The Arbitrum ecosystem is a complete blockchain universe with its wallets, dApps, and NFT Marketplaces. Symbiosis Finance, on the other hand, is a liquidity enabler that aggregates decentralized exchange liquidity across numerous blockchains. After integrating with several popular blockchains like the Polygon, Avalanche, OKEx, and more, Symbiosis has expanded its coverage to Arbitrum. Before we delve deeper into the working mechanism of the collaboration, let’s look at why the coming together of these two entities will create a force to reckon with.

The Arbitrum Universe

Co-founded by Ed Felton in 2018, Arbitrum is a solution developed by Offchain Labs. It received backing from many leading crypto-universe patrons, including Coinbase Ventures, Pantera, Blocknation, Compound, and more. Arbitrum One, inaugurated on May 28th, 2021, works as a one-stop portal for entry into the Arbitrum ecosystem.

The objective leading to the inception of Arbitrum was to devise a solution for Ethereum’s transaction fee crisis. Despite being the second-largest cryptocurrency, only after Bitcoin, network congestion and high gas fees was a hurdle that Ethereum could not do away with. Arbitrum aimed to reduce the transaction fees and congestion by moving a substantial quantum of computation and data storage off of Ethereum’s main blockchain layer.

Arbitrum One, the flagship layer chain of Offchain Labs, was released for the decentralized application developers. Right now, it has several wallets, dApps, and NFT marketplaces active on it.

Among Wallets, it is compatible with the Coinbase Wallet, Huobi Wallet, Metamask Wallets, Trust Wallet, and many more. The dApps active on the chain include 1INCH, AAVE, Curve, DAI, etc. Among the tools it leverages are those from the Band Protocol, Chainlink, Ankr, etc. Additionally, it comes with bridges and on-ramps, and NFT marketplaces.

According to the latest available numbers, the total value locked in the Arbitrum protocol is nearly US$2 billion.

Symbiosis: Multi-Exchange Liquidity Aggregator

The vision of the Symbiosis Finance ecosystem is to offer liquidity to every major blockchain, helping – ultimately – to form a blockchain metaverse. In brief, it works as a unified transport layer for cross-chain communication.

Several benefits attract participants to the overall Symbiosis paradigm. Primarily, it is a go-to any-to-any token swap service that no one else offers in the market. It also constantly monitors the best exchange rates for available cryptocurrencies, going up to thousands, in real-time.

All these come with best-in-class security standards, and a trustless non-custodial system secured by the threshold signature scheme and multi-party computation. It has a robust incentivization scheme in place with all relayers’ network community-driven nodes having bonded tokens at stake to process swaps. Since virtually anyone can become a relayer, the state of decentralization is ideal.

Symbiosis offers a seamless user experience, where the usage is as convenient as other leading protocols like the Uniswap. The user does not need to go through the hassles of backing up key files, downloading new browser wallets, or installing some special software. Finally, the cross-chain gasless transaction provision of Symbiosis helps solve the issue of unnecessarily holding different native assets to pay gas fees.

These benefits that Symbiosis comes with help it grow into one of the leading providers in the DeFi universe in a short time with backing from players like Blockchain.com, Spartan, Dragonfly Capital, BTC, Wave Financial, and more.

How Will Collaboration Benefit Symbiosis Users?

Due to integration with Arbitrum, Symbiosis users will be able to benefit from Arbitrum’s low fees while working with Ethereum, which is a major benefit considering the exorbitantly high gas fees that users have to shell out when on the Ethereum network. As for how this works, it is crucial to point out here that Arbitrum is an L2 network, which means a large part of computations and data is stored outside the Ethereum network.

