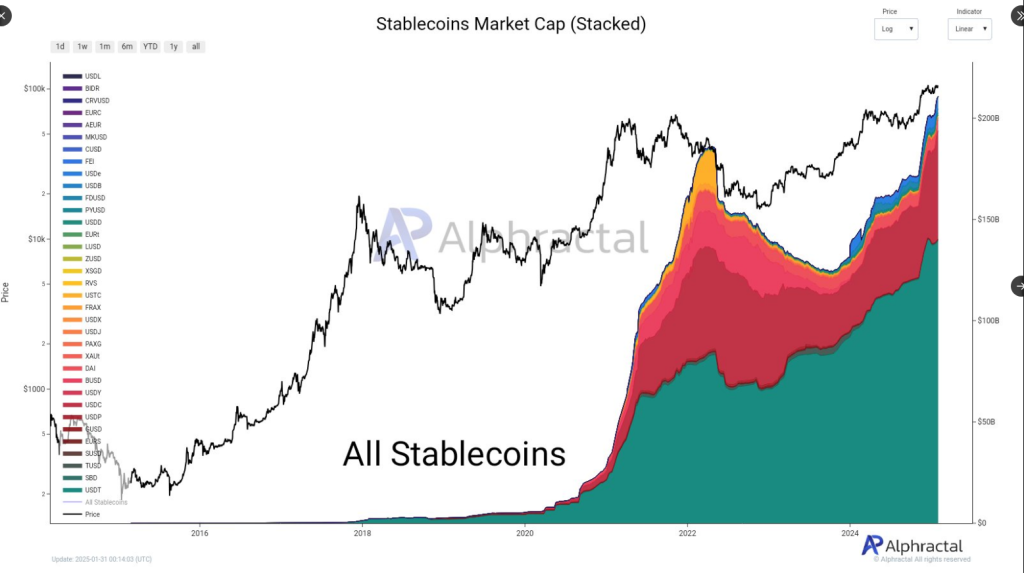

For the past few months, stablecoins have yielded the spotlight to their more speculative counterparts, including tokens inspired by politicians. However, recent on-chain data suggests that stablecoins are back and have surpassed the $200 billion market cap.

According to the data shared by Alphractal, the segment’s capitalization has surged to $211 billion, a record high, thanks to months of stable growth, which started in mid-2023.

Stablecoins‘ market capitalization grew by 73% from its August 2023 value of $121 billion, updated data released on January 31st show. The primary driver of this segment’s growth is still Tether’s USDT, however, USDC has been gaining ground recently, which is fascinating.

Stablecoin Market Cap Surpasses $211B – USDC Gains Momentum!

Since 2023, the stablecoin market has grown significantly, mainly driven by USDT (Tether). However, recently, USDC has been gaining an edge over other stablecoins.

This trend is occurring due to the recent drop in… pic.twitter.com/IRKrQErmCE

— Alphractal (@Alphractal) January 31, 2025

Tether’s USDT Remains Primary Driver Of Growth

Since 2023, the stablecoin market has grown steady, mostly due to Tether’s USDT. As of now, stablecoins are worth $223 billion, which is a 0.2% increase from yesterday.

Interestingly, USDT and USDC are the present growth drivers of stablecoins. Apart from the numbers from both coins, the stablecoins group hasn’t changed much since 2023 and has shown steady and average values. Right now, Tether’s USDT is valued at almost $140 billion, and USDC is at $53 billion.

USDC Slowly Gains Ground On Other Coins

Alphractal’s post on Twitter/X shows that USDC has been gaining ground over other stablecoins in the market. According to the post, this is happening due to a drop in altcoin prices and since a substantial part of the sell-offs have been swapped into USDC.

The post also showed that USDC’s dominance in this segment has hit a key resistance level, the same amount observed in 2021. This was the start of the bear market in 2022 when Bitcoin’s price dropped to as low as $15,500. If this metric persists, it can serve as the market’s bearish signal, impacting investors’ buying decisions. However, if this metric declines, it can be USDC’s jumping board to claim new highs.

What To Expect From The Stablecoins Segment In The Short-Term

In the last bull run, USDC’s supply increased in May, then reached its high in March 2022. The stablecoin’s market cap increased by 170% from April 2021 to March 2022. If the current coin supply continues to grow but price starts to dip, then the stablecoin market may hit its peak in a few months.

Traditionally, a rising market cap for stablecoins reflects growing investors’ confidence, which signals an increase in capital inflows.

On the contrary, a rising stablecoin market cap is usually associated with growing investor conviction, signaling the potential for boosted capital inflows. This suggests that the bullish momentum could continue for a few more months.

Featured image from Gemini Imagen, chart from TradingView