The post The Future of MEV in a Multi-Chain Ecosystem: How ZENMEV is Leading the Way appeared first on Coinpedia Fintech News

As decentralized finance (DeFi) continues to grow, the future of Miner Extractable Value (MEV) is closely tied to the rise of multi-chain ecosystems. This article explores how the emergence of such ecosystems is reshaping the landscape for MEV, the evolution of cross-chain MEV, key considerations, and how platforms can leverage MEV for healthier cross-chain operations.

The Emergence Of Multi-Chain Ecosystems

Multi-chain ecosystems are becoming central to the decentralized world as various blockchain networks gain adoption. Instead of relying on a single blockchain, projects are building bridges and interoperability protocols, enabling seamless interactions across multiple chains. Ethereum, Binance Smart Chain (BSC), and Polkadot are examples of blockchain platforms that offer distinct features and capabilities. Developers and users are eager to leverage these for greater flexibility, scalability, and user experience.

One prominent example is the rise of decentralized exchanges (DEXs) that operate across multiple chains, such as PancakeSwap (on BSC) and SushiSwap (on various blockchains, including Ethereum and Polygon). These platforms play a pivotal role in cross-chain liquidity, allowing users to trade assets between blockchain networks with minimal friction.

Moreover, the growing use of Layer 2 solutions (such as Optimism and Arbitrum) and new blockchain projects focused on interoperability (like Cosmos and Polkadot) are accelerating the trend of multi-chain development. This shift provides more opportunities for value extraction and trading and raises new challenges in managing and understanding MEV across multiple platforms.

How MEV Evolves In a Multi-Chain Blockchain Industry

Multi-chain ecosystems broaden the scope of MEV beyond a single network. Cross-chain MEV involves identifying and exploiting opportunities that span multiple blockchains. These opportunities include:

- Cross-Chain Arbitrage: Exploiting price discrepancies of assets between different blockchains or DEXs.

- Interoperability Protocol Exploits: Capitalizing on delays or inefficiencies in cross-chain bridges or communication layers.

- Layer 2 to Layer 1 Settlement: Extracting value from transaction timing and ordering when settling Layer 2 transactions back to Layer 1 networks.

While these opportunities enhance MEV’s potential profitability, they also bring challenges and require several considerations.

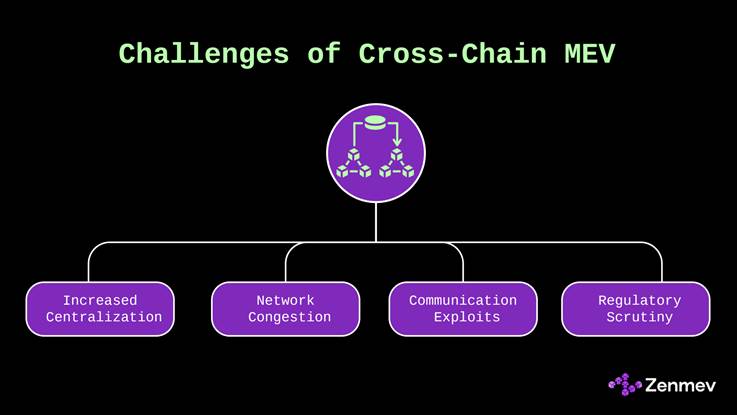

Considerations of Cross-Chain MEV

While cross-chain MEV presents opportunities, it also introduces several complexities that need careful consideration. One of the most pressing issues is the possibility of increased centralization in the MEV extraction process. As searchers—who use bots and algorithms to detect arbitrage or profit-making opportunities—expand across multiple chains, they can gain a significant advantage over smaller, less sophisticated participants. This centralization of MEV extraction can lead to concerns about fairness in blockchain ecosystems.

Additionally, cross-chain MEV can potentially affect network congestion and transaction fees. For example, when MEV searchers flood a network with transactions to take advantage of arbitrage opportunities, they may overload the blockchain, causing delays and increased gas fees. This could undermine the user experience, especially for average users not involved in high-frequency trading or sophisticated MEV strategies.

Another consideration is the risk of exploitation in the cross-chain communication layer. Interoperability protocols such as bridges, which connect multiple blockchains, are often targets for attacks or exploits. If these bridges are compromised, they could lead to MEV opportunities that disrupt the stability of the underlying chains and the cross-chain ecosystem as a whole.

Lastly, regulators may begin scrutinizing cross-chain MEV, especially as the practice becomes more prominent. As multi-chain ecosystems grow, regulatory frameworks that ensure transparency, fairness, and security will likely become more critical. It is essential to balance encouraging innovation and maintaining a decentralized ethos.

While these are challenges, platforms such as ZenMEV employ techniques and technologies to ensure that these issues are solved and the balance between fairness and profitability is maintained.

