Alabama State Auditor Andrew Sorrell has publicly proposed the establishment of a Strategic Bitcoin Reserve (SBR). Sorrell’s call comes amid a growing wave of interest in SBRs among both federal and state-level policymakers, as well as a sharp rise in BTC’s price following the election of President-elect Donald Trump, who campaigned on pro-Bitcoin policies.

Speaking to 1819 News, Sorrell emphasized what he views as the inevitability of Bitcoin and crypto’s long-term success: “The debate over whether crypto will succeed has ended.” He further underscored the value of digital assets in broadening state portfolios: “As of now, crypto is a $3 trillion asset class that the state has zero exposure to. It is also the most rapidly growing asset class […] with the greatest potential for price appreciation.”

Is Alabama Next To Draft A Strategic Bitcoin Reserve Bill?

According to Sorrell, establishing a SBR would serve three primary goals: portfolio diversification, crypto-friendly positioning, and protection against currency-related risks. “What happens if the dollar ceases to be the reserve currency of the world?” Sorrell asked. “What happens if inflation runs 8% again? […] Bitcoin’s value is unaffected by what happens to the U.S. dollar […] It would strengthen our state’s balance sheet and could be used as collateral for future debt issuances.”

Sorrell’s initiative closely follows national and federal developments. President-elect Trump’s stated intention to create a “national Bitcoin stockpile” has become more tangible following a 50% surge in BTC’s price since Election Day. Trump has met with several top crypto executives and has pledged to keep and potentially add to the approximately 207,189 BTC seized by the US government over the years, a holding that now represents over 1% of global BTC supply.

In the US Senate, Wyoming’s Sen. Cynthia Lummis has introduced the BITCOIN Act (Boosting Innovation, Technology and Competitiveness through Optimized Investment Nationwide), a measure that would require the US Treasury to create a strategic Bitcoin reserve.

At the state level, momentum is building. Florida is exploring plans to form its own SBR as early as Q1 2025. The Florida Blockchain Business Association (FBBA) has proposed investing one percent of the state’s pension fund—an estimated $1.85 billion—into Bitcoin. Pennsylvania introduced its SBR Act in November, which could allocate up to 10% of its General Fund into the digital asset. Now, Alabama could be on the verge of a similar move, potentially intensifying interstate competition to secure early and substantial BTC holdings.

Sorrell noted that states would likely face fewer regulatory hurdles in purchasing BTC than in previous years, particularly following the US Securities and Exchange Commission’s authorization of exchange-traded funds (ETFs). “States can buy into Crypto as easily as they can purchase stock through a traditional brokerage account,” Sorrell said.

He also suggested that a potential Alabama SBR mirror the federal approach promised by President-elect Trump. “We can model Alabama’s Bitcoin reserve after the federal American Strategic Bitcoin Reserve that Donald Trump promised to start,” he explained. “The US Government already owns 207,189 BTC, acquired through various seizures […] worth $20 billion dollars. Those were slated to be sold, but Trump has pledged to keep them and possibly even add more.”

Despite his enthusiasm, Sorrell advised caution in execution. He proposed a two-year, dollar-cost-averaging model to mitigate timing risks, given the volatile nature—particularly after its price recently surpassed $100,000.

“The framework the state should follow would be to dollar-cost-average our way in over a period of 2 years. Bitcoin just crossed over $100,000 recently, so buying into a bull market may not be the best timing. A better strategy is monthly purchases over a 2-year period that average out your entry price,” Sorrell stated.

Just like Eric Trump at the Bitcoin MENA Conference, Sorrell shared an eye-popping price prediction: “The idea is for a Bitcoin reserve […] not to flip it for a quick profit,” Sorrell said, emphasizing the importance of a long-term strategy. “It is highly likely Bitcoin will one day reach $1 million per coin. The individuals and institutions that have done the best with Bitcoin investing are the ones that have bought and held for the long-term.”

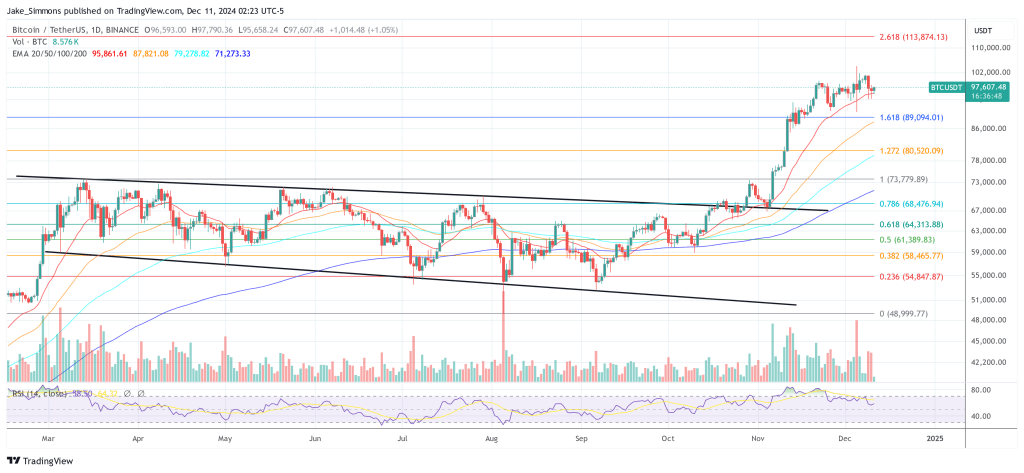

At press time, BTC traded at $97,607.