Stablecoin issuer Tether (USDT) achieved a historic net profit of $4.52 billion in the first quarter despite facing a significant drop in market share.

Record net profit

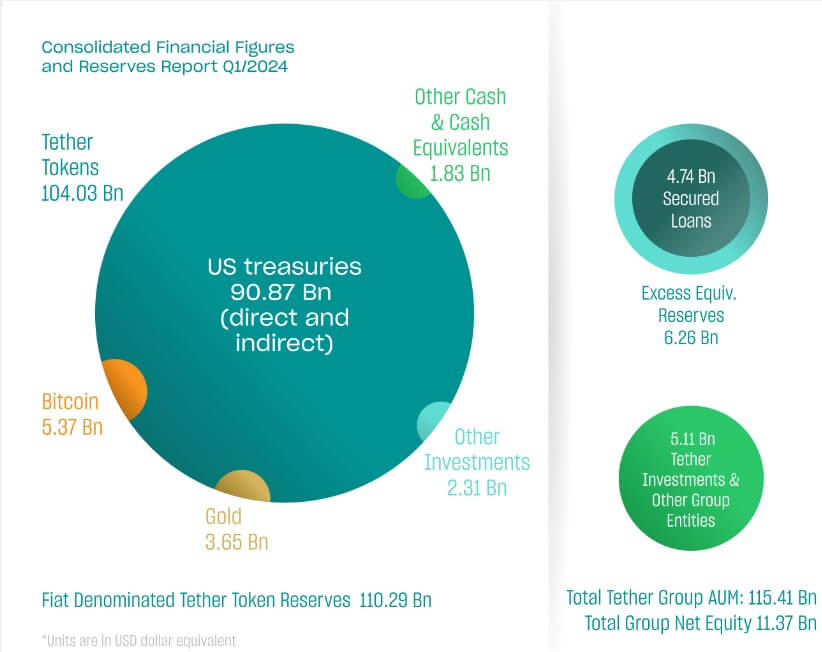

According to the attestation report shared with CryptoSlate, the firm’s substantial profits chiefly originated from its US Treasury holdings, supplemented by gains from its Bitcoin and gold investments.

Paolo Ardoino, Tether CEO, said:

“Tether has demonstrated its unwavering commitment to transparency, stability, liquidity, and responsible risk management. As shown in this latest report, Tether continues to shatter records with a new profit benchmark of $4.52 billion, reflecting the company’s sheer financial strength and stability.”

As of March 31, 2024, Tether boasted a treasury portfolio exceeding $90 billion in US Treasury bills, encompassing direct and indirect holdings. Consequently, its surplus reserve surged by $1 billion, reaching nearly $6.3 billion.

Simultaneously, Tether Group’s equity surged to $11.37 billion, a notable increase from the $7.01 billion reported on December 31, 2023.

The disclosure also affirmed that Tether-issued stablecoins remain backed by 90%, including assets such as cash and cash equivalents, maintaining the reserve ratio consistent with the fourth quarter of last year.

Specifically, Tether token reserves totaled approximately $110.3 billion, with liabilities amounting to around $104 billion. However, the value of assets in the reserve surpassed liabilities by over $6 billion.

Declining market share

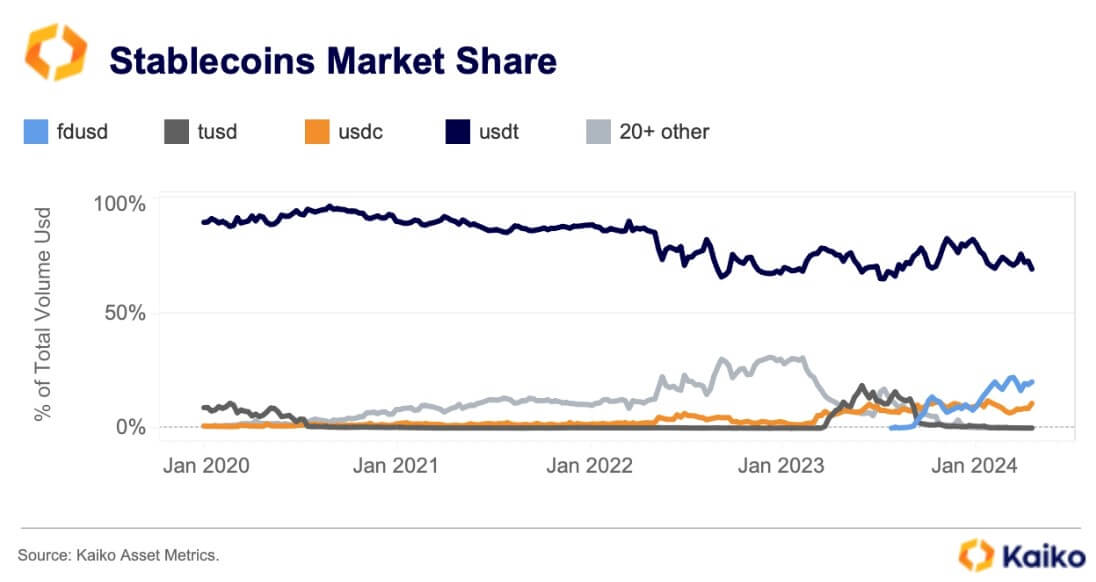

Despite minting $12.5 billion in new USDT tokens during the first quarter, the firm is gradually losing its market share due to the intense competition in the stablecoin market.

According to Kaiko data, the stablecoin’s market share on centralized exchanges (CEXs) has dwindled to 69% year-to-date.

During the first quarter, Tether encountered mounting competition from stablecoins like FDUSD, which capitalized on Binance’s zero-fee promotions. Moreover, USDC, backed by Circle, witnessed a surge in its market share to 11%, suggesting a growing inclination towards regulated alternatives.

Market observers also pointed out the emergence of innovative yield-bearing alternatives like Ethena’s USDe, which are impacting USDT’s dominance. Since its launch in February, USDe’s trading volume has experienced substantial growth, although it receded from April’s peak of over $800 million following Ethena’s ENA airdrop.

The post Tether reports record $4.52 billion profit in Q1 despite shrinking market share appeared first on CryptoSlate.