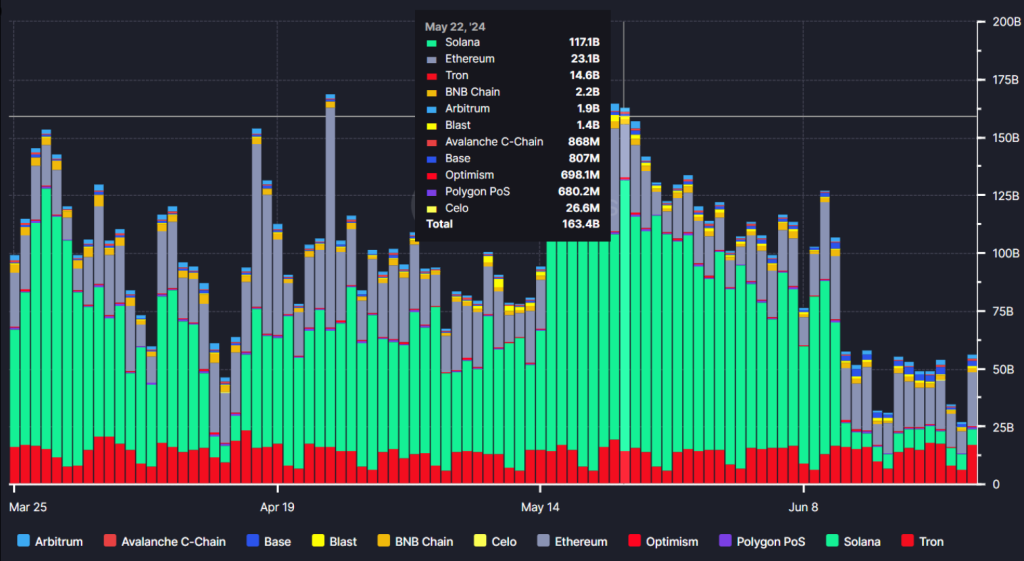

Solana has been thrown into a tailspin after a shocking revelation: its daily stablecoin volume may have been significantly inflated. Reports indicate a staggering drop – from a dizzying $75-100 billion to a mere $7 billion in a 24-hour period.

This dramatic shift has unsettled the crypto community, raising serious questions about the legitimacy of Solana’s past performance and its future as a DeFi powerhouse.

Wash Away The Hype: Inflated Figures Or Fabricated Reality?

Market sentinels are pointing fingers at wash trading, a manipulative practice where investors essentially buy and sell crypto back and forth to each other, creating an illusion of high activity. This tactic inflates trading volumes, potentially misleading investors about the true level of adoption and liquidity on the platform.

Amazing how Solana went from $75-100 BILLION DAILY stablecoin volume to $7 BILLION daily in 1 day!!

Might it be because the data was totally fake??? Like how I’ve been talking about all these months??

And by the way even at $7 Billion 90% of the volume is still fake https://t.co/CnKWGAbjsM pic.twitter.com/ScfCgv5UhS

— Wazz (@WazzCrypto) June 25, 2024

The discrepancy is too large to ignore. While some wash trading might occur on any exchange, a legitimate DeFi ecosystem shouldn’t be so heavily reliant on it. This raises serious concerns about the organic growth of Solana’s stablecoin market.

The finger of suspicion falls particularly on USDC, a leading stablecoin pegged to the US dollar. Experts estimate that even with the revised $7 billion volume figure, a staggering 90% could still be inflated. This throws a wrench into Solana’s narrative as a DeFi leader, potentially shaking investor confidence.

Investor Jitters And The Road To Redemption

The sudden data plunge has unnerved investors who made decisions based on the previously reported figures. This could lead to a sell-off, causing short-term volatility in the Solana market. Additionally, the revelation comes at a sensitive time – just ahead of the highly anticipated Ethereum ETF deadline, which some believe could have boosted Solana’s DeFi activity further.

This is a major blow to Solana’s credibility. Investors need to be able to trust the data they’re basing their decisions on. Regaining that trust will require a swift and transparent response from Solana’s development team.

SOL market cap currently at $63 billion. Chart: TradingView.com

Beyond The Hype: Does Solana Still Have DeFi Potential?

While the data debacle undoubtedly casts a shadow on Solana’s recent performance, it doesn’t negate the platform’s strong technological foundation. Solana boasts one of the fastest and most scalable blockchains in existence, making it a technically sound option for DeFi applications.

The coming weeks will be critical for Solana. How the platform addresses the data controversy and implements reforms to ensure transparency will determine whether it can weather this storm and reclaim its position as a viable DeFi contender.

Featured image from YouTube, chart from TradingView