Following such a historic run in the past two years, it was only a matter of time before the projections for a Bitcoin bear market took over crypto discussions. Several pundits and experts have shared when they think the digital asset market will reach its cycle top and probably witness a reversal.

While the crowd is still fairly optimistic about the potential of various cryptocurrencies, the market moving in the opposite direction won’t come as a surprise. A popular crypto trader on the social media platform has echoed a similar sentiment, providing a possible timing for the arrival of the crypto bear market.

Why The Bear Market Could Begin In April

In a Jan. 25 post on the X platform, prominent crypto analyst Ali Martinez shared his “unpopular opinion” about the current Bitcoin bull cycle and its potential end. According to the pundit, the bear market could commence in approximately three months.

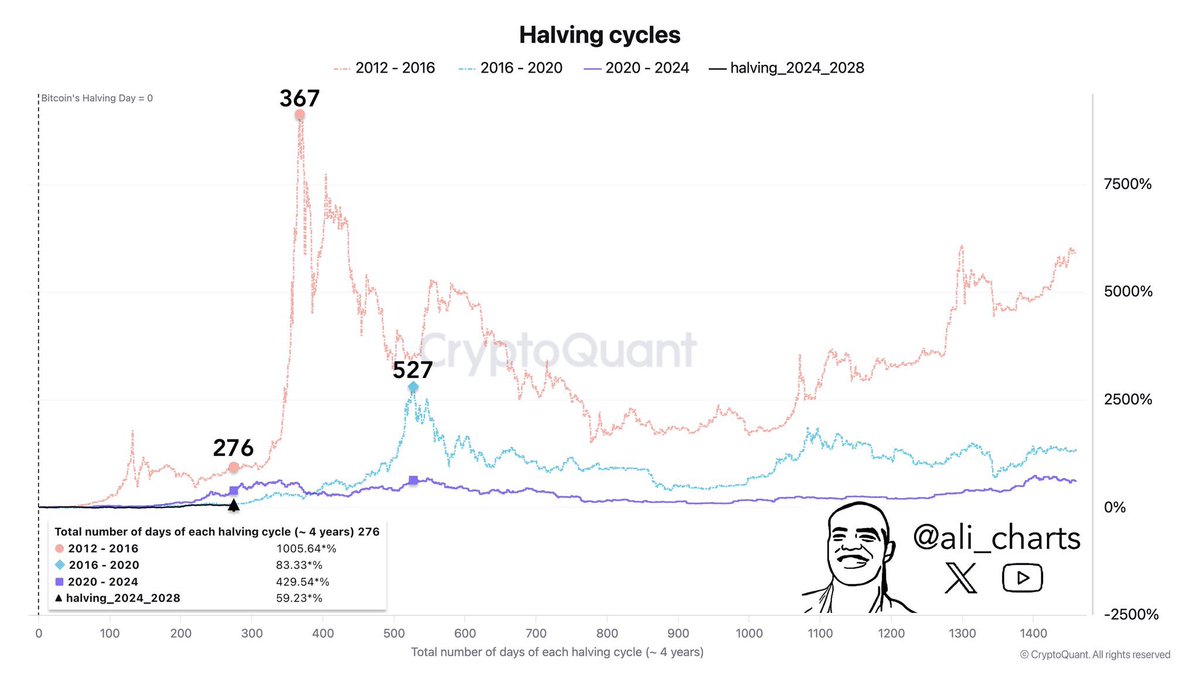

The reasoning behind this projection is the historical price performance of Bitcoin across different halving cycles. The Bitcoin halving, an event that occurs approximately every four years, tightens Bitcoin’s supply by slashing the mining reward by half.

As seen in 2024 — the most recent halving year, the halving event has historically been a precursor to substantial price growth. However, post-halving rallies are typically followed by significant profit-taking, leading to market consolidation and a bear market.

From a historical standpoint, approximately 276 days after the halving event have proven to be pivotal in the trajectory of the Bitcoin market. Specifically, the Bitcoin price experienced significant price growth after crossing the 276-day milestone in the 2012 -2016 halving cycle.

However, the BTC market witnessed a shift in sentiment and a severe market downturn 367 days following halving — 91 days after the 276-day milestone. If this historical pattern holds, investors could see the bear market commence sometime in late April.

As of this writing, the price of BTC sits just beneath the $105,000 mark, reflecting no significant movement in the past day.

Retail Interest On The Rise?

While historical price data is an effective way of analyzing a cycle’s trajectory, on-chain data is another method that sheds light on cyclical price movements. One such data is the retail interest in Bitcoin, which measures the demand of small-scale investors in the premier cryptocurrency.

Related Reading: MicroStrategy May Face Tax Issues Over $19 Billion Unrealized Bitcoin Gains: Report

Typically, demand from retail investors is often correlated with the peak euphoria phase. “Looking at past cycles, the last two major spikes in searches for “how to buy crypto” occurred when BTC was around $65,000 in May 2021 and $69,000 in November 2021—right at the market top,” Martinez said in a separate post on X.

As shown in the chart above, the “interest over time” indicator seems to be picking up again in 2025. This could be a signal of an impending top for the crypto market.