Bitstamp‘s latest Crypto Pulse survey showed that the overwhelming majority of cryptocurrency investors believe that crypto will see mainstream adoption within the next decade.

The data comes from a survey of over 28,000 respondents from 23 different countries, including 5,450 senior institutional investment strategy decision-makers and more than 23,000 retail investors.

Despite the vast differences between the respondents, the vast majority seem to agree that the crypto market is yet to see its heyday.

Crypto is bound to overtake traditional investment vehicles, investors agree

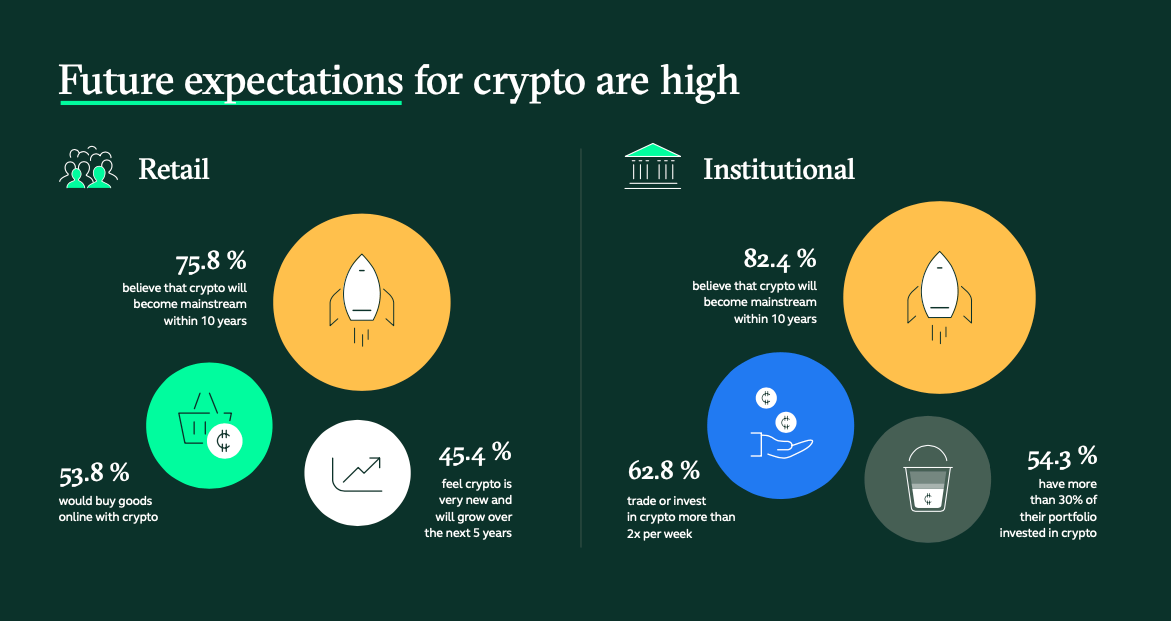

According to Bitstamp‘s extensive survey, 88% of institutional investors and 75% of retail investors believe that cryptocurrencies will see mainstream adoption within a decade. A further 80% of institutional investors said that cryptocurrencies are set to overtake traditional investment vehicles such as stocks and bonds.

Having such a large number of institutional investors realize the potential of cryptocurrencies paints a bullish picture for the future of the crypto industry.

