Ethereum (ETH) has plummeted 11.4% in the past 24 hours, reflecting a broader market downturn that saw Bitcoin (BTC) drop by 8%, XRP by 13.6%, and Solana (SOL) by 12.9%. Despite the sea of red, several leading voices—including CryptoQuant CEO Ki Young Ju—are calling for a more optimistic perspective on ETH.

Time To Go Bullish On Ethereum

Sharing his “bullish thoughts on ETH” via X, Ki Young Ju argued there has been “no significant sell pressure” despite the recent Bybit hack, pointing out that both on-chain and market data remain neutral. “Exchange selling takes time, and OTC offloads barely affect the price,” he added.

He also emphasized Ethereum’s dominant share of the stablecoin market cap—currently around 56% and noted how potential regulatory shifts under the Trump administration, which is reportedly “easing crypto regs,” could spur further adoption of ETH-based stablecoins and smart contracts in 2025.

Ju referenced additional catalysts, reminding followers that the ETH spot ETF “is already approved,” suggesting that a “Large Cap ETF altseason” might be on the horizon for Ethereum. He added, “BlackRock ETH spot ETF holdings increased 124% over the past three months.”

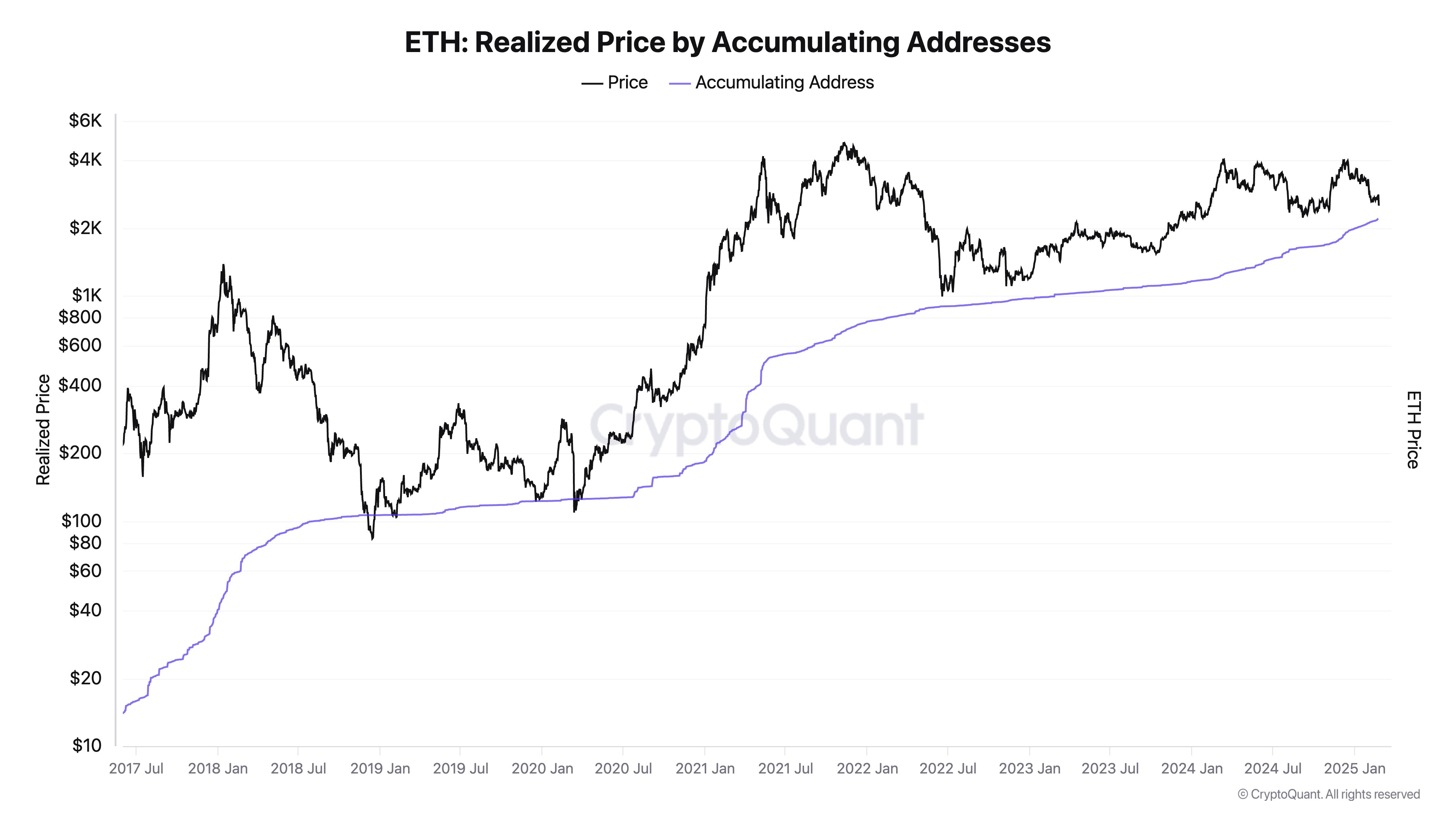

Lastly, Ju highlighted growing whale accumulation: addresses holding 10,000 to 100,000 ETH have increased their balances by 24% over the past year, with the current price “nearing the cost basis of accumulating addresses.”

However, Ju admitted he was “surprised” by what he sees as an overwhelmingly bearish mood on Crypto Twitter.

