Alon Muroch, the founder of SSV Network, has been drafted into the Israeli Army, according to an X post shared on October 10. Following this news, SSV, the native token of the SSV Network, fell 5%, dropping below the $14 mark. At this pace, SSV is moving closer to its all-time low of around $13.40, registered in September 2023.

SSV Founder Getting Drafted

In response to the ongoing crisis in the Middle East, Muroch stated that the situation on the ground is “much worse than described.” The founder said that being drafted into the army might help “tip the scale” and improve the situation on the ground.

The escalation in the Middle East as of this week has created a humanitarian crisis leading to loss of lives and destruction of property. As of writing on October 11, it is unclear whether Muroch has been mobilized and actively serving in the military.

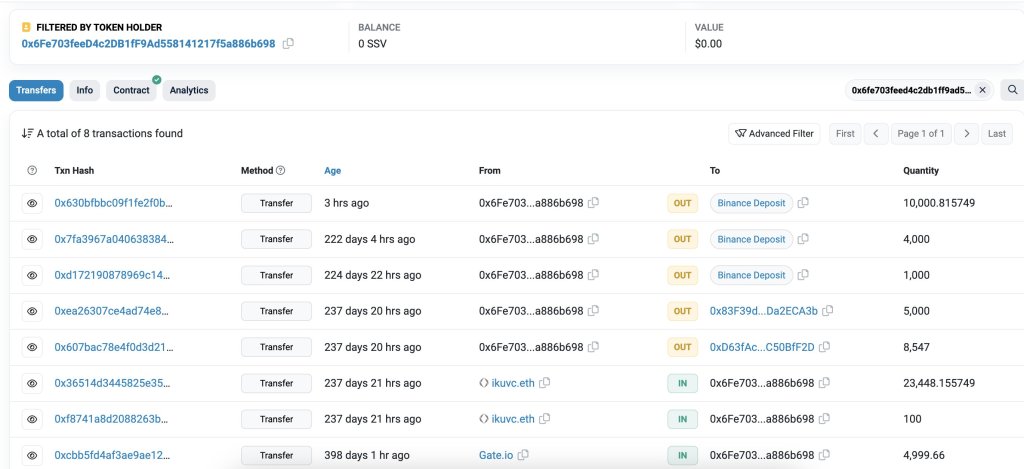

Although this news didn’t immediately impact sentiment, blockchain analysis platform Lookonchain picked out two notable transfers. Two addresses, “ikuvc.eth” and “0xF447,” deposited 18,055 SSV worth over $250,000 to Binance, a leading exchange.

Transfers to centralized exchanges usually indicate a potential intention to sell. Even so, it still needs to be determined whether these addresses have liquidated their tokens for other currencies, usually USDT or more liquid and stable tokens such as Bitcoin (BTC) or Ethereum (ETH).

SSV remains under pressure at spot rates. The token is down 5% on the last trading day, extending losses, collapsing from its all-time highs of nearly $100 when it first listed on Binance. Currently, SSV is down by over 95% from its peak, highlighting the dicey state of the token and how unfavorable the markets have been in the past eight months.

SSV Network Still Under Development

The SSV Network aims to strengthen Ethereum by allowing anyone to become a validator without necessarily operating a node. Ethereum is a proof-of-stake network reliant on a web of validators for security.

The SSV Network uses the Distributed Validator Technology (DVT). This system distributes the validator key among a network of non-trusting nodes. The platform allows anyone to stake ETH without running a full validator node, earning rewards.

In doing so, SSV Network aims to make staking more decentralized and accessible while enhancing security and reliability. Currently, SSV Network is still in development and permissioned. However, they plan to update via a Permissionless Launch, broadening their base of operators and validators.