SNX/USD has been able to dethrone STORJ this week. The crypto moved an impressive 6.24% up in value. SNX/USD which has been moving sideways since around the 10th of May has eventually been able to break that jinx today.

Synthetix Current Price: $3.7200

Synthetix Market Cap: $385 Million

Synthetix Total Supply: 215.3 Million

Rank: 79

Key Levels:

Resistance: $1.854, $2.100, $3.22

Support: $3.189, $2.080, $1.540

SNX/USD Value Prediction: Synthetix is tending slightly Upwards

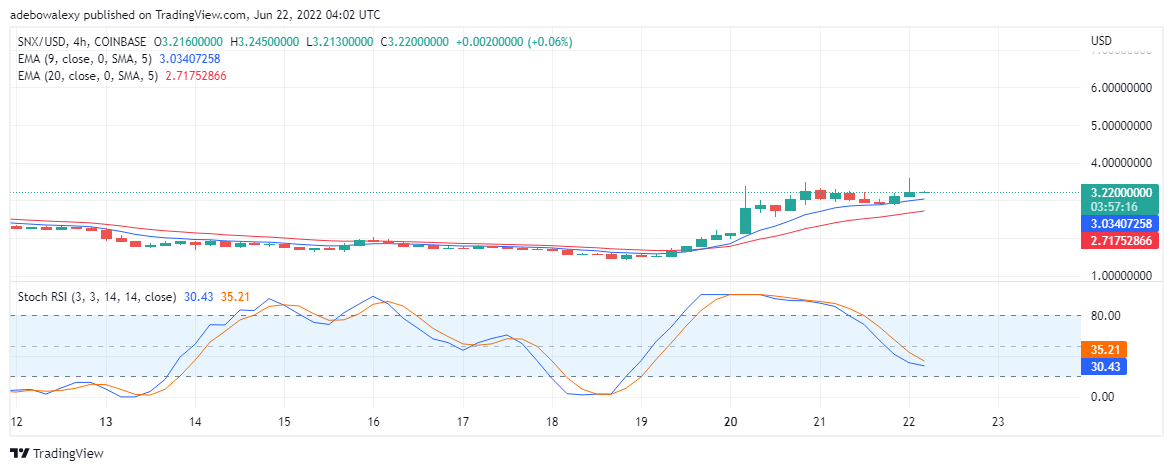

On the SNX/USD four-hour chart, Synthetix is trading in a slightly Upward manner. This crypto has got the bulls on the loose as many bullish candlesticks are showing up on its chart. Eventually, the last bullish candlestick was able to bring the crypto price to $3.2200.

Also, the Exponential Moving Average is still under the value activity. This implies that the value of this crypto may move further upwards. Adding to this, the Relative Strength indicator curves are just about to get to the highly sold area and are already showing signs of crossing one another. If the crossing eventually occurs this may bring the crypto value to $4 and $5.

SNX/USD Value Prediction: Synthetix on the High

The SNX/USD daily chart is suggesting another interesting point to consider. Looking at this chart we can see that the crypto value activity is positioned considerably high above the EMA. Also, we can see that these EMA curves are crossed already. So if these curves should cross one another once more while still under the values activity then the Synthetix price may move even higher.

Buy SNX Now[/su_button

However, more likely to occur is that the value activity may move in between the EMAs. If this happens, Synthetix value may find new support at around $4. The RSI curves have begun bending towards each other and this implies that the value of this crypto may trend downwards soon. Hopefully, for traders who entered this market lately, the anticipated downtrend may be very short. But, those who entered the market earlier, such may be getting ready to go short.

eToro – Our Recommended Trading Platform

- CySEC, FCA & ASIC regulated – Trusted by Millions of Users

- Trade Crypto, Forex, Commodities, Stocks, Forex, ETFs

- Free Demo Account

- Deposit via Debit or Credit card, Bank wire, Paypal, Skrill, Neteller

- Copytrade Winning Traders – 83.7% Average Yearly Profit