Toncoin, the brainchild of messaging app giant Telegram, is making waves in the cryptocurrency world. A recent report by CryptoQuant, a leading crypto analysis platform, has identified Toncoin as one of the fastest-growing blockchain networks. While established giants like Bitcoin reign supreme in daily transaction volume, TON’s growth metrics paint a compelling picture of a network poised for a breakout.

Transaction Velocity: A David-Vs-Goliath Story

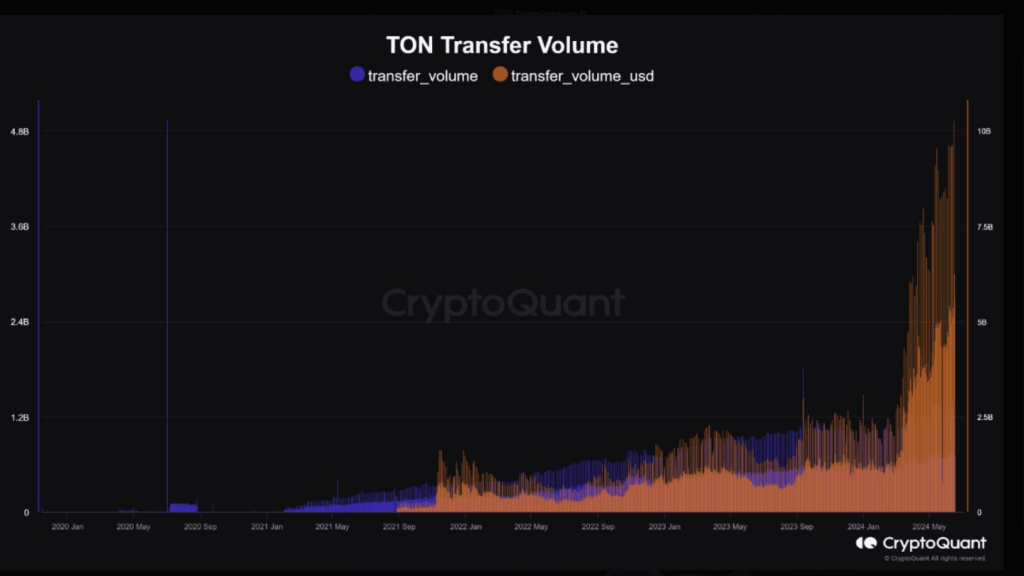

While Bitcoin processes a staggering $50 billion daily in transactions, TON’s daily volume sits between $5-$10 billion. This, at first glance, might seem like a David-and-Goliath scenario. However, there’s a crucial detail to consider: TON is only four years old, a mere pup compared to Bitcoin’s seasoned presence. This rapid climb in transaction volume for such a young network suggests a growing appetite for TON’s capabilities, particularly for facilitating large transfers of digital assets.

On-chain metrics of $TON are going parabolic!

“The transfer volume ranges between $5.0B ~ $10.0B. For comparison, #Bitcoin‘s average daily transfer volume is around $50.0B. This indicates that #TON has already achieved between 10% Bitcoin’s capacity.” – By @JA_Maartun

Read… pic.twitter.com/56VjsAGOwL

— CryptoQuant.com (@cryptoquant_com) June 20, 2024

Crypto analysis reveals a tenfold increase in TON token holders over the past year, skyrocketing from 2.9 million to over 30 million. This surge in user adoption suggests a growing trust in the network and could potentially pave the way for a more robust and vibrant TON ecosystem. A larger user base translates to a wider pool of developer talent, increased opportunities for innovation, and ultimately, a stronger network effect that attracts even more users.

Messaging App Integration: A Catalyst For Crypto Adoption?

The unique advantage TON possesses lies in its connection to Telegram, one of the most popular messaging apps globally, boasting over 900 million users. This integration has the potential to be a game-changer for crypto adoption.

Challenges Ahead For Toncoin

However, there are still hurdles to overcome. The regulatory landscape surrounding cryptocurrencies remains complex, and TON will need to navigate these challenges to achieve mainstream adoption. Additionally, questions linger about the scalability of the TON network. Can it handle the massive influx of users that Telegram’s integration might bring?

Meanwhile, as TON boasts impressive growth in users and transaction volume, its token price hasn’t quite mirrored this enthusiasm. In the last 24 hours, TON has dipped 0.5%, and over the past week, it’s down 10.4%.

Featured image from California Business Journal, chart from TradingView