Solana (SOL), a prominent player in blockchain technology, finds itself at a crossroads. While crypto analyst Altcoin Sherpa remains bullish on its long-term potential, recent price drops and a surge in failed transactions raise concerns.

Is Solana Poised For A Major Rally?

Sherpa, known for simplifying complex investment strategies, suggests a buying range of $168-208 for SOL. He emphasizes a long-term approach, advocating patience over short-term price movements.

This aligns with Solana’s reputation for innovation, offering a fast and scalable platform for decentralized applications (dApps). Its growing popularity and strong foundation in blockchain technology further solidify Sherpa’s optimistic outlook.

$SOL: It’s very simple- buy within this $168- $208 range and don’t think too much about price for the next few months. Watch # go way higher. The end. pic.twitter.com/InCvCIRdzo

— Altcoin Sherpa (@AltcoinSherpa) April 4, 2024

The analyst urges investors to exercise patience and adopt a long-term perspective while dealing with the erratic cryptocurrency market and advises against overanalyzing the short-term price fluctuations.

By contrast, he advocates refocusing towards a broader point of view, emphasizing that significant profits could result from a less fearful response to price fluctuations within the suggested purchase frame.

In light of the volatility of cryptocurrency investments, this perspective offers some degree of clarity and suggests that Solana’s value is about to see a significant increase.

But, SOL Price Is On The Weak Side

However, Solana’s recent price performance paints a different picture. Over the past 24 hours and the last week, SOL has experienced a slight decline. This dip comes amidst a period of high trading volume, exceeding $4.3 billion in the last day alone. While high volume can indicate strong market interest, it can also be a sign of volatility.

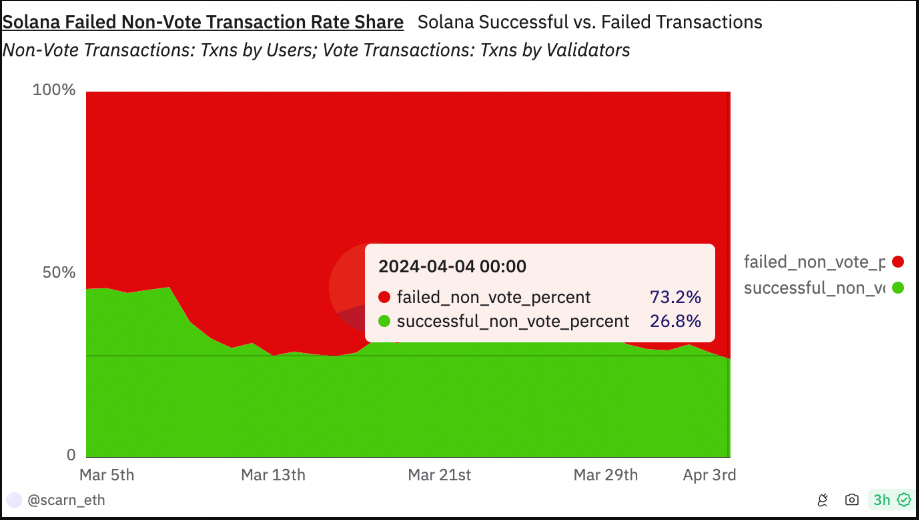

Further dampening investor sentiment is a concerning rise in failed transactions on the Solana network. Data from Dune Analytics reveals a staggering rate – nearly three-quarters of all transactions on the SOL chain have failed since March 2024.

While bots causing spam are attributed to most of these failures, legitimate users interacting with the blockchain for swaps or decentralized exchange (DEX) transactions could also be affected. This network congestion raises questions about Solana’s scalability, a core strength Sherpa highlights.

The Road Ahead For SOL

Solana’s future trajectory hinges on its ability to address these network issues. Developers are actively working on solutions, but it remains to be seen if they can effectively mitigate the problem. Addressing scalability concerns will be crucial to maintaining user confidence and attracting new ones.

The contrasting perspectives on Solana highlight the inherent volatility of the cryptocurrency market. Investors considering SOL should carefully weigh Sherpa’s long-term vision against the recent price decline and network issues.

Looking ahead, several factors will influence Solana’s future. The success of upcoming projects built on its platform and the broader adoption of blockchain technology will play a significant role. Additionally, regulatory developments and the overall performance of the cryptocurrency market could also impact SOL’s price.

Solana remains a force to be reckoned with in the blockchain space. Its innovative approach and strong foundation are undeniable. However, overcoming network congestion is paramount to fulfilling its long-term potential.

Featured image from Pexels, chart from TradingView