THORChain, a cross-chain decentralized exchange using Cosmos technology, successfully conducted a hard fork yesterday, September 4. However, while the update was highly anticipated, sellers still needed to press on, looking at the formation in the daily chart.

RUNE Slumps, Drops 70% In 6 Months

According to CoinMarketCap data, RUNE, the native currency of the THORChain ecosystem, remains under pressure, losing 12% at press time. The drop over the last 24 hours means the token is down nearly 70% from March highs and continues to trend lower.

At press time, the path of least resistance remains southwards. The immediate support lies at August lows at around $3. Conversely, buyers have resistance at approximately the $5 mark. RUNE traders can closely monitor how prices react at these levels as the coin moves sideways in a possible distribution.

If buyers take over, RUNE may peel back losses, possibly doubling in the coming months. The pace at which the token will expand largely depends on market-related factors and how the broader crypto market performs.

If Ethereum prices, for example, recover, breaking $3,500 in a buy trend continuation formation, it could rejuvenate the slump in DeFi. This would positively spark activity on the THORChain ecosystem, lifting sentiment and possibly RUNE prices.

DeFi Slumps, THORChain Hard Fork For System Efficiency

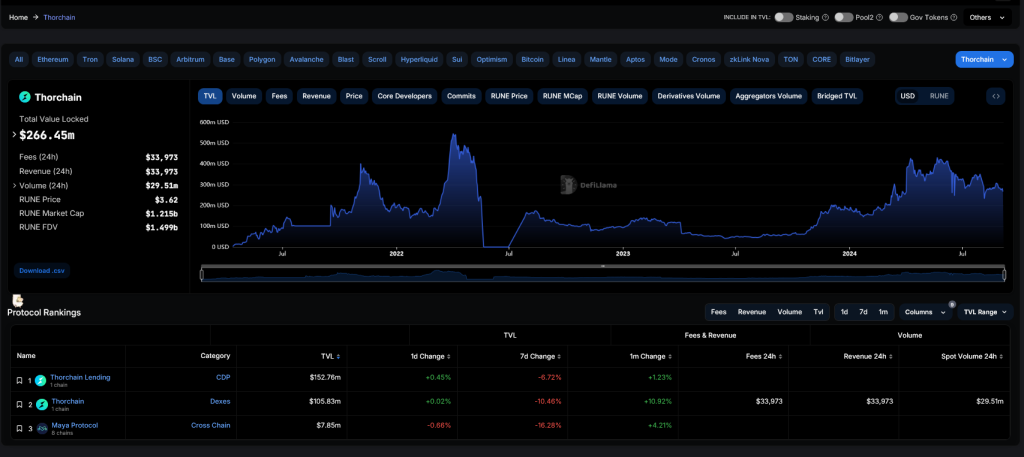

Overall, DeFi is flat, slumping after the expansion of early Q1 2024. According to DeFiLlama data, the total value locked (TVL) across all DeFi protocols is over $80 billion.

Ethereum remains the choice network for DeFi developers. Meanwhile, THORChain has a TVL of over $266 million, down from $396 million registered in late May.

Despite the general contraction, THORChain is actively building. The recent hard fork sought to improve user experience and make the DEX more robust. Changes made in this upgrade include the improvement of the Cosmos SDK from version 45.1 to 45.16.

Developers also remove unnecessary Cosmos modules to improve efficiency. At the same time, there were changes to the node state, increasing synchronization time. THORChain also introduced support for Bitcoin Taproot addresses, enhancing their interoperability with the Bitcoin mainnet.

Amid this, the THORChain ecosystem remains robust and active even as crypto prices fall. Analysts note that on Sunday, September 1, THORChain enabled the swapping of the largest-ever transaction size on the platform. On this day, the DEX helped swap $8 million worth of BTC for USDC, netting $26,000 in fees.