USDT issuer Tether plans to launch a new stablecoin pegged to the United Arab Emirates Dirham (AED) in collaboration with the Phoenix Group and Green Acorn, according to an Aug. 21 statement shared with CryptoSlate.

This new asset will be a digital representation of the UAE Dirham, pegged 1:1 and backed by reserves held within the UAE.

The introduction of this Dirham-pegged stablecoin aims to provide users with seamless access to AED while leveraging the transparency and efficiency of blockchain technology. This initiative is expected to boost international trade and remittances, lower transaction fees, and offer a hedge against currency fluctuations.

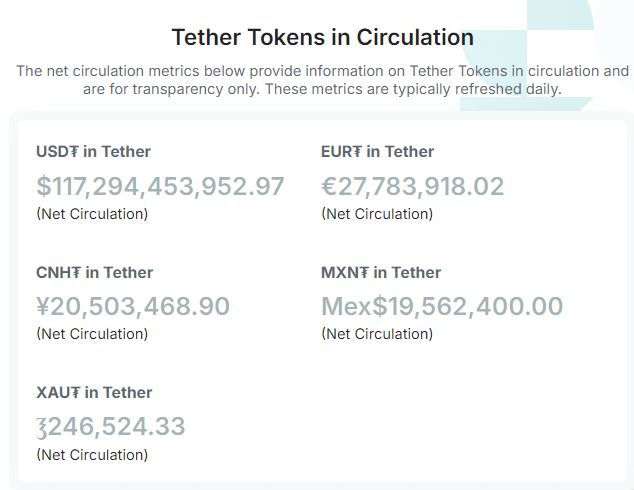

Once launched, the stablecoin will join Tether’s existing portfolio of fiat-based tokens, including USDT, EURT, CNHT, MXNT, XAUT, and aUSDT.

Why Tether is launching an AED stablecoin

Tether CEO Paolo Ardoino cited UAE’s status as a global economic hub as a key factor behind the launch. He emphasized the importance of creating a Dirham-pegged token to facilitate regional transactions.

Ardoino stated:

“Tether’s Dirham-pegged stablecoin is set to become an essential tool for businesses and individuals looking for a secure and efficient means of transacting in the United Arab Emirates Dirham whether for cross-border payments, trading, or simply diversifying one’s digital assets.”

The stablecoin’s launch coincides with Abu Dhabi’s Financial Services Regulatory Authority (FSRA) proposing a regulatory framework for fiat-referenced tokens (FRTs).

On Aug. 20, FSRA outlined that FRT issuers proposed that the stablecoin issuers’ reserve assets should equal or exceed the par value of all outstanding FRTs at the end of each business day.

Additionally, the FSRA recommends that issuers of multiple FRTs maintain separate pools of reserve assets for each token and manage them independently.

Further, the regulator stated that the FRT must not be promoted as nor considered to be an investment or a savings product. However, it will not prohibit an issuer from accruing and distributing income earned from Reserve Assets to the FRT holder.

This initiative reflects the rapid expansion of the crypto market in the UAE, which has experienced significant growth in recent years.

The post Tether expands fiat portfolio with new UAE Dirham stablecoin appeared first on CryptoSlate.