Market prices of Chainlink (LINK) suffered another major decline in the past 24 hours as the general crypto market continued to react negatively to US new international tariffs. Over the last two months, LINK has exhibited a prolonged downtrend losing over 40% of its market value. Amidst this bearish market, popular analytics company Glassnode has highlighted two price cluster levels that have shaped investors’ behavior in this period.

Chainlink’s CBD Data Reveals Key Investor Clusters At $14.6 And $16 – What Could This Mean?

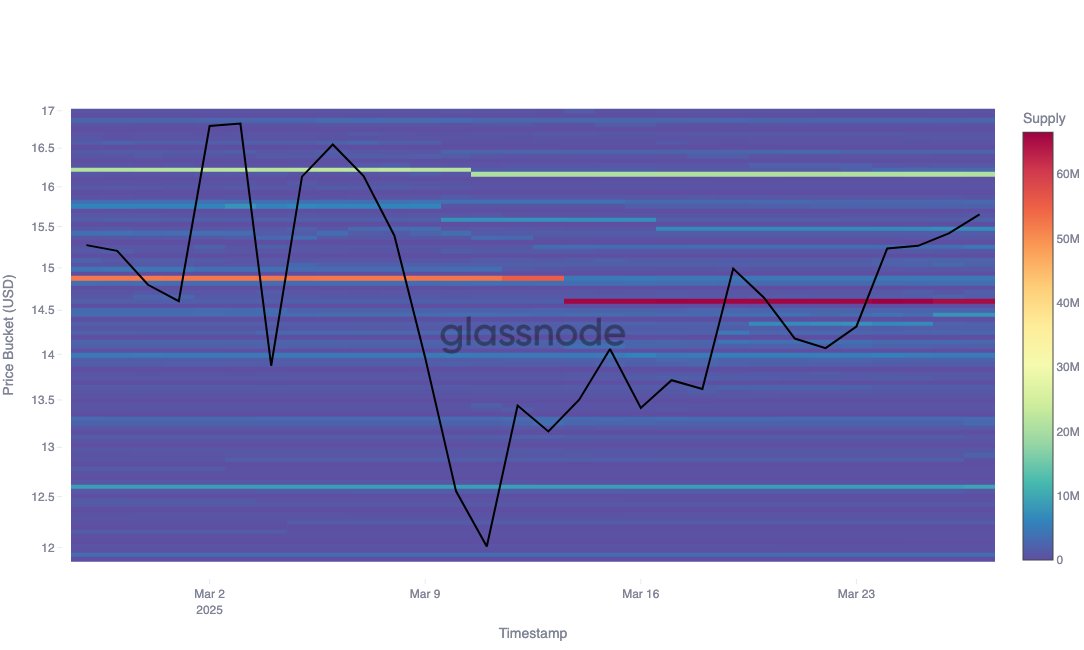

In a recent post on X, Glassnode shared valuable on-chain insights on the LINK market using Cost Basis Distribution (CBD) – a metric that reveals at what prices investors acquired their assets, thus helping to determine potential resistance or support zones.

According to Glassnode, LINK’s data has identified two price levels with high accumulation activity i.e. $16 and $14.6, noting that both price zones feature long-term investors who have remained active since August-October 2024. In analyzing transactions at the $16 price level, Glassnode discovered that investors at this level have shown strategic repositioning by actively accumulating during downtrends.

Source: @glassnode on XThis positive development has been observed during a price drop from $29 to $19 in December, a correction to around $18 in February, and most recently as prices reached a new low of $12.70 on March 11. Glassnode explains that these recurring transactions indicate the presence of high-conviction holders at $16.0 with strong long-term confidence in LINK and are thus less likely to sell their holdings.

Conversely, LINK holders at $14.6 have shown a less active but more timely accumulation by investors at this price level. Glassnode shows that these investors increased their holdings during key phases such as when LINK traded at $17 and $28 in December, at $25 in January, and on March 15 following a major price gain from $12. These observations also suggest current LINK holders are not fast money allocators but patient and confident of a future price accumulation.

What Next For Chainlink?

At press time, LINK trades at $14.0 just below the key cluster level at $14.6. The proximity to this accumulation zone indicates the market is at a critical juncture. However, Glassnode data suggests that holders at the $14.6 are not fast money traders and are likely to reinforce their position through another accumulation.

If this positive scenario occurs, LINK could reclaim $14.6 and $16 which could serve as important support structures in a potential market rebound.