The post Solana (SOL) Breakout, $260 the Next Target? appeared first on Coinpedia Fintech News

Solana (SOL), the world’s fourth-largest cryptocurrency by market cap, is poised to reach an all-time high after breaking out from a crucial resistance level.

Following the victory of pro-crypto candidate Donald Trump in the U.S. presidential election, sentiment across the cryptocurrency landscape has shifted from a downtrend to an uptrend, leading to breakouts in Solana (SOL) and other cryptocurrencies.

Solana Technical Analysis and Upcoming Levels

According to CoinPedia’s technical analysis, SOL has experienced a significant price surge leading to the breakout from an inclined resistance level it has been faced since March 2024. Previously, whenever the asset’s price approached this level, it experienced selling pressure and a price decline.

However, with the sentiment changes and the breakout of this level, his breakout, there is now a strong possibility that SOL could soar significantly and reach its all-time high of $259.90 in the coming days. Currently, the asset is trading above 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend.

In addition to this breakout, SOL’s upward rally could gain further momentum if it closes a daily candle above the $205 level, unless it may take longer to reach its all-time high.

Bullish On-Chain Metrics

On-chain metrics further support this bullish outlook. According to the on-chain analytics firm Coinglass, SOL’s Long/Short ratio stands at 1.05 at the time of writing, indicating strong bullish sentiment among traders.

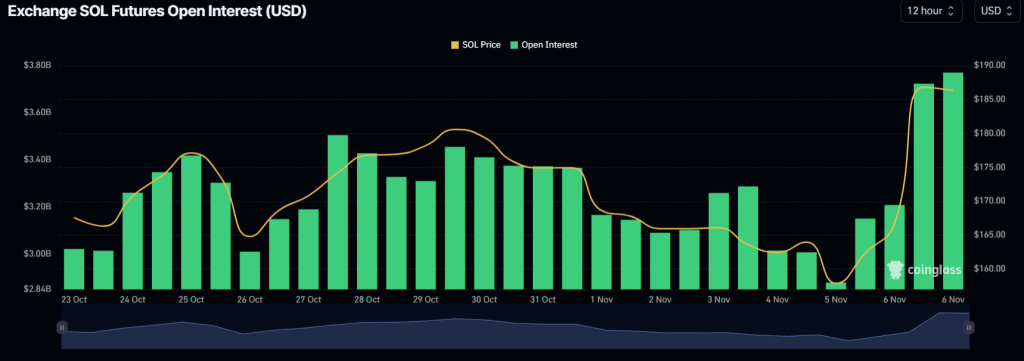

Additionally, SOL’s open interest has jumped by 18% over the last 24 hours, further indicating a bullish outlook. An increase in open interest suggests that derivative traders are building new positions, anticipating either a rally or decline depending on market sentiment.

By combining on-chain metrics with the technical analysis, it appears that bulls are currently dominating the asset and could help SOL reach its all-time high in the coming days.

Current SOL Price

As of now, SOL is trading near $186 and has experienced a price surge of over 12% in the past 24 hours. During the same period, its trading volume skyrocketed by 185%, indicating heightened participation from traders and investors following the breakout.