After last week’s historic approval of Spot Bitcoin ETFs (Exchange Traded Funds) by the US Securities and Exchange Commission (SEC), investors worldwide wonder about the possibility of this financial product launching in their countries.

A local source released a report on January 17 stating that Thailand’s SEC has rejected the trading of ETFs in the country “for the time being.”

Thailand’s Regulator Speaks Out On Bitcoin ETFs

Since the US SEC approved listing 11 Bitcoin ETFs, Thai securities brokerage firms have prompted investors to invest directly in US spot Bitcoin ETFs, as the report explains.

Thailand’s SEC, however, has come out to say that it doesn’t plan to allow ETF launches in the country for now, stating:

The SEC has been following these developments closely but we do not have a policy to allow spot Bitcoin ETFs to be established in Thailand for the time being.

Despite the rejection of spot Bitcoin ETF launches in Thailand, the regulator maintains that investors still have the option to invest in digital assets through the already licensed domestic exchanges that fall under the Digital Assets Decree, which ensures “fair and transparent” trading for the benefit of Thai investors, as the regulator noted.

Thailand currently has 9 licensed digital asset exchange operators providing investment in cryptocurrencies that follow the exchange’s listing rules. However, the SEC does not oppose customers’ investment in foreign products through securities companies, but these companies must guarantee that investors receive appropriate investment advice.

Securities companies can provide services to retail customers to invest in foreign products, but they must have the same characteristics as products that can be offered for sale in Thailand.

Lastly, the SEC expressed its desire to “monitor developments, supervision, and operations in various areas to develop further policy guidelines for ETF supervision” that could suit Thailand’s context.

Thai Regulations To Protect Investors

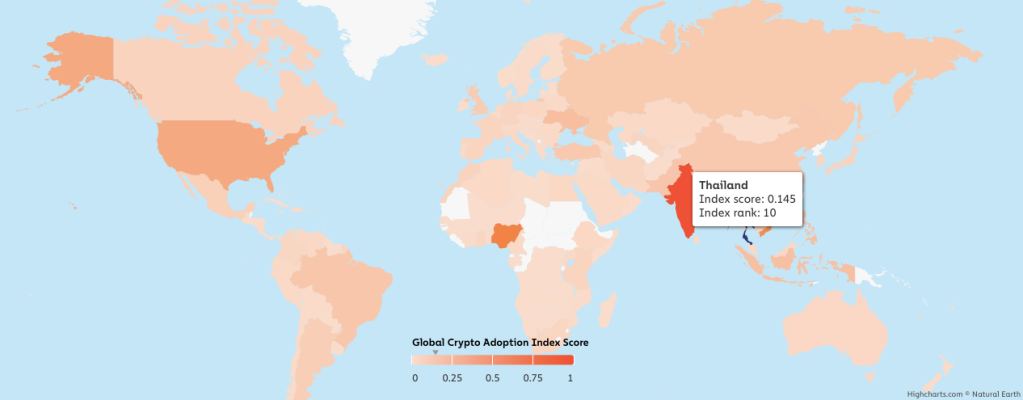

Thailand’s crypto adoption is among the highest worldwide, ranking in the top 10 on Chainalysis’s Global Crypto Adoption Index released in 2022 and 2023. Thailand’s government has implemented various regulations on cryptocurrencies and digital asset products to protect its customers.

Most notably, in 2018, the government enacted the Digital Asset Business Emergency Decree to regulate digital asset transactions and all related activities in the country. The Decree covers the regulation of cryptocurrencies, digital tokens, and other digital assets and applies to businesses, individuals, and all exchanges operating in Thailand.

Regarding some of the regulations in the country, the Thai regulator commented on the following in the report:

Digital asset operators are required to have a digital wallet management system and cryptographic keys to ensure business efficiency and the customers’ digital assets are well protected.

Ultimately, the licensing requirements and strict rules and regulations businesses face when dealing with digital assets in Thailand create a challenging landscape for cryptocurrencies.