Capital poured into US-listed Bitcoin exchange-traded funds this week, with Tuesday alone witnessing nearly $1 billion in fresh cash.

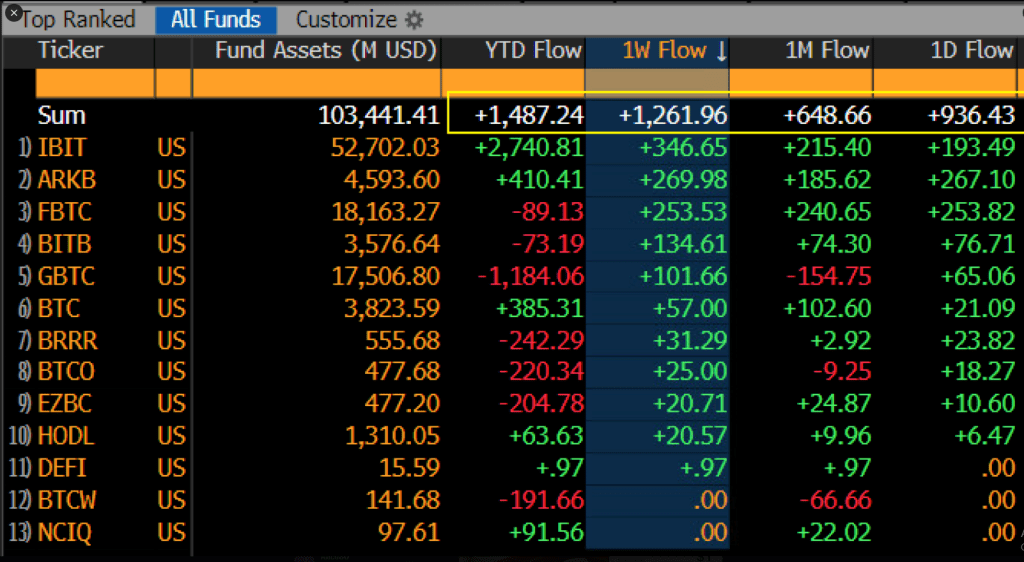

The rush propelled weekly inflows to $1.2 billion and total assets under management (AUM) to $103 billion, based on Bloomberg data. The investment deluge occurred while Bitcoin’s price rose above $93,000, reaching $93,700 – its highest since early March.

BlackRock Fund Remains Top Dog Among Rivals

BlackRock’s iShares Bitcoin Trust (IBIT) remains at the forefront with year-to-date inflows of $2.7 billion. The fund took in another $346 million last week alone.

Ark Invest’s ARKB and Grayscale’s Bitcoin funds lag behind with significantly smaller year-to-date inflows of $410.41 million and $385.31 million.

Not everything is coming up roses, however. Grayscale’s GBTC has seen $1.18 billion of outflows since January, going against the overall positive tide.

The spot bitcoin ETFs went Pac-Man mode yesterday, +$936m, $1.2b for week. Also notable is 10 of 11 of the originals all took in cash too. Good sign to see flow depth vs say $IBIT doing 90% of the lifting. Price up $93.5k. Pretty strong all things considered IMO. pic.twitter.com/HeLwffgT8F

— Eric Balchunas (@EricBalchunas) April 23, 2025

Increasing Institutional Confidence Reflected In Broad Participation

Ten of 11 spot Bitcoin ETFs saw inflows of fresh funds this week, Bloomberg senior ETF analyst Eric Balchunas reported. They’re going “Pac-Man mode”, the analyst said on X. That broad-based involvement indicates institutional players are diversifying their bets into several funds rather than focusing on one or two.

The value traded across all Bitcoin spot ETFs totaled $496 million, while net assets in them now represent nearly $57 billion – equivalent to around 2.80% of Ethereum’s market cap.

Ethereum Products Keep Losing Streak While XRP Shocks

As Bitcoin-linked investments thrive, Ethereum products simply can’t seem to get a break. According to reports from CoinShares, investment products centered around Ethereum lost yet another $26.7 million last week.

This takes their eight-week outflow amount to a mind-boggling $772 million. Even in the face of this continued outflow, Ethereum remains in second place for year-to-date inflows at $215 million.

Short Bitcoin Products Under Ongoing Pressure

Short Bitcoin products are experiencing the squeeze. Short BTC products had their seventh consecutive week of outflows, with $1.2 million exiting these funds.

CoinShares data show that these short bets have now lost $36 million over seven weeks – 40% of their assets under management. The ongoing outflows from short positions are consistent with Bitcoin’s recent price strength.

XRP is the only exception among alternative coins, and its investment products attracted over $37 million last week, the third highest for year-to-date inflows on $214 million. This defies the trend observed in most of the other altcoins, which still face selling pressure.

Certainly, all of this new money being poured into Bitcoin ETF investments is perhaps the clearest sign yet that traditional financial institutions are coming around to cryptocurrency as an asset class.

We’re talking almost $1 billion coming into the market in just one day: this looks like the dawn of a new era in which acceptance of the asset class by the mainstream is even greater.

Featured image from Wallpapers.com, chart from TradingView