ZenMEV’s Adaptation To Multi-Chain MEV

ZenMEV is at the forefront of adapting MEV strategies to the complexities of multi-chain environments. Learn more about how ZENMEV is revolutionizing MEV in multi-chain ecosystems by visiting ZENMEV Website. Its comprehensive approach leverages cutting-edge technologies, staking infrastructure, and a future-proof architecture to ensure MEV extraction aligns with the principles of fairness, efficiency, and decentralization.

1. Advanced Staking Infrastructure

ZenMEV’s staking module forms the backbone of its multi-chain strategy. By allowing users to stake assets such as ETH, BNB, SOL, USDC, and USDT, ZenMEV ensures the platform has access to the liquidity necessary to capitalize on MEV opportunities across chains. Key features of ZenMEV’s staking infrastructure include:

- Dynamic Fund Allocation: Staked assets are automatically allocated to the most profitable MEV strategies, whether on Ethereum, Binance Smart Chain, or Solana. Real-time analytics guide these allocations, ensuring optimal returns.

- Transparent Profit Distribution: Profits from MEV activities are distributed proportionally to stakers via a smart contract-based engine, maintaining trust and transparency.

- Cross-Chain Staking Support: Users can stake assets on one chain and participate in MEV opportunities across multiple networks, simplifying participation.

2. Future-Proof Architecture

ZenMEV’s platform is designed to adapt to the ever-changing blockchain landscape. Its architecture includes:

- Interoperability-First Design: ZenMEV seamlessly integrates with major interoperability protocols, ensuring compatibility with cross-chain bridges and Layer 2 solutions. This design reduces latency and ensures efficient transaction execution across networks.

- Modular MEV Strategies: The platform employs modular MEV strategies, allowing it to adapt to new blockchain updates, consensus mechanisms, and interoperability standards without major overhauls.

- Robust Security Measures: ZenMEV prioritizes the security of its infrastructure, employing advanced cryptographic techniques and rigorous audits to protect against vulnerabilities in cross-chain communication layers.

3. Cutting-Edge Technologies and Strategies

ZenMEV employs innovative technologies to navigate the complexities of multi-chain MEV:

- Mempool Monitoring Across Chains: ZenMEV analyzes transaction mem pools in real time to identify cross-chain opportunities such as arbitrage and front-running. Its algorithms account for variables like gas fees, transaction latency, and liquidity availability.

- AI and Machine Learning Models: Advanced models predict MEV opportunities and optimize transaction execution. These models adapt to shifting market conditions, ensuring consistent performance.

Benefits of ZenMEV’s Multi-Chain Approach

1. Enhanced Decentralization

By democratizing access to MEV through staking, ZenMEV ensures that rewards are distributed across a broad user base, reducing the concentration of power among a few searchers or validators.

2. Improved Network Efficiency

ZenMEV’s strategies minimize network congestion by optimizing transaction bundling and execution. This reduces gas fees and enhances the user experience across chains.

3. Robust Security and Stability

ZenMEV’s focus on securing cross-chain communication layers and implementing proposer-builder separation protects against exploits, ensuring the stability of interconnected networks.

4. Future-Proof Profitability

The platform’s adaptability to evolving technologies and standards ensures its continued relevance and profitability in an ever-changing blockchain ecosystem.

5. Regulatory Alignment

ZenMEV’s transparent operations and ethical MEV practices position it to comply with emerging regulatory frameworks, fostering trust among users and investors.

Looking Ahead: The Future of MEV in Multi-Chain Ecosystems

As multi-chain ecosystems mature, MEV will play a pivotal role in shaping their growth. Platforms like ZenMEV, which prioritize transparency, security, and decentralization, will lead the way in harnessing MEV for ecosystem-wide benefits. By combining advanced staking infrastructure, future-proof architecture, and cutting-edge technologies, ZenMEV ensures that MEV extraction aligns with the values of the blockchain community.

ZenMEV’s commitment to innovation and fairness highlights the potential for MEV to contribute positively to the evolution of DeFi. As the multi-chain era unfolds, ZenMEV stands ready to adapt and thrive, setting a benchmark for sustainable and equitable MEV practices in interconnected blockchain ecosystems.

Takeaways

The future of MEV in a multi-chain ecosystem is both exciting and challenging. Cross-chain MEV offers substantial opportunities for arbitrage and profit-making but also introduces risks such as centralization, increased network congestion, and fairness concerns. By focusing on transparency, fair distribution, secure interoperability, and community-driven governance, platforms can leverage MEV to foster healthier, more efficient cross-chain operations.

As the multi-chain ecosystem evolves, collaboration between developers, searchers, validators, and users will be essential to ensure that MEV practices align with the core values of decentralization, security, and fairness. Only by striking the right balance can we unlock MEVs’ full potential while maintaining their full potential in thechain ecosystem.