It’s been a busy week for Tether, as the company announced that it had authorized the minting of another 1 billion USDT tokens, pushing the total number of minted tokens to $33 billion in the last year. According to blockchain data, the additional tokens were minted on the Tron network and immediately sent to the company’s treasury wallet.

Whale Alert also confirmed the latest transaction last Tuesday at around 20:43 (UTC). The company’s latest replenishment order has sparked speculation of increasing demand and a potential price surge.

1,000,000,000 #USDT (999,750,000 USD) minted at Tether Treasuryhttps://t.co/Vxw2yhfwTY

— Whale Alert (@whale_alert) October 29, 2024

Tether CEO Confirms New Mint, Saying It’s ‘Authorized But Not Issued’

Paolo Ardoino, Tether’s CEO, has confirmed this latest mint order, saying that the transaction was “authorized but not issued.” In blockchain parlance, the newly minted USDT tokens on the Tron network are not yet circulating but are still part of the company’s inventory. In short, these are just in storage, ready for the next batch of chain swaps and issuance requests.

The company officially disclosed the minting order on its transparency page. The newly minted tokens totaling $1.05 billion are listed under the “authorized but not issued” column of USDT.

USDT: Issuance At Tron Reaches $20 Billion

Tether is experiencing a surge in demand, reflected in the number of tokens minted on the Tron network last year. To date, as of October 29th, the Tron network had minted $20 billion in tokens. The Tron network occupies a special place in USDT’s ecosystem, accounting for more than half of the total USDT tokens in circulation.

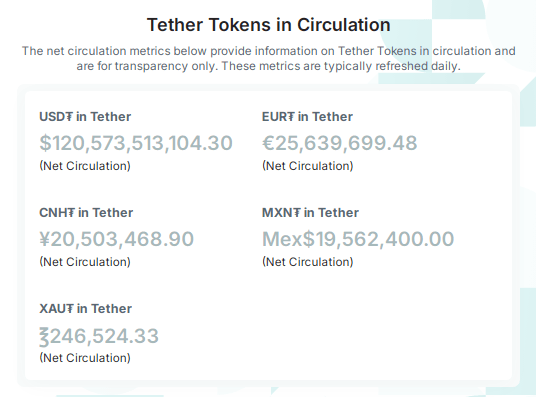

According to the latest data available, as many as $120 billion Tether tokens are in circulation; more than 51% and about 61.7 billion are stored on the Tron network. Ethereum represents the second largest USDT reserve, which is about 45% of $55 billion. All in all, Tether still leads as a stablecoin issuer with a share of more than 67% of the overall stablecoins in circulation.

What’s Next For Tether?

The most recent mint order has raised questions on what the future holds for Tether’s USDT tokens. One of the assumptions is that the recent spike in bitcoin price had caused an increase in the stablecoins. “when they print, we go higher,” one user posted on social media, relating it to the minting of fresh tokens to meet future requests for the issuances.

Traditionally, the minting and deployment of stablecoins signal an increasing demand for crypto in a bullish market. An increase in stablecoin’s supply often pushes cryptos’ market prices. For example, when Tether introduced $3 billion worth of USDT tokens last August, Bitcoin’s price stabilized after dipping below the $50,000 level.

Featured image from Tether.io, chart from TradingView