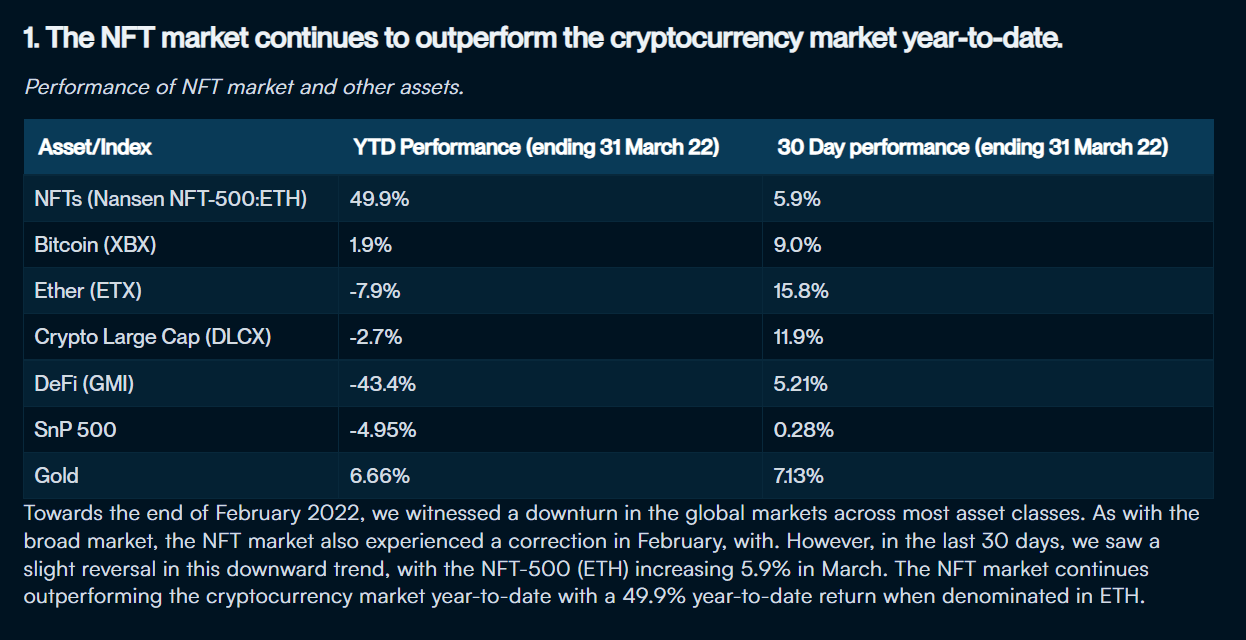

Nansen, a blockchain data analytics company, recently issued its quarterly study on non-fungible tokens (NFTs). The analysis emphasized the NFT sector’s year-to-date outperformance of the cryptocurrency market, predicting a $80 billion market valuation by 2025.

The NFT market has outpaced the cryptocurrency market this year, according to the Nansen 2022 Quarterly NFT Report, with a year-to-date return of 103.7 percent in ETH and 82.1 percent in USD. Despite a drop in global markets across most asset classes at the end of February 2022, the NFT-500 gained 5.9% over the preceding 30 days in March.

Louisa Choe who authored the report stated: “The NFT market continues outperforming the cryptocurrency market year-to-date with a 49.9% year-to-date return when denominated in ETH.”

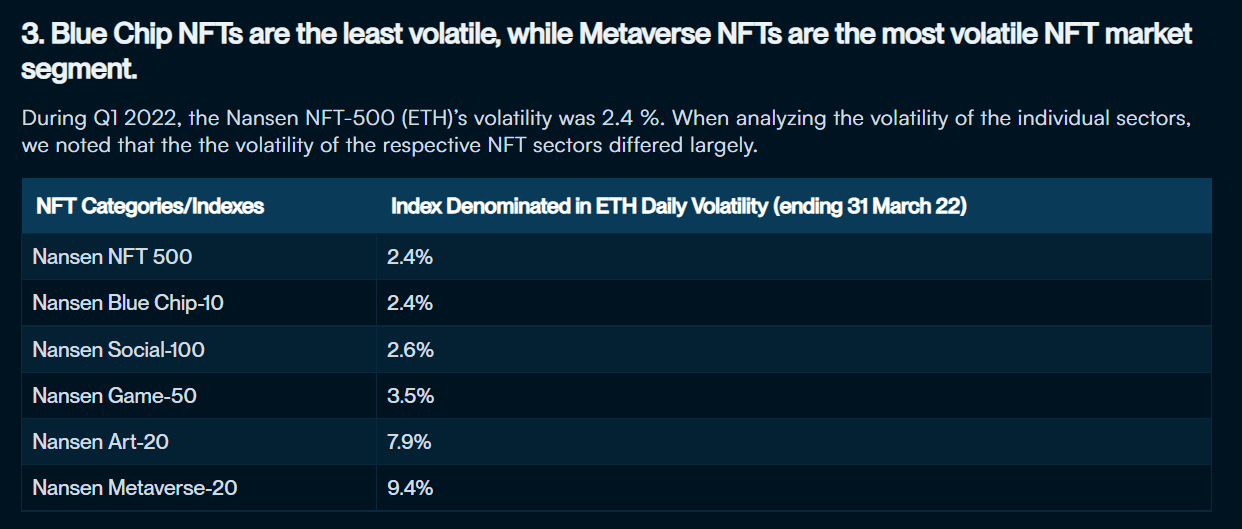

The volatility of each of these sectors varies, and according to the Nansen research, Blue Chip NFTs, which are classified by market size, are the least volatile. Azuki, Clone X, and Doodles, among other OpenSea chart-topping compilations, have been designated as Blue Chip.

