Amid a general crypto market rebound, SUI stood out from the crowd, emerging as the second-highest weekly gainer, rising by 67.21%. The prominent altcoin has been one of the major headliners of the current market cycle, increasing by 192.70% in the past year.

However, certain market technical indicators show that SUI is likely headed for a correction following its most recent explosive gains.

Elliott Wave Count Suggests Pullback Looms For SUI

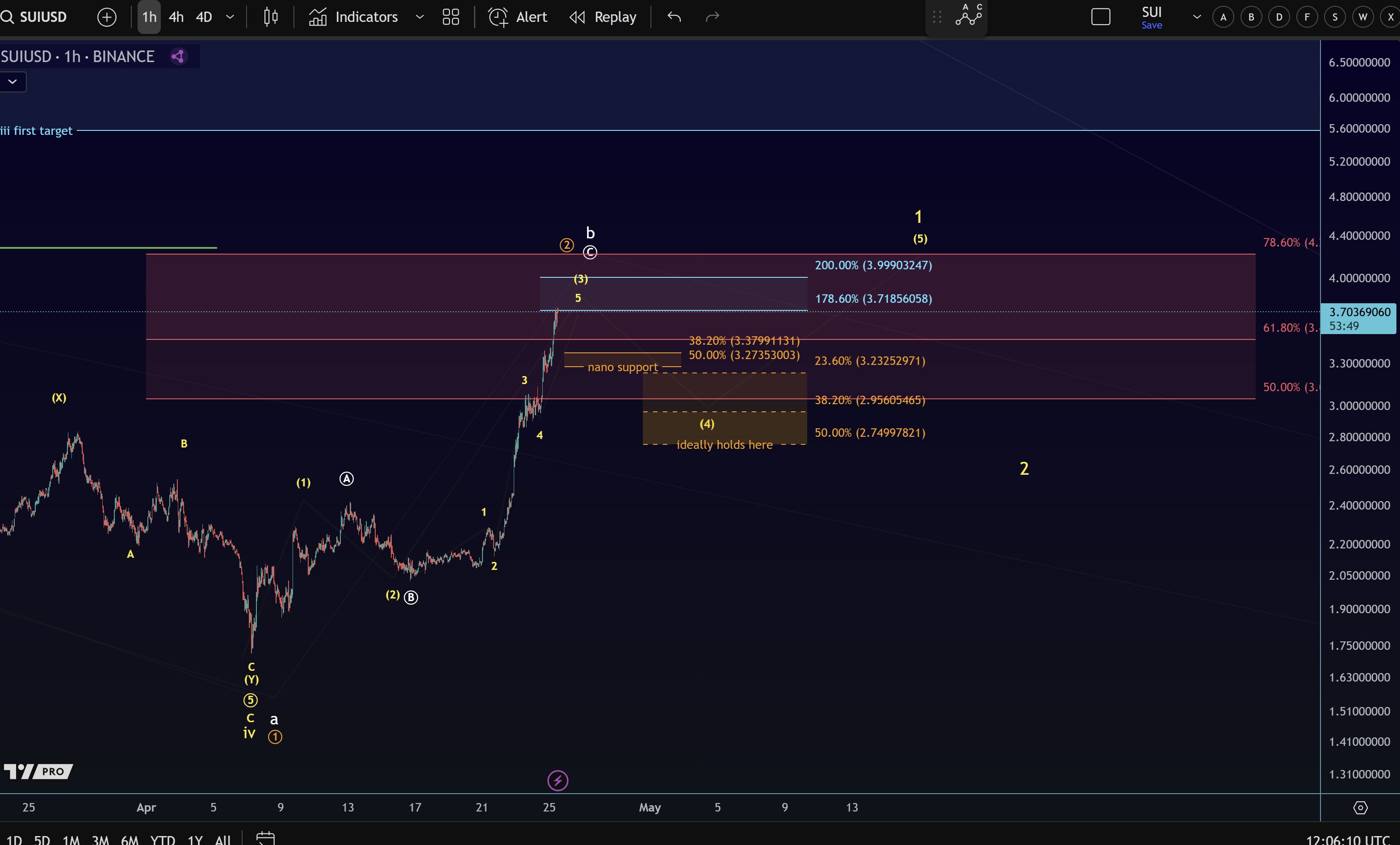

In an X post on Friday, X market analytics handle More Crypto Online shared an interesting analysis on the SUI market using the Elliott Wave theory — a technical tool that predicts future price trends by recognizing recurring wave-like patterns.

According to the analysts at More Crypto Online, SUI’s bullish performance in the past week means the altcoin has surged to the 178.6% Fibonacci extension level around $3.71. This specified Fibonacci level represents a major technical milestone as it is a classic target area in Wave 3 in the Elliott Wave analysis.

For context, the Elliott Wave theory postulates that price movements occur in five recurring wave patterns. Wave 3 is usually regarded as the strongest and longest wave in a bullish trend. It is a wave of confirmation indicating a robust market participation.

Based on the current wave count in the SUI market, the altcoin is completing the final stages of Wave 3, having surpassed the minimum Fibonacci extension level of 138%. As expected, signs of waning demand are beginning to set in, as indicated by a 5.7% price retracement in the past day.

More Crypto Online predicts Wave 4 — a corrective price phase may now be imminent. SUI is expected to experience a price pullback with initial support zone set at $3.27. Notably, a decisive price break below this level would confirm the end of Wave 3 and the beginning of Wave 4.

Furthermore, a deeper market support lies between $2.95 and $2.75, which represents the 38.2% – 50% Fibonacci retracement zone of the Wave 3 move. More Crypto Online views this price region as the support target zone for a healthy Wave 4 correction.

Therefore, market bulls must hold this price zone to retain SUI’s bullish structure and set the stage for a potential Wave 5 breakout.

SUI Price Outlook

At press time, SUI trades at $3.58 following an 8.85% overall gain in the past day. Meanwhile, the coin’s daily trading volume is up by 18.64% and valued at $3.44 billion.

If SUI’s price retracement continues, the altcoin is expected to trigger Wave 4 of its current wave cycle, indicating a potential 50% correction lies ahead. However, if bullish momentum remains intact, SUI could rise to around the 200% Fibonacci extension level, around $3.99, which represents the coin’s next major resistance.

Featured image from Adobe Stock, chart from Tradingview