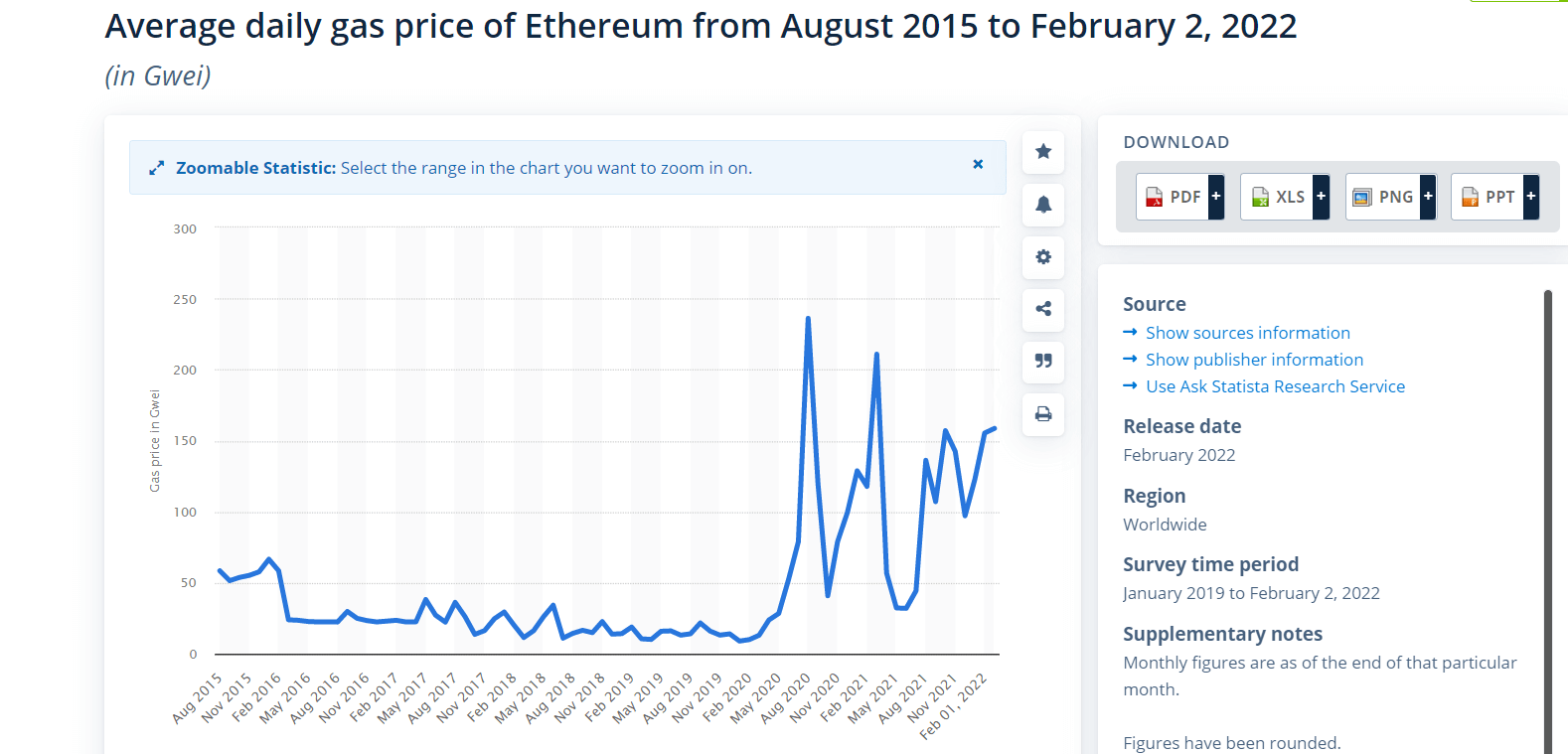

Ethereum’s high gas fee is a major cause of concern among crypto users, as it has been on a constant rise year-on-year since 2015. In early 2015, the Ethereum gas fee was hovering around 58 gwei, which crossed 236 gwei in April 2020, the all-time high figure for Ethereum gas fee. The current ETH gas fee is just over 158 gwei. It means that it has reduced by a considerable margin compared to the figure from April 2020, but it is still quite high, and that’s where Arbitrum makes the difference. After all, Arbitrum brings down the transaction fees that act as a major barrier for users. Also, Symbiosis integrating into Arbitrum would expand the set of options to swap more assets across chains, and the benefit is available to the users on both sides.

Fasten your seat belts

We've just deployed $SIS pool on @arbitrum @sushiswap

https://t.co/TZYNeHrxw3

Farming coming soon

pic.twitter.com/RBh4v1puoF

— Symbiosis Finance

(@symbiosis_fi) February 2, 2022

Symbiosis recently rolled out SIS farming on Arbitrum, which will benefit the users through lower gas fees and bring in more users to the Symbiosis community by keeping them engaged.

Overall, staying committed to its best-in-class user experience features, the Symbiosis team monitors the performance of the network 24/7 for consistently up-to-the-mark stability and speed.

The post Symbiosis Finance Launches SIS Farming on Arbitrum on the Eve of Mainnet appeared first on CryptoSlate.