The post Solana (SOL) Poised for 25% Rally, On-Chain Metrics Signal Buy Opportunity appeared first on Coinpedia Fintech News

Solana (SOL), the fourth-largest cryptocurrency has gained notable attention from the cryptocurrency community as it breaks out of bullish price action patterns. Following the breakout, SOL is currently consolidating near the support level of $204, indicating potential accumulation before a major rally begins.

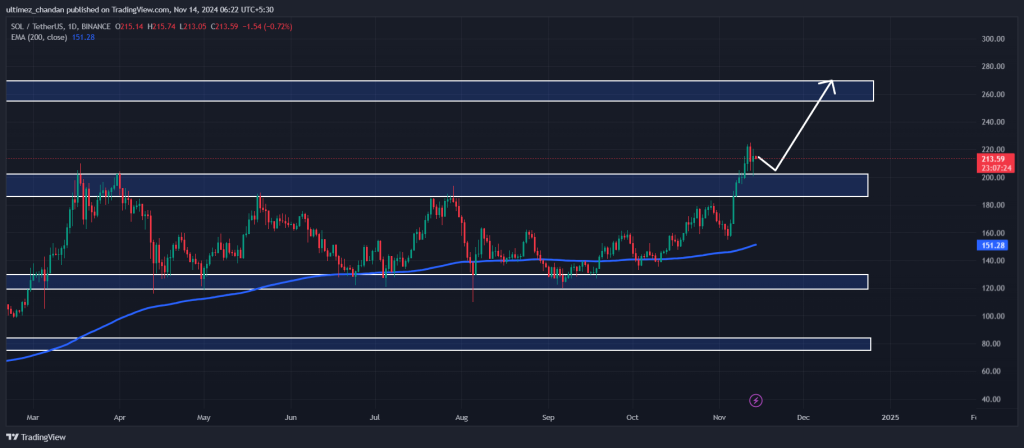

Solana Technical Analysis and Upcoming Levels

According to expert technical analysis, SOL appears bullish as it breaks out of a nine-month-long parallel channel pattern. Experts suggest that this breakout has shifted the sentiment from a range-bound market to a bullish one.

However, the market has been consolidating in a tight range for the last three days, which suggests potential accumulation and signals a bullish outlook for SOL holders.

Based on recent price action and historical price momentum, if SOL breaks out of this small consolidation, there is a strong possibility it could soar by 25% to reach the $260 level in the coming days. Currently, the asset is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating an uptrend.

Bullish On-Chain Metrics

SOL’s positive outlook is further supported by on-chain metrics. According to on-chain analytics firm Coinglass, Solana’s Long/Short ratio currently stands at 1.05, indicating strong bullish market sentiment among traders. Meanwhile, its open interest has skyrocketed by 11% in the past 24 hours and 4.7% in the past four hours.

This rising open interest suggests growing participation from traders, and the price consolidation also signals a bullish trend.

The combination of these on-chain metrics with technical analysis suggests that bulls are still dominating the asset amid the price consolidation and could support SOL in its upcoming bull run.

Current Price Momentum

At press time, SOL is trading near $214.85 and has experienced a price surge of voer 1.10% in the past 24 hours. During the same period, its trading volume jumped by 2.6%, indicating rising participation from traders and investors amid a potential upside rally.