The post Sui (SUI) Price Prediction For February 5 appeared first on Coinpedia Fintech News

After a sharp fall, Sui (SUI) has recovered significantly and is poised for massive upside momentum due to its bullish price action on the four-hour timeframe. Data shows that after witnessing a price drop of over 38%, the altcoin has soared more than 55%, reclaiming all the losses.

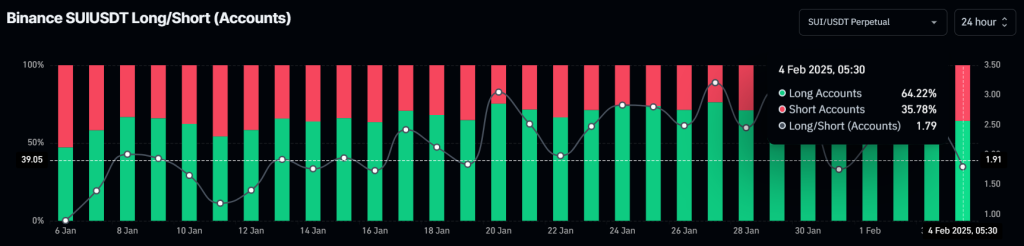

64% of SUI Traders on Binance Go Long

Following this significant price recovery, the sentiment around SUI appears to have shifted, as intraday traders are strongly betting on the long side.

According to on-chain analytics firm Coinglass, the Binance SUIUSDT Long/Short ratio stands at 1.80, indicating strong bullish sentiment among traders. This ratio means that for every 1.80 long positions, traders hold a single short position.

However, the data further reveals that 64% of the top SUI traders on Binance currently hold long positions, while 36% hold short positions.

Whales’ and Investors’ Rising Interest

In addition to traders, long-term holders are also showing strong interest and confidence in the token, as exchanges worldwide have witnessed an outflow of over $45 million worth of SUI tokens in the past 48 hours.

This substantial outflow during the market recovery suggests potential accumulation, which could create buying pressure and drive further upside momentum, as seen in SUI today.

SUI is currently trading near $3.76 and has experienced a price surge of over 6% in the past 24 hours. However, during the same period, its trading volume dropped by 53%, indicating lower participation from investors and traders compared to the previous day.

SUI Technical Analysis and Upcoming Levels

This strong interest and confidence in SUI have emerged due to its bullish price action. According to expert technical analysis, SUI has formed a bullish cup and handle pattern and is poised for a breakout.

Based on historical price momentum, if the asset breaches the neckline of this bullish pattern and closes a four-hour candle above the $3.80 level, there is a strong possibility it could soar by 30% to reach the $5 level in the coming days.

However, mild resistance exists at the $4.20 level, where the 200 Exponential Moving Average (EMA) on the four-hour timeframe is forming, which could pose a hurdle to SUI’s upside rally.