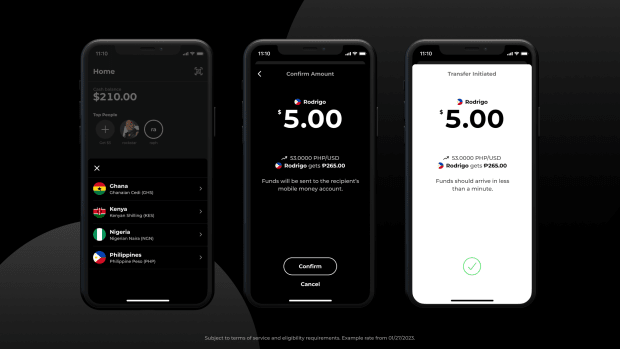

U.S. users of Strike can now use Send Globally to send instant, cheap remittances to loved ones in the Philippines.

Strike, the leading digital payment platform built on Bitcoin’s Lightning Network, has announced the expansion of its “Send Globally” product to the Philippines. This will allow for fast, secure and low-cost money transfers between the U.S. and the Philippines, which is one of the world’s largest remittance markets. The Philippines relies on more than $35 billion annually in money sent from abroad, with over $12 billion coming from the U.S. alone.

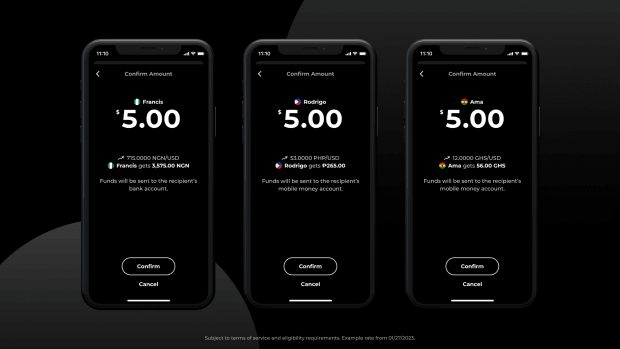

Strike has partnered with Pouch.ph to enable transfers from U.S. dollars to Philippine pesos, which can be received in a bank or mobile money account in the Philippines.

Strike uses the Lightning Network to make digital payments faster, cheaper, and more accessible, particularly in countries with a high number of unbanked individuals. With Send Globally, dollars are converted into bitcoin, sent via the Lightning Network to a third-party partner in the recipient’s country, then converted into local currency and sent directly to the recipient’s bank or mobile money account. This eliminates the need for both the sender and recipient to worry about bitcoin’s tax treatment, dollar volatility or custody implications.

“Remittances are a broken system and Strike delivers an incredibly empowering experience for people to send money around the world in nearly an instant,” Jack Mallers, founder and CEO of Strike commented. “We’re excited to partner with Pouch.ph to advance financial inclusion and bring fast, low-cost cross-border payments via the Lightning Network to the Philippines. Our technology allows us to both improve on the existing cross-border experience and include those that have previously been excluded by legacy payment rails.”

Bitcoin Magazine was fortunate enough to interview Mallers on the development, which can be viewed below:

Send Globally was launched in December 2022 starting with transfers from the U.S. to Nigeria, Kenya, and Ghana. CoinCorner has also partnered with Pouch.ph to enable remittances for European customers.

With the integration of Pouch.ph and Strike, the cross-border payment experience has been revolutionized and has further empowered people to easily send money to their loved ones back home. Lightning will continue to expand into more markets with more partners to provide better payment services to communities around the world.