Quick Take

Susquehanna, a prominent trading firm, has disclosed a $1.3 billion investment in spot Bitcoin ETFs. The firm’s portfolio is primarily dominated by the Grayscale Bitcoin Trust (GBTC), which accounts for a substantial $1.1 billion of the total investment. The company’s appetite for Bitcoin exposure extends beyond just GBTC, as the firm has invested in nine spot Bitcoin ETFs in the US market.

According to the 13F filing, their investments span a diverse range of Bitcoin-related products, including $470,944 invested in the Bitwise Funds Trust.

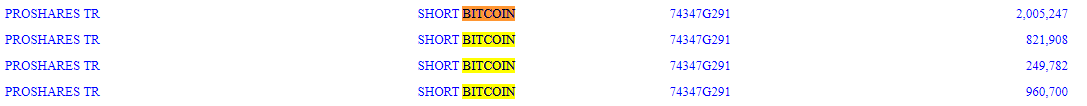

The company has a $2.91 million investment in Global X Funds Bitcoin Trend Strategy (BTRN) and multiple investments in ProShares Short Bitcoin (BITI) totaling $4.03 million.

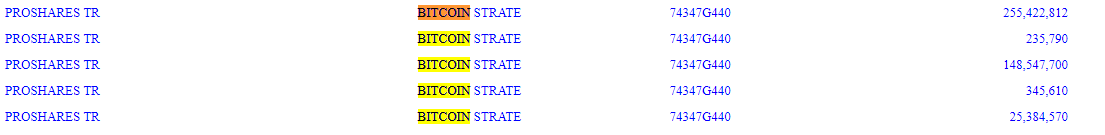

Furthermore, Susquehanna has made substantial investments in the ProShares Bitcoin Strategy ETF (BITO), with five separate investments amounting to $429.93 million.

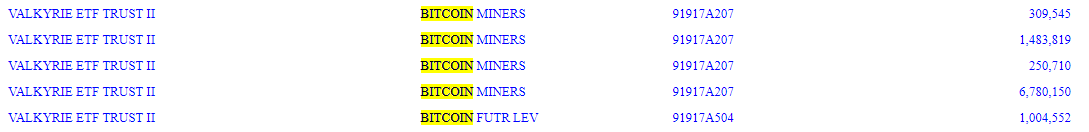

They have a $1 million investment in the Valkyrie Bitcoin Futures Leveraged Strategy ETF and the Valkyrie ETF Trust for Bitcoin miners, totaling $8.82 million.

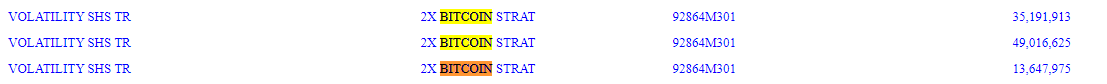

Susquehanna has three separate investments in the 2x Bitcoin Strategy (BITX), amounting to $97.85 million.

As a large proprietary trading firm, Susquehanna’s diverse portfolio includes leveraged, short, and volatility-based investments. This approach enables the company to take a strategic approach to trading and capitalizing on market opportunities. In their pursuit of maximizing gains, they’re not just holding spot ETFs but diversifying and hedging various investments to optimize returns.

The post Susquehanna has more Bitcoin exposure than just ETFs appeared first on CryptoSlate.