On-chain data shows the Bitcoin supply on exchanges has seen a further plunge recently, now hitting lows not seen since December 2017.

Bitcoin Supply On Exchanges Has Dropped To Just 5.38% Now

According to data from the on-chain analytics firm Santiment, BTC’s supply has continued to shift towards self-custody recently. The indicator of relevance here is the “supply on exchanges,” which keeps track of the percentage of the total Bitcoin supply that’s currently sitting in the wallets of all centralized exchanges.

When the value of this metric rises, it means that the investors are depositing to these platforms currently. Generally, one of the main reasons why investors would make such transfers is for selling purposes, so this kind of trend can have a bearish impact on the cryptocurrency’s price.

On the other hand, the indicator going down implies that the holders are making net withdrawals from the exchanges. Such a trend may be a sign that the investors are accumulating right now, which may be bullish for the asset.

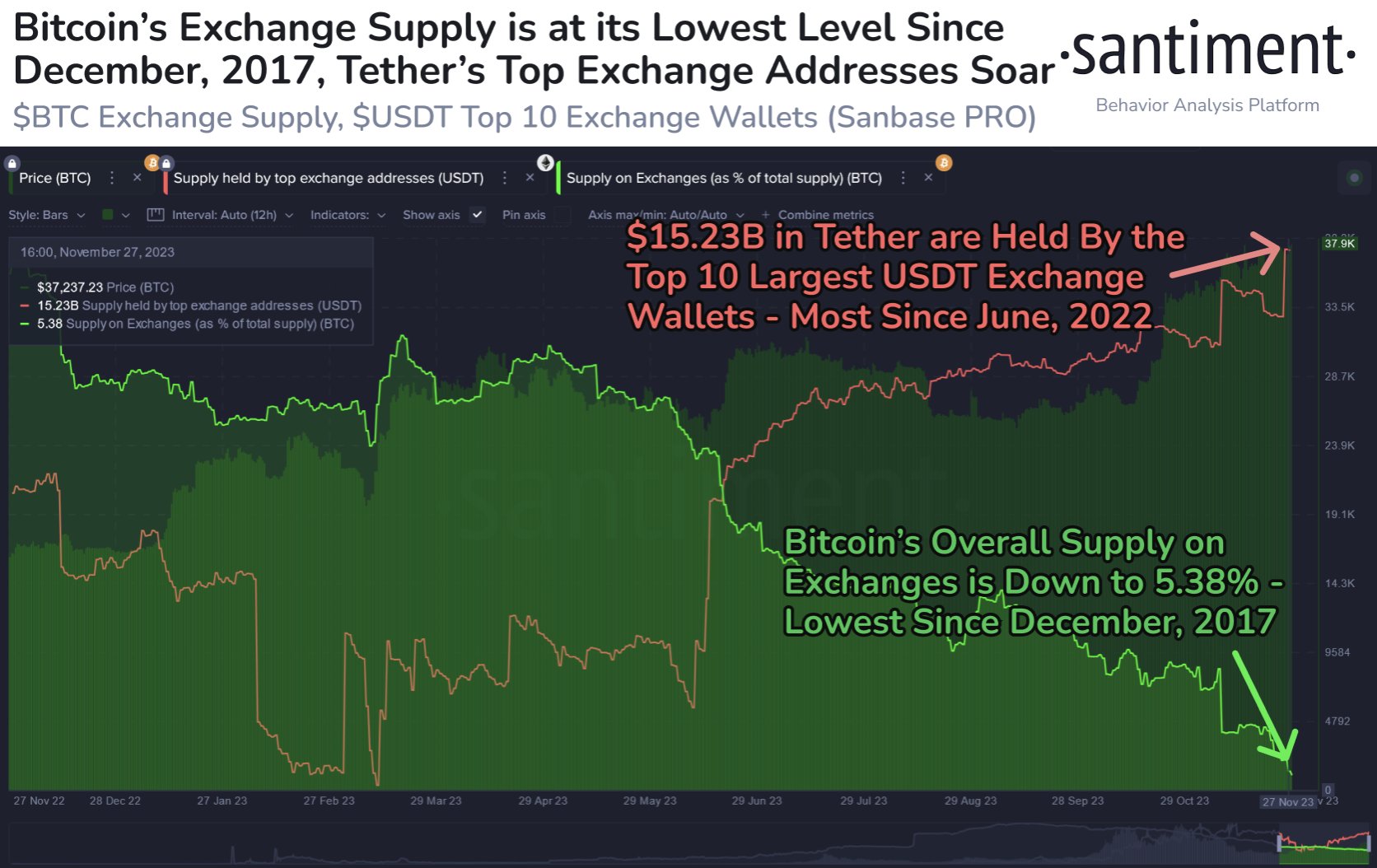

Now, here is a chart that shows the trend in the Bitcoin supply on exchanges over the past year:

As displayed in the above graph, the Bitcoin supply on exchanges has been going down during the past few months and it would appear that the downtrend isn’t coming to an end anytime soon, either, as the indicator has only plunged further recently.

The indicator’s value has now hit the 5.38% mark, meaning that just 5.38% of the BTC in circulation is being stored inside the wallets attached to these central entities, the lowest level since December 2017.

Interestingly, while this latest plunge in the Bitcoin supply on exchanges has come, another metric has seen a sharp uptrend instead. As is visible in the chart, this indicator is the sum of supply held by the ten largest Tether (USDT) addresses on exchanges.

This metric has risen to $15.23 billion now, the highest value since June 2022. Usually, investors store their capital in the form of a stablecoin like USDT whenever they seek temporary shelter away from the volatility of BTC and others.

Such holders eventually move back towards the volatile side once they feel that the time is right. To make the shift back, the Tether investors naturally deposit to exchanges, so the supply of the stablecoin on exchanges can be looked at as the potential buying power available for Bitcoin and other coins.

Since the USDT exchange supply held by the 10 largest whales has shot up recently, it means that these humongous entities can provide a significant buying boost to the market, should they choose to make the swap.

Both these developments are obviously positive for Bitcoin, as they mean that not only has the selling potential in the market lessened, but the buying power has also gone up at the same time.

BTC Price

Bitcoin is currently floating around the $38,100 level after having registered an uplift of over 4% in the last seven days.