Data analyzed by CryptoSlate analysts revealed that around $4 billion worth of stablecoins left the exchanges over the past seven days, leaving a volume of $38 billion.

This analysis is based on the STBL data, which is a virtual asset that aggregates the data of all ERC20 stablecoins to create a metric that can reflect the stablecoin balances across all crypto exchanges.

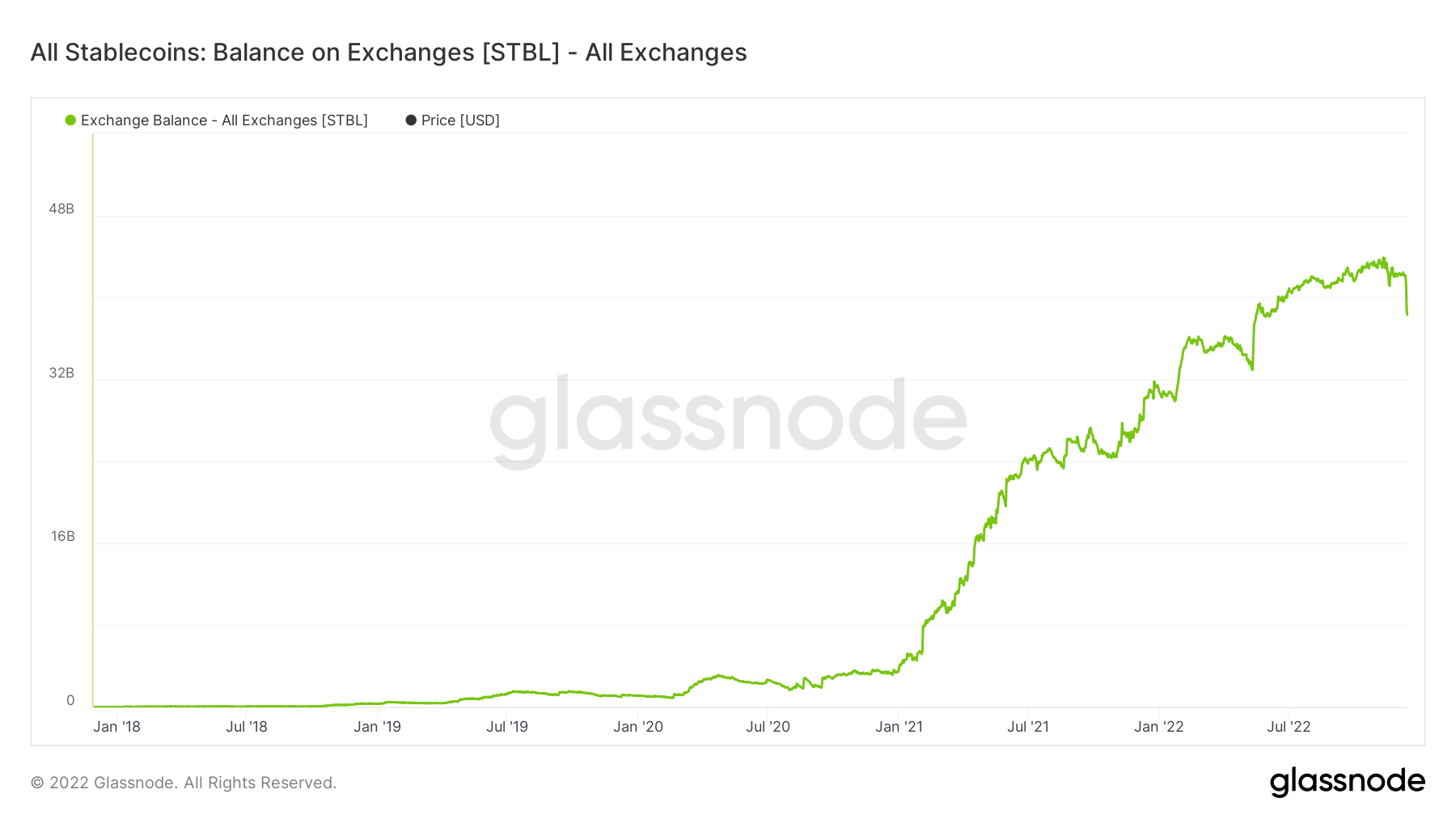

Stablecoins held on exchanges

STBL includes Binance USD (BUSD), Gemini Dollar (GUSD), HUSD (HUSD), DAI (DAI), Paxos Standard (USDP), Stasis Euro (EURS), SAI (SAI), Synthetix USD (sUSD), Tether (USDT), USD Coin (USDC).

The green line on the chart below reflects the total volume of the stablecoins included in the STBL metric that has been held on exchanges since the beginning of 2018.

According to the data, the exchanges started accumulating stablecoins at an increasing rate in January 2021. The growth has been more or less stable since then, except for a few downfalls during late 2021 and 2022.

The chart also shows a visible drawdown recorded over the past week. Exchange users purchased around $4 billion worth of stablecoins and removed them from the exchanges’ portfolios.

USDC vs. USDT

When it comes to the market shares of stablecoins that sit on exchanges, a recent analysis by CryptoSlate revealed that USDT has taken the lead.

According to numbers from Sept 2022, the USDT balance on exchanges doubled and reached $17.7 billion, compared to Sept. 2021, when it was just below $8 billion. USDT has been available on exchanges since early 2019, but its share started to grow exponentially only after 2021.

USDC has also been increasing its market share since the beginning of 2021. By early 2022, it stood at $7 billion. However, its dominance didn’t continue as it fell to $2.1 billion by Sept. 2022.

The post Stablecoins worth $4B exited exchanges in last 7 days appeared first on CryptoSlate.