This is most likely due to their growing popularity in the crypto world and the fact that they may be regarded as strong long-term investments due to their track record of development and value.

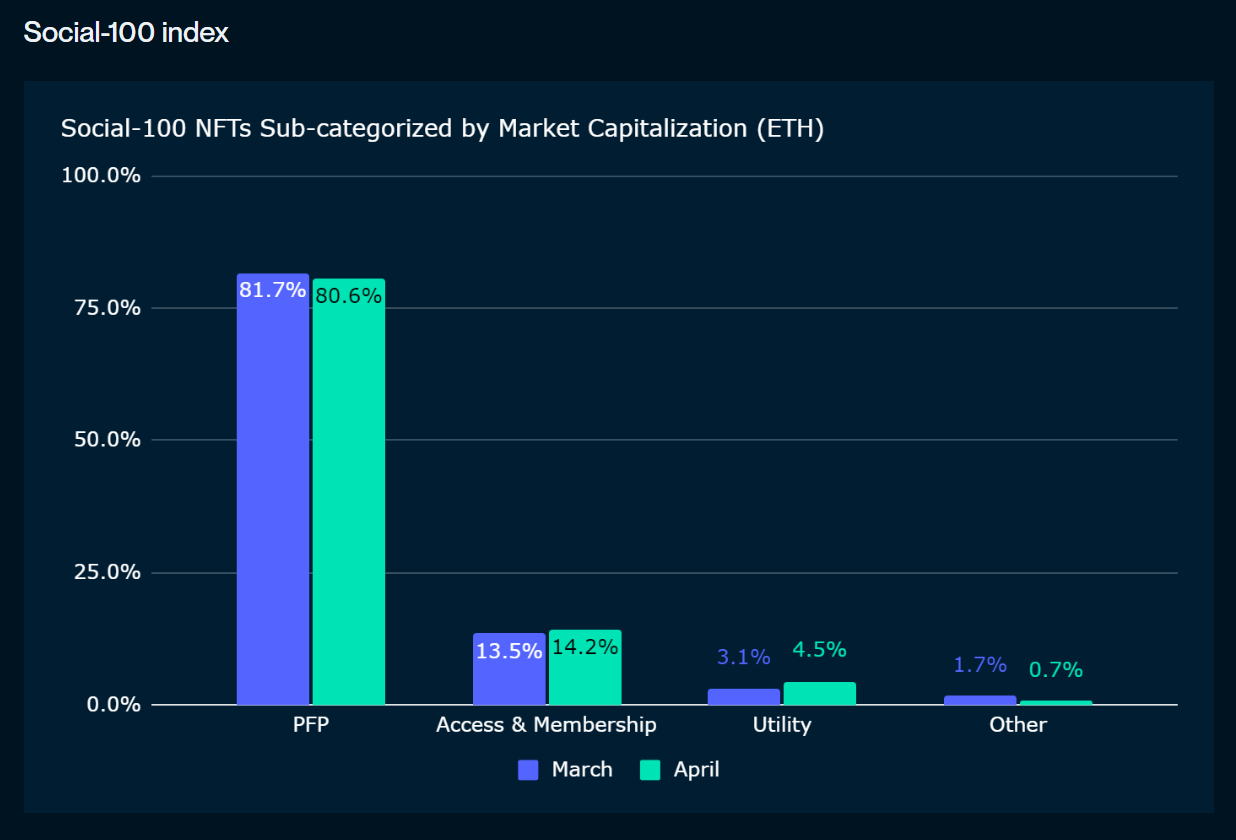

The Social-100 index’s composition remained mostly unchanged before and after it was rebalanced. However, the proportion of Access & Membership NFTs and Utility NFTs have seen an increase.

When measured in ETH, the Social-100 index has increased by 49.9% year to date, but when measured in USD, it has increased by 37.5 percent.

Access & Membership NFTs and Utility NFTs include NFTs that give holders access to certain events, products, or services. For example, the entertainment company Mola held the Mola Chill 2303 event on March 23rd. Entrants had to purchase membership passes in the form of an NFT to gain entry to the sci-fi themed event.

Bored Ape Yacht Club also held a meetup event in July 2021, which was exclusive only to people who owned a Bored Ape NFT. Social clubs could be one of the main driving forces behind the growth of access and membership NFTs.

