The post Tether Adds 8,888 BTC to Its Holding, Signaling Confidence in Bitcoin’s Future appeared first on Coinpedia Fintech News

Tether has withdrawn at least 8,888 BTC from the Bitfinex hot wallet. Due to the development, the total Bitcoin holding of Tethter’s BTC address, the sixth largest BTC address in the world, has grown to 92,647 BTC. Time to explore more! Dive in!

Tether Withdraws 8,888 BTC – What Happened?

Tether has withdrawn at least 8,888 BTC tokens from the Bitfinex hot wallet. A hot wallet is like an easily accessible bank account for the exchange, which is used for frequent transactions. At the time of withdrawal, these 8,888 BTC tokens were worth approximately $735 million.

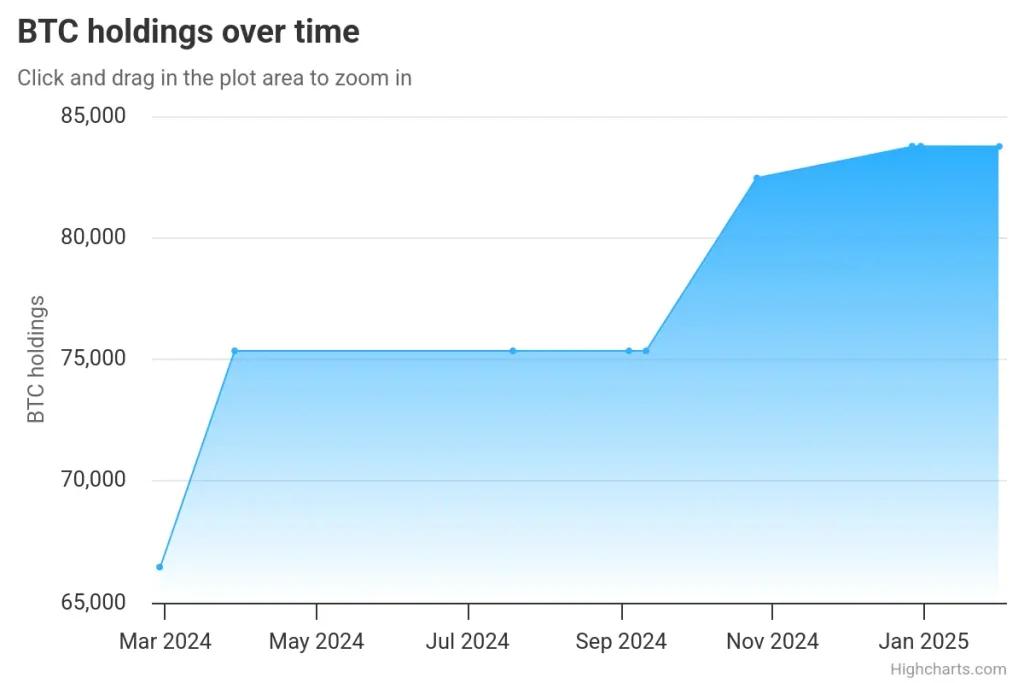

Tether’s Bitcoin Reserve

As a result of the withdrawal, the main Bitcoin reserve address of Tether has swelled to no fewer than 92,647 BTC tokens. The price of Bitcoin stands at $82,990.57. This means that Tether’s BTC holding is worth at least $7,688,827,338.79.

Why Tether Has Withdrawn Bitcoin?

Tether’s main BTC reserve address is the sixth largest Bitcoin address in the world. It seems that Tether is very confident about the long-term potential of the Bitcoin market.

Tether has a plan to increase its Bitcoin reserve over time. Already, the company declared that it would use at least 15% of its profit to regularly buy more Bitcoin.

How Tether’s BTC Strategy Impacts the Market?

Primary, the growing BTC holdings of Tether could impact market liquidity. In the last 30 days, the Bitcoin market has dropped by 3.1%. In the last seven days alone, the market has declined by around 4%. However, in the last 24 hours, it has surged by approximately 1%. The 24-hours trading volume of BTC sits at $28,086,253,203. Bitcoin’s On-Balance Volume is -852.46K.

Secondly, Tether’s move indicates that institutional interest in BTC has increased tremendously.

In conclusion, with Tether consistently using 15% of its profits to acquire Bitcoin, the company’s growing reserves signal a strong commitment to BTC. As one of the largest Bitcoin holders, Tether’s investment strategy could have significant implications for the crypto market.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As per Coinpedia’s BTC price prediction, 1 BTC could peak at $169,046 this year if the bullish sentiment sustains.

With increased adoption, the price of 1 Bitcoin could reach a height of $610,646 in 2030.

As per our latest BTC price analysis, Bitcoin could reach a maximum price of $5,148,828.

By 2050, a single BTC price could go as high as $12,436,545.