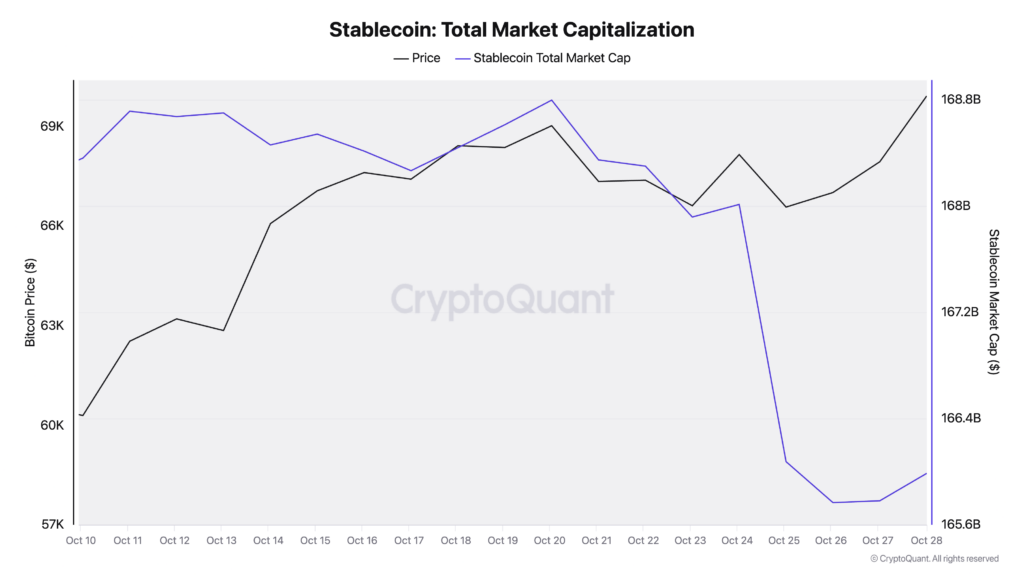

The market cap of all stablecoins has fallen from $168 billion at the start of October to around $166 billion as Bitcoin surpassed $70,000 once again.

Stablecoins, the liquidity of the crypto industry, decline as investors trade them for other assets such as Bitcoin. While more stablecoins can enter the ecosystem through fiat deposits to exchanges, this inflow appears to be outpaced by the flight to non-stablecoin assets.

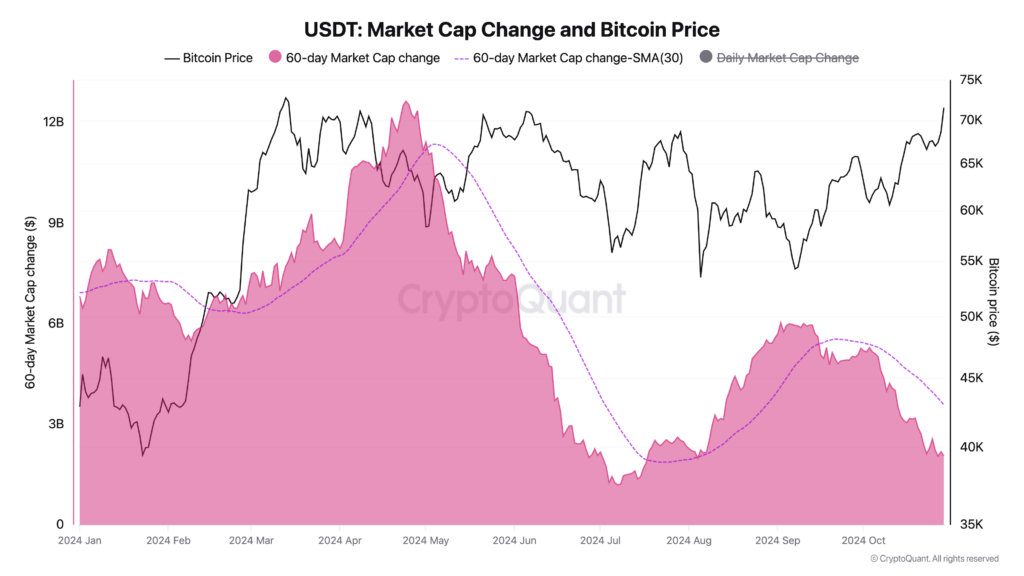

The largest stablecoin by market cap, Tether, stands at $120 billion, having surged from $90 billion at the start of 2024. However, the rate of this increase has slowed dramatically since the beginning of the month. The 60-day change in market cap has fallen below $3 billion for the first time since August after a peak of over $12 billion in late April.

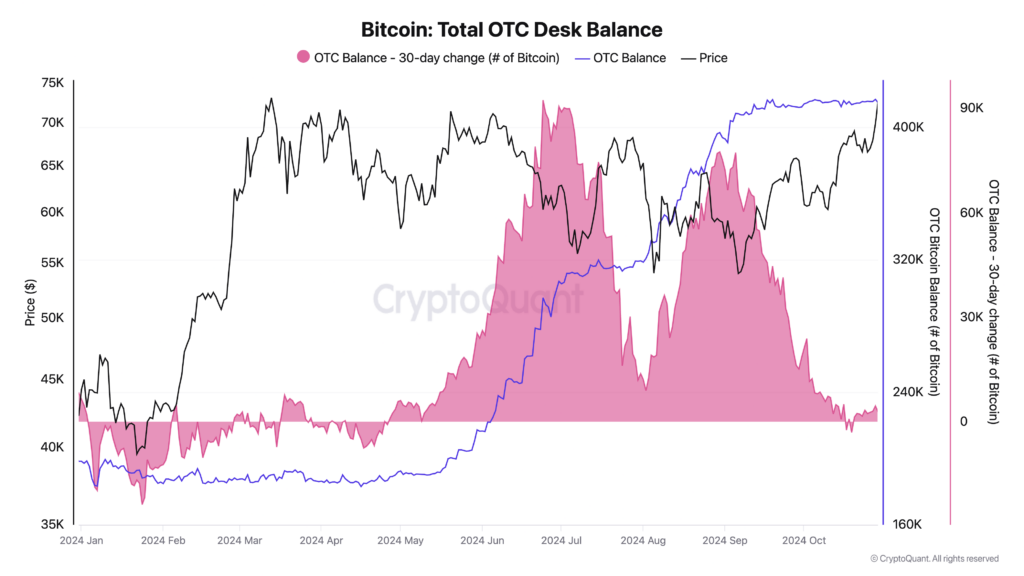

In addition to a reduction in both stablecoin balances and the rate of increase in Tether’s market cap, the growth rate for OTC Bitcoin balances has also decreased. OTC balances reached an all-time high in September but have remained relatively stable since.

With over $160 billion in stablecoins, there is still plenty of liquidity in the market to potentially fuel a sustained bull run toward or beyond the all-time high.

The post Stablecoin market cap falls $2 billion as liquidity fuels Bitcoin price surge appeared first on CryptoSlate.