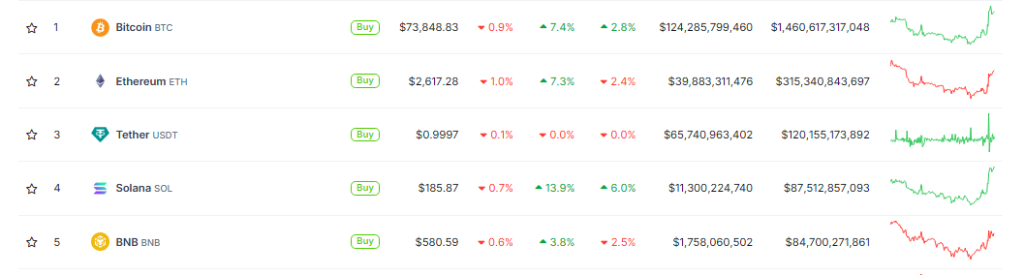

Among the largest cryptocurrencies by market capitalization, Solana (SOL) has surpassed Binance Coin (BNB) to secure the fourth position. SOL has recently experienced a 14% increase, which has enabled it to surpass BNB.

This represents an emerging market momentum of Solana. According to Coingecko, the market capitalization of Solana has reached over $87 billion in comparison to that of Binance Coin at almost the $84 billion mark. Thus, this shows the emergence of Solana’s strong appeal to investors.

Solana’s most recent ascent has brought it into the limelight, prompting crypto devotees and analysts to contemplate whether this represents a new era for the network. Despite a nearly 4% increase in BNB during the same period, Solana’s rapid recovery and robust community support have eclipsed its rival.

Increasing User Engagement and Activity

Apart from market size, active participation and complete information on-chain have raised Solana’s price. The network just noted a historic first: 123 million active monthly addresses in October, up 40% from September. According to the latest data, active addresses increased month by month displaying participation and confidence in the promise Solana presented.

According to the real-time economic activity reports by Blockworks Research, transaction fees and MEV tips recently peaked at a new all-time-high figure of $11 million on October 24th. These values have remained much above past ones, even though they have fallen somewhat lately.

Particularly from regular users and small-scale transactions, the higher use and engagement show the dynamic character of Solana’s ecosystem and its capacity to draw each daily players.

Memecoins Add To The Frenzy

The memecoin mania has taken off within its network, thereby amplifying trading volume and attracting more users, which has contributed to Solana’s rally. Pump.fun, a memecoin generator, and Raydium, a decentralized exchange, have received substantial attention. Pump.fun generated $30 million in revenue in October. On the other hand, Raydium’s trading volume exceeded $30 billion.

Memecoins have been a significant factor in the recent growth of Solana, as a growing number of users are flocking to these platforms to trade or generate meme-based tokens. The emergence of these niche areas has heightened the enthusiasm surrounding Solana, illustrating its adaptability as a blockchain that accommodates both mainstream and unconventional projects.

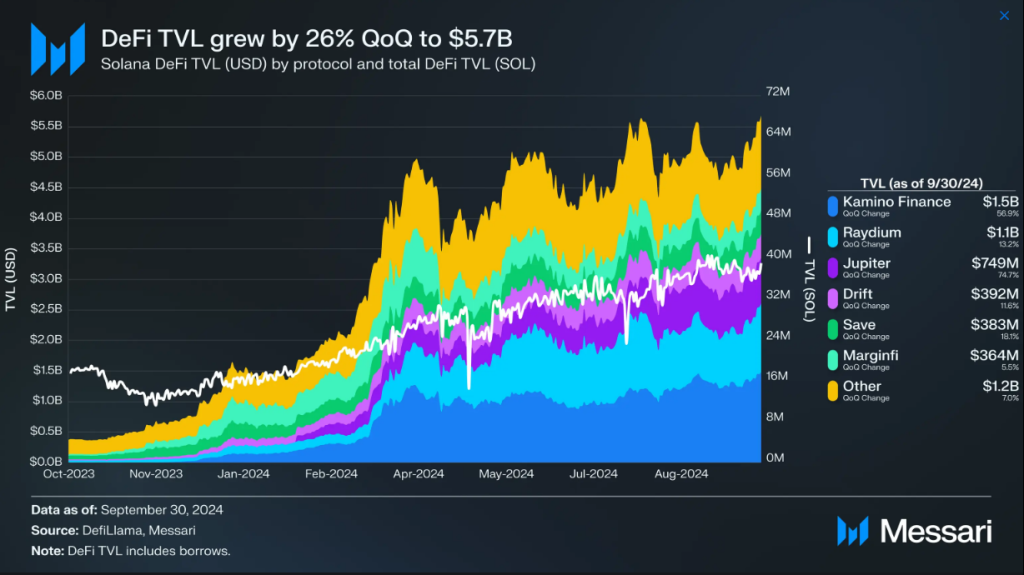

DeFi Expansion Boosts Solana’s Ecosystem

The price and volume of token transactions are not the only factors that contribute to Solana’s growth. According to a research by Messari, the Solana decentralized finance ecosystem is experiencing growth in terms of value locked (TVL), reaching $5.8 billion in Q3 2024. This is a 25% increase from the previous quarter, which propelled Solana to the position of third largest network by TVL.

Featured image from Reddit, chart from TradingView