Solana (SOL) finds itself stuck in neutral. Once a frontrunner in the 2023 crypto bull run, SOL’s price has been range-bound between $155 and $170 for the past few days, leaving investors cautiously optimistic but undeniably perplexed.

Technical Tug-of-War: Bulls Vs. Bears

Technical indicators paint a conflicting picture for the high-speed blockchain darling. The dreaded “death cross” – a bearish signal formed when the 50-day moving average dips below the 200-day average – has materialized, suggesting a potential short-term price decline. However, the Relative Strength Index (RSI) remains neutral, hinting at some underlying buying pressure, albeit weak.

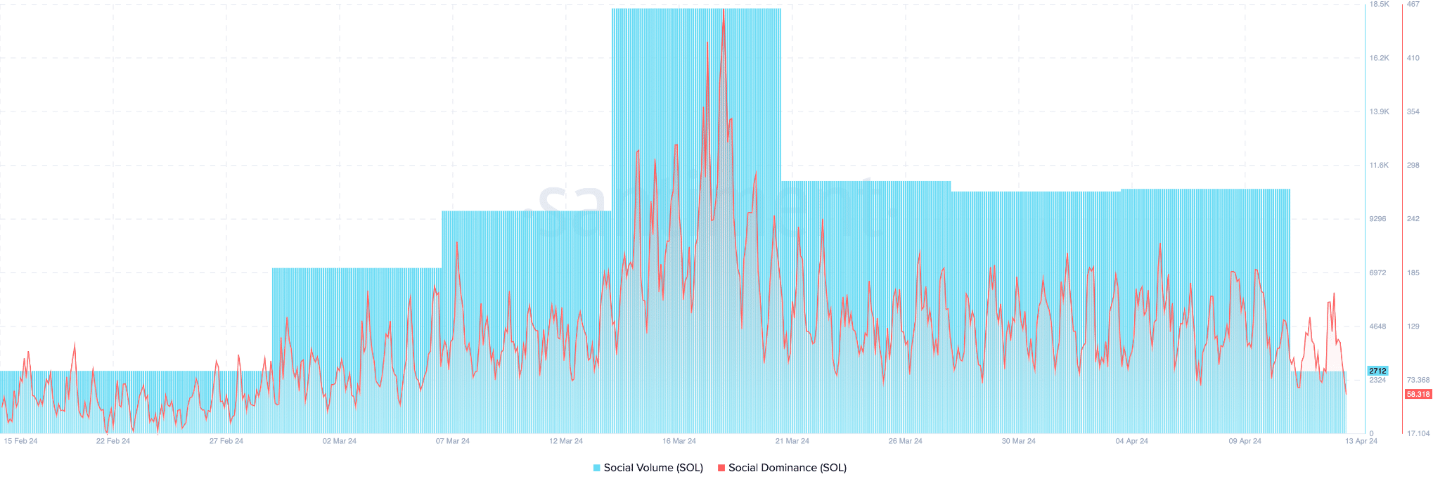

The social media front isn’t much clearer. Mentions and discussions surrounding Solana have dipped, indicating a decline in public interest. Additionally, trading activity has plummeted by over 50%, mirroring the community’s lukewarm engagement.

Whispers Of Opportunity

Despite the prevailing uncertainty, there are glimmers of potential for bullish surges. The derivatives market reveals an interesting dynamic. While the overall long/short ratio suggests investor indecision, some major exchanges like Binance and OKX see a more optimistic outlook with higher long positions.

Furthermore, recent price spikes have triggered short liquidations, indicating that short-sellers might be getting squeezed out, potentially paving the way for a short-term rally. This phenomenon highlights the inherent volatility of the crypto market, where sudden bursts of bullish momentum can catch bears off guard.

Solana Price Projection

Looking ahead, analysts offer a mixed bag of predictions. Some, like the report from CoinCodex, predict a bullish surge to $185 by July 10th. However, this optimism clashes with the bearish technical indicators and the “greed” reading on the Fear and Greed Index, which could signal overvaluation.

The path forward for Solana hinges on several factors. External influences, like regulatory decisions or broader market trends, could significantly impact its price. Additionally, the success of upcoming projects on the Solana blockchain could reignite investor interest and propel the token value upwards.

Solana’s current predicament is a microcosm of the broader cryptocurrency market. While innovation and potential abound, uncertainty and volatility remain constant companions. Investors in the Solana ecosystem, along with the rest of the crypto world, are left in a wait-and-see mode, eagerly awaiting the next move in this intricate game of digital value.

Featured image from Live Wallpaper, chart from TradingView