Solana’s price action is being shaped by investor behavior at key price levels, as revealed by new on-chain data from Glassnode. Large clusters of traders have formed at both ends of the current trading range, which are now playing a central role in how Solana moves in the short term. This is especially true as overall Solana trading activity and market participation continue to slow down.

$144 Resistance Builds As Break-Even Sellers Line Up

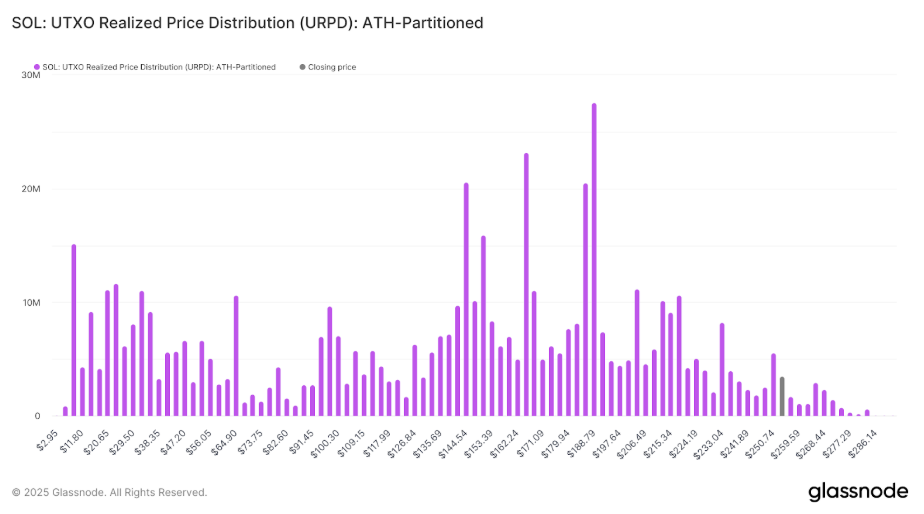

According to Glassnode’s URPD chart, Solana’s supply distribution reveals a sharp cluster of holdings at $144, where 27 million SOL, close to 5% of the total supply, is currently concentrated. This level has now become a test of resistance for Solana’s price action in the past few days.

What makes this zone particularly significant is its historical context. On January 19, when SOL reached its all-time high, this same level already held 20.6 million tokens. The rise in holdings since then indicates that many investors are sitting near their entry points and may be inclined to sell once prices revisit $144 to break even. This creates a psychological barrier that could stall or even reverse rallies if bullish momentum proves too weak to overpower profit-taking at this zone.

Beneath this resistance lies another major supply wall at $135, where 26.6 million SOL is currently held. Taken together, these two zones are likely to cap upward movement unless volume surges dramatically or there are new bullish events that will attract stronger demand.

Image From X: Glassnode

Long-Term Holders Reinforce Positions To Form Strong Support At $112

A Solana price support is also forming with notable strength, especially around the $112 region. Glassnode’s data shows that 9.7 million SOL, approximately 1.67% of the supply, is now positioned at this level. Back on January 19, only 4 million SOL tokens were held here.

Therefore, the increase to 9.7 million SOL tokens means that long-term investors have doubled down and reinforced their cost basis after the decline in recent weeks. This signals a high probability of price defense in the face of selling pressure, as these holders are likely committed to maintaining their positions rather than cutting losses.

Below $112, however, the safety net begins to thin. The $94 to $100 range collectively holds nearly 21 million SOL, but beneath that, there’s a wide void. Between $94 and $56, supply thins out dramatically, indicating a potential “air pocket” in price action. If the $100 mark collapses, Solana could experience a strong drop due to the absence of strong buyer interest in this lower range.

Further complicating the outlook is Solana’s steadily declining velocity, which has now sunk to its lowest point in five months. This metric, which tracks how often SOL changes hands, has reverted to levels last seen in October 2024.

Such a sharp decline in circulation reflects a clear drop in investor engagement. This dwindling activity exacerbates bearish sentiment, suggesting that even with support at $112, a muted market response may limit recovery efforts.

SOL: Velocity. Image From Glassnode

At the time of writing, Solana is trading at $131. Solana has spent the past seven days trading between the upper end of $135 and the lower end of $122.

Featured image from Coins.ph, chart from TradingView