“Wow, CT [Crypto Twitter] sentiment on ETH is extremely bearish. Let me know if you have any data-driven analysis to support your bearish thesis. Most bears seem to cite the dropping price itself as their reason for selling. Very interesting,” Ju remarked.

On his alternative X account—under the handle @kate_young_ju—he reiterated that “whales are stacking ETH,” pointing to the current cost basis for these accumulating addresses at around $2,199, compared to the spot price hovering near $2,505.

Ju is not alone in challenging the doom-and-gloom market narrative. AdrianoFeria.eth (@AdrianoFeria), an member of the ETH community, asserted that “the market is in the shitter” but urged investors to focus on high-level institutional and political signals favoring Ethereum.

He specifically cited reports of the US President and family purchasing “hundreds of millions of dollars worth of ETH,” the CEO of BlackRock’s endorsement of tokenization (and BlackRock’s own tokenized USD experiment on Ethereum), and Bybit’s need to buy large quantities of ETH to cover its hack—potentially fueling more demand.

Feria also mentioned that Ken Griffin, the CEO of Citadel believes Ethereum could replace Bitcoin. For this community member, the fact that “everyone on CT is still taking a shit on ETH” only reinforces a contrarian bullish stance.

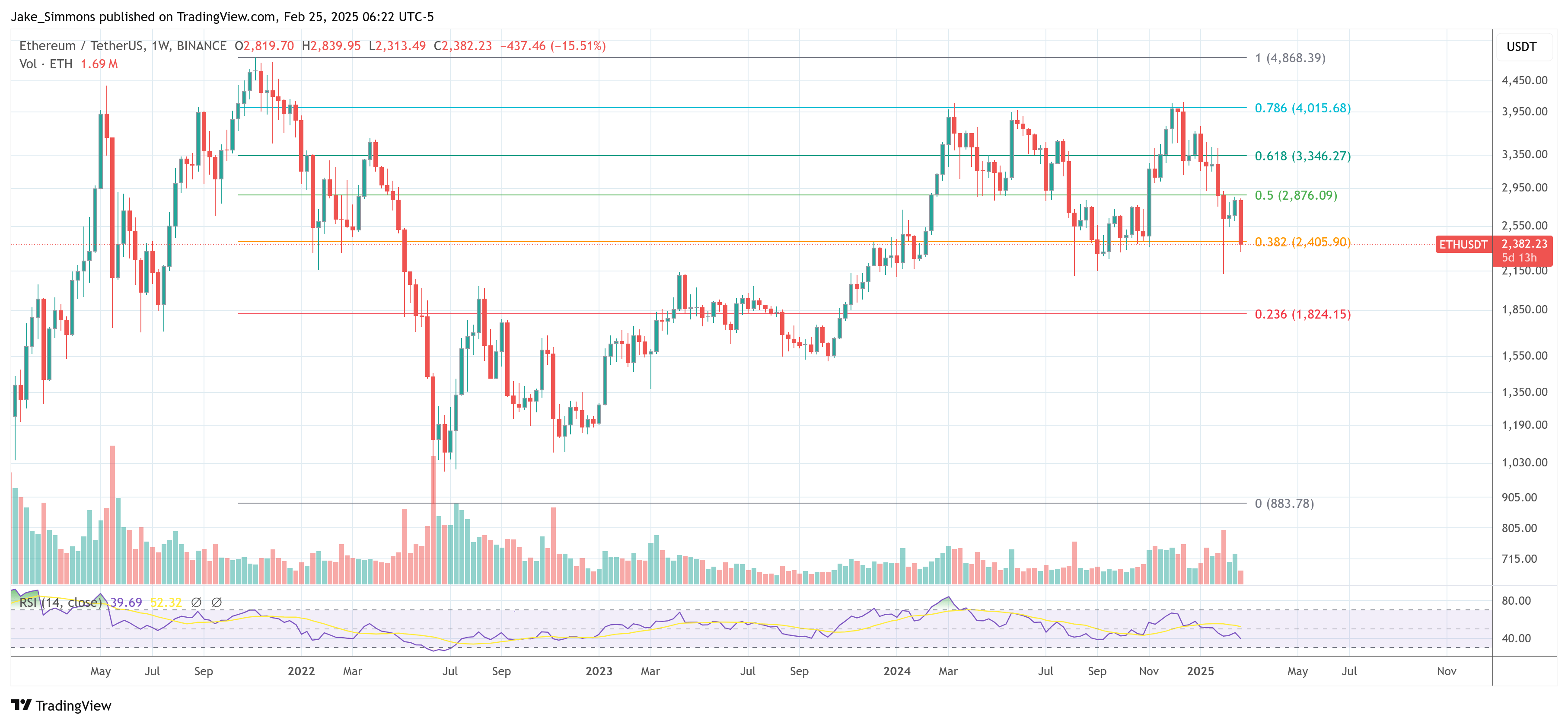

Popular crypto analyst IncomeSharks (@IncomeSharks) weighed in by posting a chart showing another “red scary candle” but indicating a buy zone above $2,400.

Meanwhile, Chris Burniske, partner at Placeholder VC, offered historical perspective, reminding followers of 2021’s mid-cycle drawdowns: BTC fell 56%, ETH 61%, SOL 67%, and many other assets 70-80%. According to Burniske, “you can come up with all the reasons for why this cycle is different, but the mid-bull reset we’re going through isn’t unprecedented. Those calling for a full blown bear are misguided.”

At press time, ETH traded at $2.382.