Solana’s price has fallen to $116, marking a 12% decrease over the past week amid growing concerns about large investors selling their holdings. According to reports, several major cryptocurrency holders, known as “whales,” unstaked and moved approximately $46 million worth of SOL tokens to exchanges, fueling the downward trend.

Four Major Wallets Lead Selling Wave

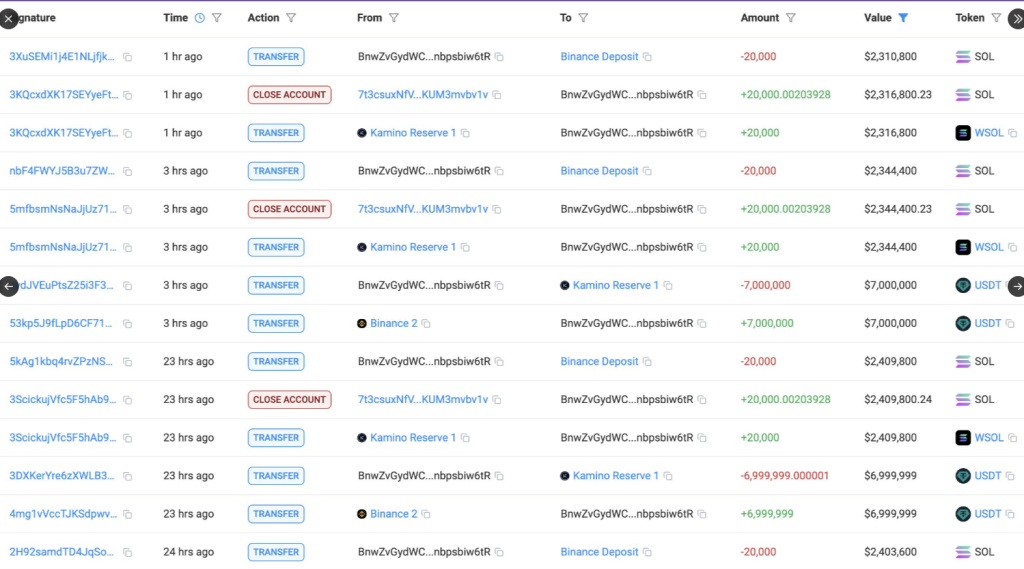

According to cryptocurrency monitor Lookonchain, four wallet addresses accounted for the massive exchange of funds. The largest seller, ‘HUJBzd,’ transferred $30 million worth of SOL to exchanges. Three other wallets also did the same, with ‘BnwZvG’ selling $9.47 million, ‘8rWuQ5’ transferring $3.53 million, and ‘2UhUo1’ transferring $3 million worth of tokens.

These mass transfers usually presage bearish sentiment in the market since they add selling pressure to exchanges. The recent price movement bears this trend out, with SOL falling by more than 3% within the past 24 hours alone.

Many whales unstaked and dumped $SOL today!

HUJBzd dumped 258,646 $SOL($30.3M).

BnwZvG dumped 80,000 $SOL($9.47M).

8rWuQ5 dumped 30,000 $SOL($3.53M).

2UhUo1 dumped 25,501 $SOL($3M).

Address:https://t.co/mCaB45W6pVhttps://t.co/wjhEwyZgFHhttps://t.co/Waqe4cxvbP… pic.twitter.com/kc1Q5GEKIX

— Lookonchain (@lookonchain) April 4, 2025

Market Uncertainty Tied To Tariff Announcements

The wider cryptocurrency market has been buffeted by economic policy shifts. Reports indicate that Bitcoin price fluctuations have been influenced by the announcement by US President Donald Trump of reciprocal tariffs. This uncertainty in the economy has spread to the altcoin market, with Solana being one of the cryptocurrencies under pressure.

Based on recent data, the price of Bitcoin might still move according to stock market trends in reaction to these fresh tariffs. Analysts have cautioned that the entire cryptocurrency market might witness short-term volatility as Bitcoin emulates stock market trends.

Some Analysts Remain Optimistic Despite Declines

Though the present figures indicate a declining trend, not everyone in the market is pessimistic. Cryptocurrency expert Brandon Hong recently expressed an opposing view on social media platform X and wrote: “SOL is about to have its biggest breakout ever.”

Hong’s forecast is focused on Solana possibly breaking out of its 400-day trading range. The analyst encouraged investors to “Buy now or regret later,” providing a rare optimistic view amidst the overall market uncertainty.

Traders Keep An Eye On SOL

This divergence in market opinion reflects the volatile nature of cryptocurrency investments in times of economic transition. Traders remain closely monitoring Solana as it navigates these tough market conditions.

The 30-day performance for Solana investors is even worse, with figures indicating an 15% drop in the past month. This longer decline fits with wider market trends among the cryptocurrencies that have also been depreciating over the recent era of economic instability.

While markets adapt to possible policy shifts and big holders keep shifting their assets, SOL price actions are still a major reflection of investor sentiment within the cryptocurrency market. Whether the token follows the bearish direction implied by whale action or breaks out as some analysts anticipate is to be seen within the next few weeks.

Featured image from Gemini Imagen, chart from TradingView