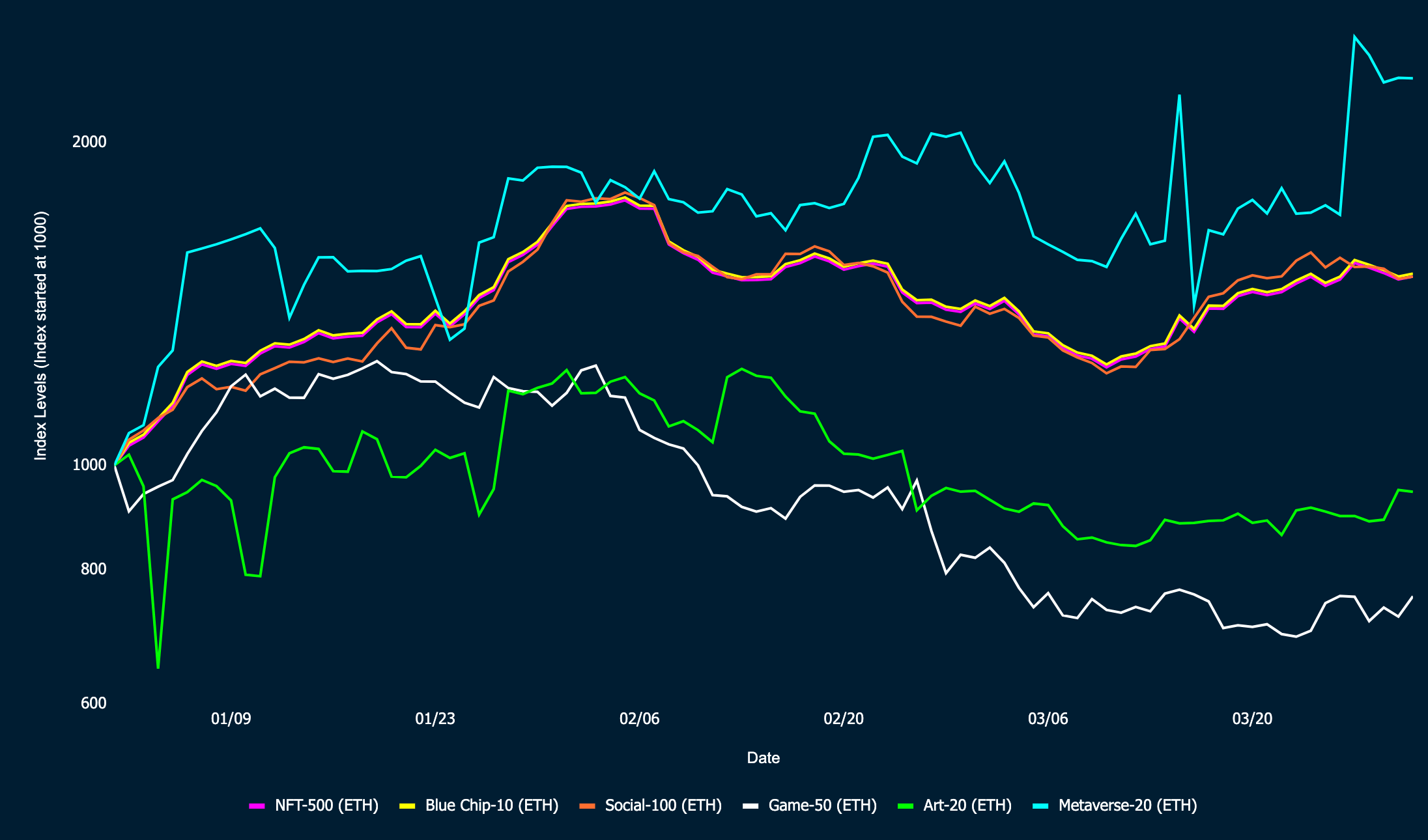

Metaverse and art NFTs, on the other hand, were deemed the most volatile part of the NFT market by the research. The Metaverse portion includes land and real-estate NFTs, avatars, and utility NFTs, according to Nansen. It may be difficult to assess pricing, particularly for virtual land like Decentraland or The Sandbox.

The subjective aspect of value assessment, as well as art’s somewhat illiquid character, contribute to its volatility when it comes to art NFTs. Nansen demonstrated that generative art is the most popular component of art NFTs in general and that the majority of Metaverse and art market players are “speculators.”

The Nansen indices also show that the gaming industry’s overall growth is declining. With a drop of -24.4 percent, the Gaming-50 index has plummeted the most out of all the NFT niches included in the research.

Despite this drop, the overall NFT market looks very healthy when compared to the crypto market. NFTs are a fast-growing and dynamic area of the cryptocurrency industry, and this is especially true for retail investors.

However, understanding the competitive NFT market environment is critical for NFT market players wishing to collect, trade, or invest in NFTs.

With the Nansen Social-100 NFT index leading the way in year-to-date returns, it seems that a broad approach that includes a diverse range of collections may be advantageous in generating profits. It is, therefore, essential for market players to do enough due diligence before investing.

The post The NFT market is growing more than the crypto market according to Nansen report appeared first on CryptoSlate.