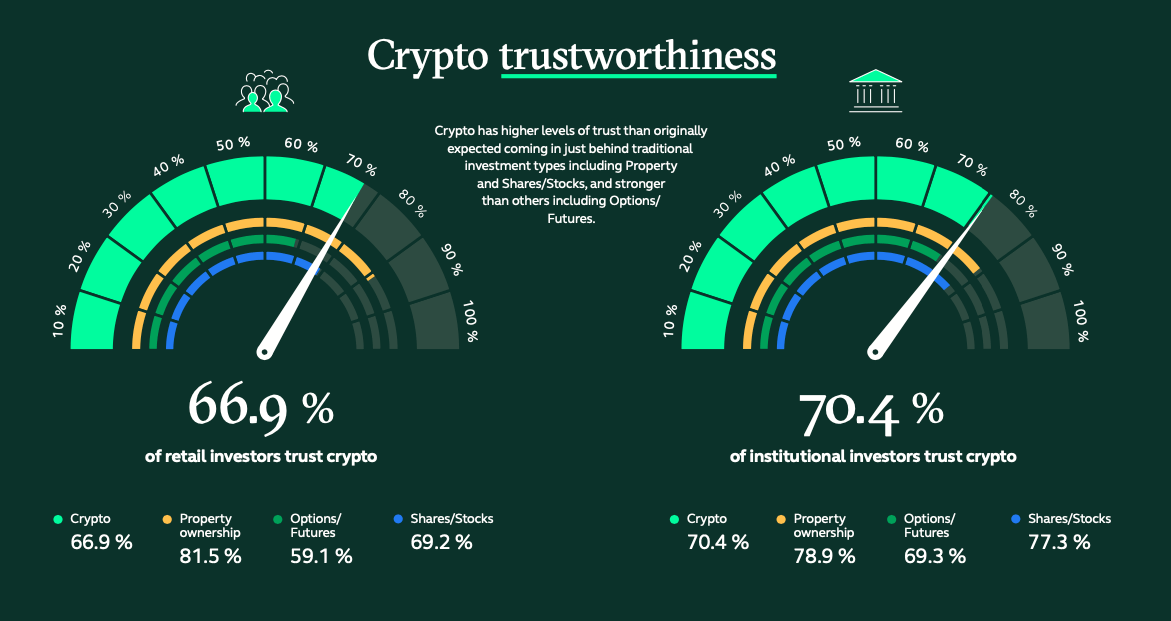

Retail investors, however, were less convinced that cryptocurrencies would overtake traditional investments, with only 54% agreeing. Retail investors also had less trust in cryptocurrencies as an asset class—while 71% of investment professionals stated they trusted crypto, only 65% of retail investors agreed with the statement.

Institutional investors were also more likely to recommend cryptocurrencies as an investment strategy to their customers and companies.

Julian Sawyer, the CEO of Bitstamp, told CryptoSlate that the adoption of cryptocurrencies and other digital assets was advancing at an unprecedented rate, which was evident in the survey’s findings.

“In the last few years, cryptocurrencies have moved from the outskirts of the financial ecosystem to find themselves front and center of mainstream investing, with many of the largest trading venues in the world now catering to both retail and institutional crypto needs,” he explained.

The growing popularity cryptocurrencies are seeing in the institutional world doesn’t mean that the asset class is universally supported. As a relative infant compared to traditional assets, cryptocurrencies are trusted less than property ownership, shares, and stocks.

Another major barrier to crypto investment is a lack of trust in regulation. According to the survey, nearly half of retail investors and more than a third of institutional investors see cryptocurrencies as “unregulated.” Bitstamp said that this demonstrates a pressing need for stronger regulation, which will increase investor trust in crypto.

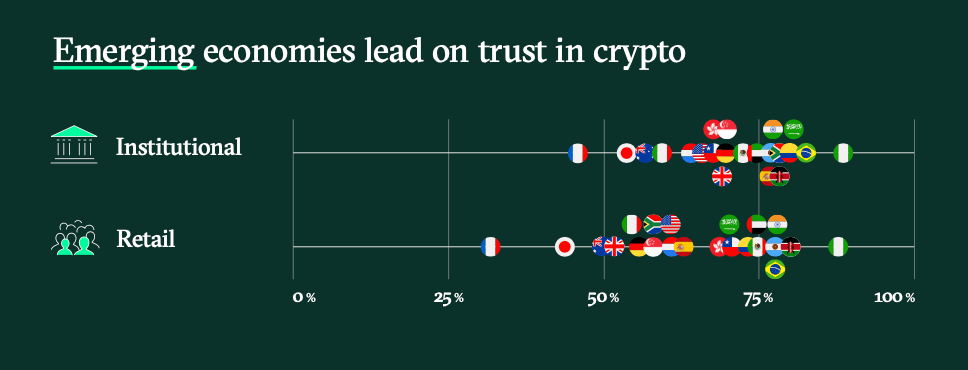

On the other hand, Bitstamp’s survey found that there’s no lack of trust in cryptocurrencies in the developing world. Trust at a global level in cryptocurrencies is primarily driven by developing countries where the overall trust in the traditional financial system is low. In emerging economies, 79% of respondents said that cryptocurrencies were more trustworthy than the traditional financial system. This is a notable increase from the 69% of respondents coming from developed financial markets.

“We’ve seen interest propel in the years since the pandemic, and crypto is now part of the wider conversation in global macro-economic matters. Our survey shows something we have advocated over a long time: talking about survival of digital assets is firmly over — the question is now about evolution,” Sawyer told CryptoSlate.

The post The market believes cryptocurrencies will overtake traditional investments in 10 years appeared first on CryptoSlate.