Data from Santiment suggests that three altcoins have recently seen particularly notable bullish action in their address activity.

Render, Aave, & Maker Are Altcoins Seeing High Active Addresses Currently

In a new post on X, the on-chain analytics firm Santiment discussed the altcoins currently witnessing a significant surge in network activity.

The relevant on-chain metric here is the “Daily Active Addresses,” which keeps track of the total number of addresses of a given asset that participates in some transaction activity daily. This indicator naturally takes into account both senders and receivers.

When the metric’s value is high, it means many addresses or users are making moves on the network right now. Such a trend implies that interest in cryptocurrency is currently high.

On the other hand, the low indicator suggests that investors may not pay much attention to the asset as the blockchain doesn’t see too much activity.

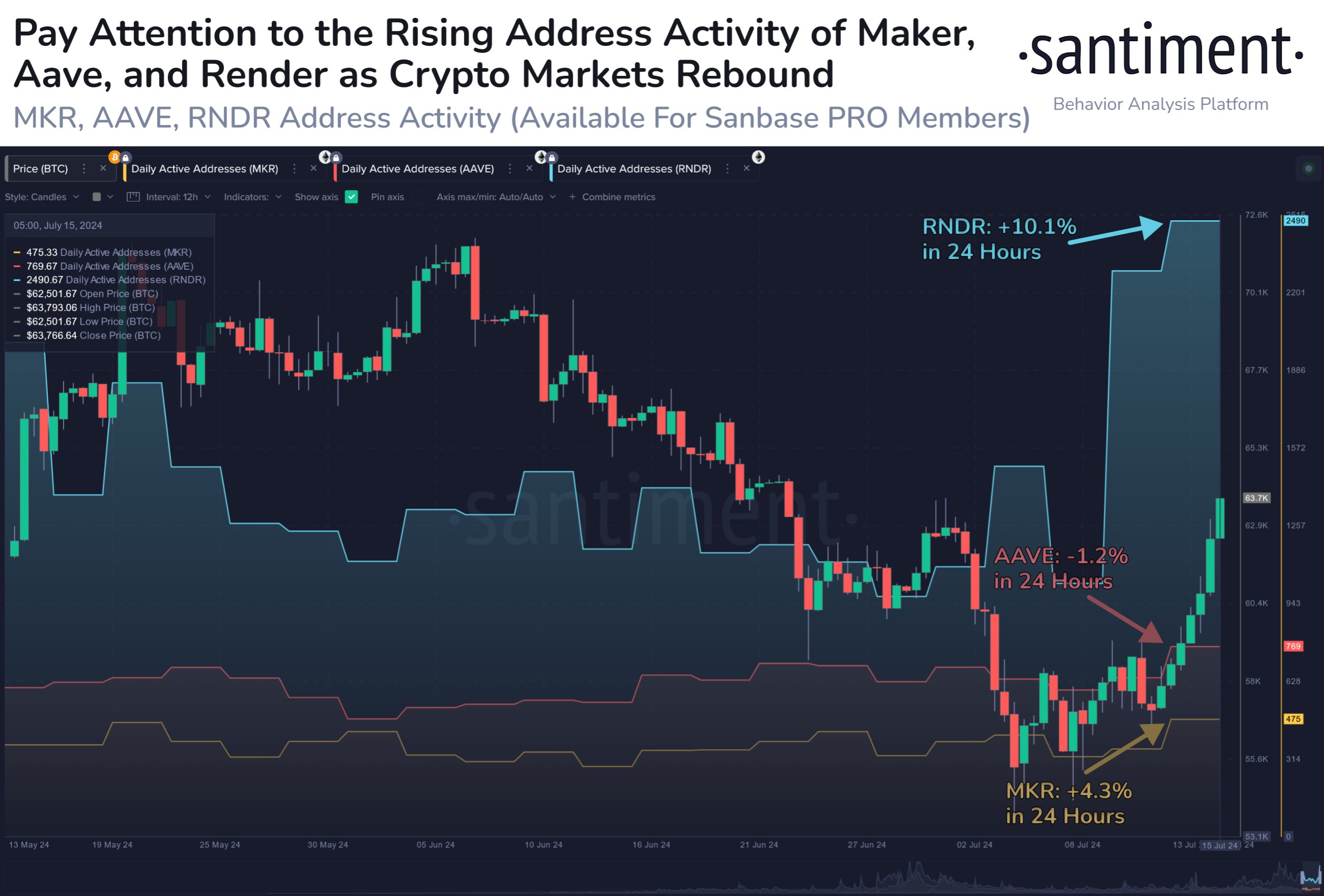

Now, here is a chart that shows the trend in the Daily Active Addresses for three different altcoins, Render (RNDR), Aave (AAVE), and Maker (MKR), over the past couple of months:

As is visible in the above graph, the Daily Active Addresses has seen a surge for all three of these altcoins recently. This increase in user activity has come for these assets as the market has been recovering.

Address activity going up alongside an increase in the price isn’t unusual for any cryptocurrency, as investors tend to find such price action exciting. Hence, they are more likely to make some moves.

A rise in the Daily Active Addresses could even be considered a prerequisite for any rally to be sustainable, as the increasing number of users provides the fuel a surge needs.

Historically, price moves that have failed to amass enough attention have run out of steam before too long. As such, Maker, Aave, and Render could be set up to see bullish action in the future, as they have seen the metric register an increase recently.

From the chart, it’s apparent that the jumps haven’t been too big in the case of MKR and Aave, but RNDR has stood out as it has enjoyed sharp growth in the metric. Therefore, it would appear that attention has been particularly strong for the altcoin.

It now remains to be seen if the rise in the Daily Active Addresses will end up benefiting the prices of these altcoins or not.

MKR Price

At the time of writing, Maker is trading around $2,950, up more than 30% over the past week.