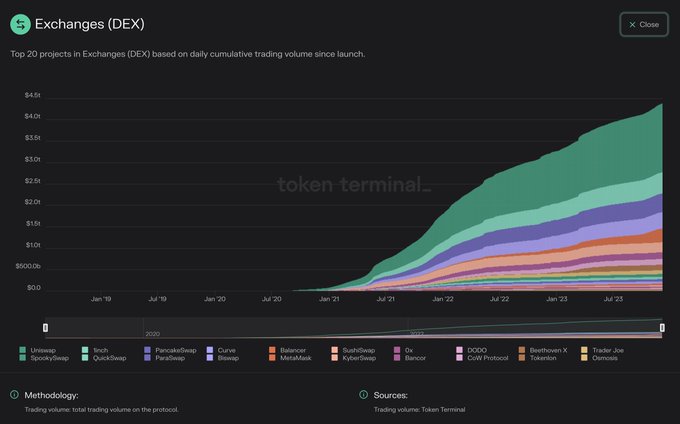

The decentralized finance (DeFi) sector continues to gain traction if on-chain data, especially from decentralized exchanges (DEXes), is anything to go by. According to Token Terminal data on December 6, the top 20 DEXes have accumulated over $4.4 trillion in trading volume since launching.

Rise And Rise Of DEXes: Uniswap, Curve Dominate

Considering the state of centralized trading in the wake of regulatory pressures in 2023, this expansion points to increasing adoption of DEXes, especially from crypto fans who might treasure and seek non-custodial trading options and exposure of tokens not yet listed on mainstream platforms like Binance or Coinbase.

Looking at Token Terminal data, Curve, Uniswap, PancakeSwap, and 1inch stand out among the leading DEXes, each catering to a specific niche within the DeFi landscape. For instance, Curve excels in stablecoin trading, Uniswap facilitates token swaps across multiple blockchains, PancakeSwap dominates in the BNB Chain, and 1inch serves as a DEX aggregator across Ethereum, Polygon, Avalanche, and other blockchains.

As of December 7, Vertex Protocol, dYdX, and Uniswap v3 emerged as the most active DEXes based on trading volume data from CoinMarketCap. Specifically, Vertex Protocol and dYdX processed over $1.1 billion in trading volume in the past 24 hours. On the other hand, Uniswap v3 on Ethereum closely followed behind with over $780 million.

Recently, the dYdX chain fully launched on Cosmos following a community vote. The transition means the introduction of advanced order-book features and a split from Ethereum. Meanwhile, Uniswap Labs, the team behind Uniswap, plans to improve and release Uniswap v4. This version will introduce more customization with features like hooks that could lead to lower fees and higher efficiency.

Binance, Coinbase, And CEXes Still An Option For Many

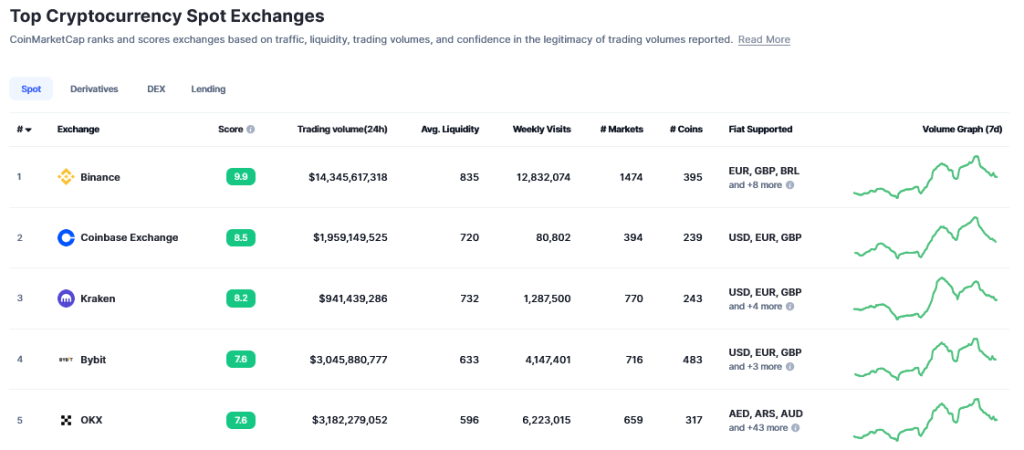

Despite the growing popularity of DEXes, centralized exchanges (CEXes) like Binance, Coinbase, and Kraken continue to dominate the overall crypto trading market. To illustrate, CoinMarketCap data shows that Binance posted over $14 billion in average spot daily trading volumes, more than 10X that of Uniswap and dYdX, within the same period.

Recently, Binance received a $4.2 billion fine from the U.S. Securities and Exchange Commission (SEC) in a settlement that saw Changpeng Zhao, the former exchange’s CEO, step down. Global regulators like the SEC and the Commodity Futures Trading Commission (CFTC) are also cracking the whip on centralized exchanges.

After the Department of Justice (DOJ) proposed a settlement with Binance, the SEC charged Kraken, penalizing them $30 million for allegedly operating without registration.