Quick Take

The downfall of the FTX exchange in November 2022, led by Sam Bankman-Fried, marked a pivotal point in the landscape of Bitcoin deposits and withdrawals. The incident led to a drop in Bitcoin price below $16,000, the lowest point in that cycle. This collapse deceived many people and led to an all-time low in cryptocurrency trust.

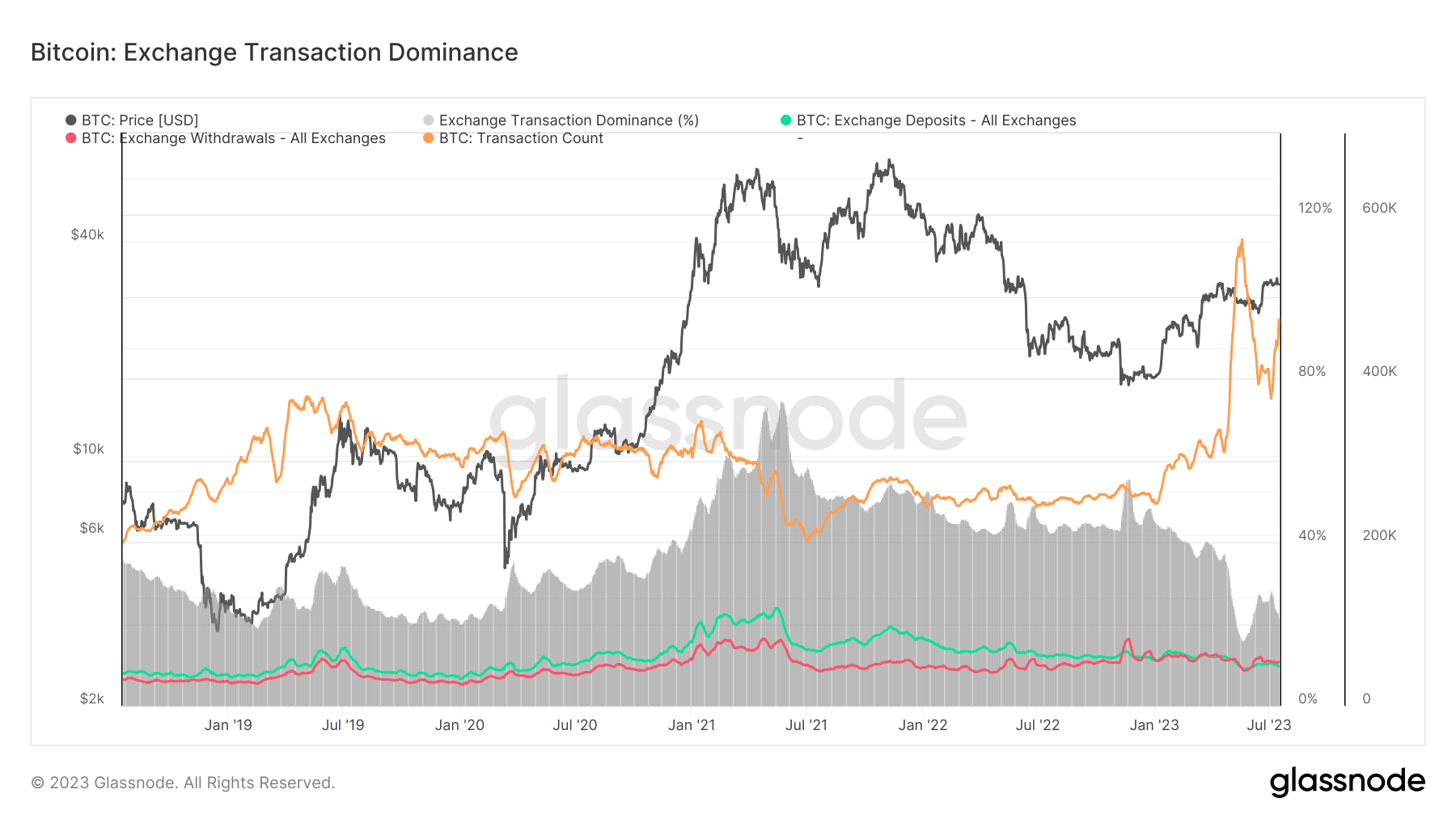

In the aftermath of the FTX failure, a divergence between Bitcoin deposits and withdrawals is now observed. This shift indicates that investors are moving their coins away from exchanges, an action spurred by diminished trust in these platforms. This was the first time Bitcoin withdrawals outpaced deposits, and the trend has continued.

While being a fallout of unfortunate events, this trend is indeed encouraging as it signifies investors’ cautious and aware approach to self-custody and considered digital asset management.

The post The aftermath of the ftx exchange collapse reshapes Bitcoin deposits, withdrawals appeared first on CryptoSlate.