. It’s unclear if the coin would become more stable now or if volatile price action would continue, but if the Open Interest is to go by, some stability could appear.