Quick Take

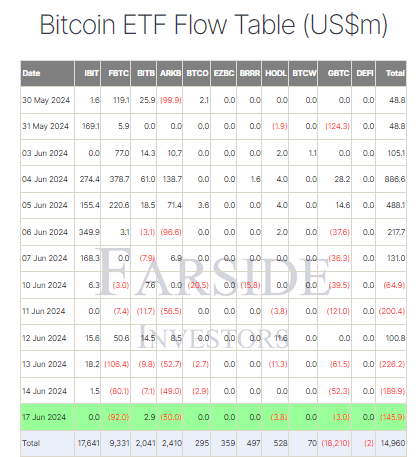

Farside data shows that on June 17, Bitcoin (BTC) exchange-traded funds (ETFs) experienced another day of significant outflows, totaling $145.9 million. This marks the third consecutive trading day of outflows and the fifth outflow in the past six trading days.

The largest outflow was from Fidelity’s FBTC, which saw a $92.0 million reduction, bringing its total net inflow to $9.3 billion. Ark’s ARKB followed with a $50.0 million outflow, reducing its total net inflow to $2.4 billion. Grayscale’s GBTC experienced a smaller outflow of $3.0 million, pushing its total net outflows to $18.2 billion. In contrast, BlackRock’s IBIT recorded no inflows or outflows, maintaining its total net inflow at $17.6 billion. Overall, the total net inflows for BTC ETFs now stand at $15 billion.

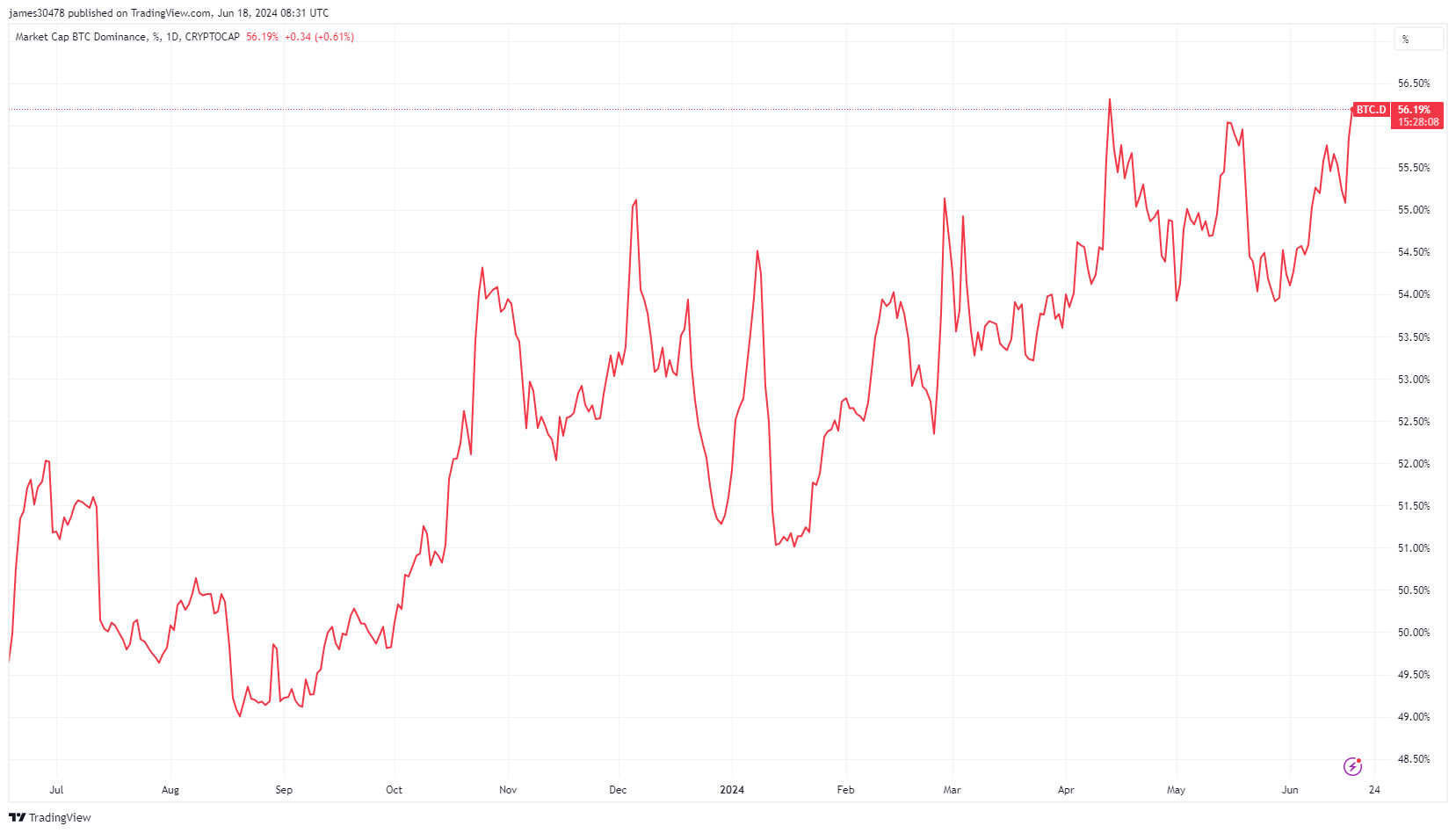

This trend coincides with Bitcoin’s price drop to $64,600, its lowest since May 16, reflecting a more than 11% decline from its all-time high. While Bitcoin’s dominance continues to climb, reaching 56.2%, it marks the second-highest level of the year.

The post Third straight trading day of Bitcoin ETF outflows: $145.9M pulled appeared first on CryptoSlate.