The post Time to Buy Cardano (ADA), Says Expert appeared first on Coinpedia Fintech News

The recent price drop across the cryptocurrency landscape seems to be attracting investors and traders, who view it as an ideal buying opportunity. Amidst this price and market uncertainty, whales appear to be betting on ADA, the native token of the Cardano blockchain, as reported by the on-chain analytics firm Coinglass.

$10 Million Worth ADA Outflow

Data from spot inflow/outflow reveals that exchanges have witnessed a significant $10 million outflow of ADA in the past 48 hours, indicating potential accumulation and a perfect example of a “buy the dip” opportunity.

In the current market situation, such a substantial outflow from exchanges can create buying pressure and drive further upside momentum.

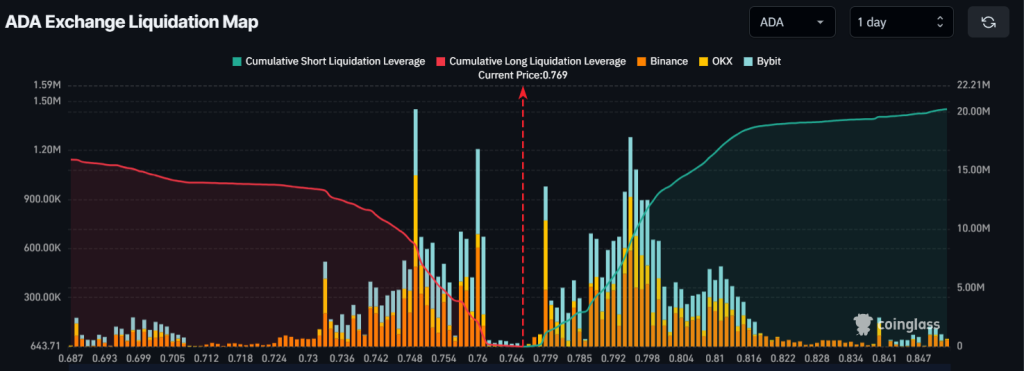

On the other hand, traders holding long positions seem to be dominating ADA’s current market sentiment. According to data, despite the bearish pattern today, intraday traders with long positions are currently in control and are over-leveraged at $0.76, holding $2.05 million worth of long positions.

Conversely, at $0.779, traders holding short positions are over-leveraged, with $1.13 million worth of short positions.

When combining these on-chain metrics, it appears that bulls are currently dominating and seem to be supporting ADA in its next move.

Buy Signal for ADA, Says Expert

This bullish sentiment among investors aligns with that of prominent crypto experts who recently made a bold prediction on X (formerly Twitter). In a post on X, the expert noted that ADA looks ready to rebound, as the key technical indicator TD Sequential flashes a buy signal for the token.

Despite these bullish on-chain metrics, ADA is currently trading near $0.77 and has experienced a price drop of over 2.35% in the past 24 hours. However, during the same period, its trading volume dropped by 15.5%, indicating lower participation from traders and investors compared to the previous day.